Even for most discerning readers, the Punjab Provincial Cooperative Bank Limited (PPCBL) would be a vague concept. Established in 1924 it is one of the oldest banks in the country and has for most of its existence survived as a specialised bank catering to the needs of housing and agricultural cooperatives.

Like most provincial cooperative banks, a concept introduced during the British Raj, the PPCBL spent the first few decades post-partition being an important avenue for agricultural lending. Except as time went by the bank’s financial performance dipped and it was mired in a multitude of challenges, ranging from bureaucratic entanglements to outright bans on conducting business

That is until now.

From the brink of losses and unimpressive numbers the bank has managed to not just keep its head above the water but chart a course towards profitability. Even more remarkable is that this turnaround has taken less than two years. So how does a bank that has nearly a century of baggage clean up its act?

Part of it may have to do with the rising fortunes of agricultural lending in Pakistan. In recent times large commercial banks have changed their stance on agri lending, particularly in the livestock sector. As a dedicated institution with tailored products and services now is an ideal time for the PPCBL to return to its glory days. The bigger reason is the fast unfolding events of the past few years. To understand those, we must go back to the very beginning.

Understanding the history

The PPCBL was first established in 1924 and was under the control of the Central Cooperative Bank. The concept of cooperatives was relatively new but wildly successful at this point. Cooperative societies, or ‘co-ops’ as they are contemporarily known, started emerging around the turn of the 18th and 19th centuries. As industrialisation pushed people away from rural areas and into cities, they were no longer able to grow their own food. Instead they were reliant on stores that sold essential food items at exorbitant prices. To manage this, many people banded together to form societies which would pool their economic resources and buy products in bulk directly from suppliers to keep costs low for their own members.

While cooperatives are a concept found even in antiquity, they took shape by this name after the Industrial revolution. Very plainly put, co-ops are when a group of people with common economic goals join together to do everything they can to achieve it. Soon co-ops began appearing not just for food supplies but also for housing, agriculture, education and other fields.

British colonial administrators all over the world felt cooperatives were a smart and efficient idea. Because of their success in Europe, co-ops were encouraged in the Indian subcontinent as well. And one of the targets was founding financial institutions that served both as co-ops and catered to co-ops.

“The cooperative movement literally means ‘bahami amdaad’. Let’s say you and ten others each have one acre of land. Individually, your holdings might not meet the bank’s criteria for granting a loan. However, by forming a cooperative society, pooling your lands together, and presenting yourselves as a group seeking a loan, you increase your collateral value. This joint collateral gives you a better chance of securing a larger loan from the bank,” explains Asma Shakeel, Head Legal, Strategy and Secretary to the bank’s Board of Directors.

After the partition, many cooperative banks became part of India and grew into substantial institutions comparable to major commercial banks we have in the country today. Pakistan only got one cooperative bank at the time of partition. This was the Central Cooperative Bank which then had further provincial subsidiaries that it operated.

However, in 1976, this bank was dissolved, and its assets were absorbed by the provincial cooperative banks. Each province had its own cooperative banks, such as the Sindh Cooperative Bank, Frontier Cooperative Bank (KPK), Balochistan Cooperative Bank, and the Punjab Cooperative Bank. There were also affiliated Azad Kashmir Government Co-operative Bank and Northern Areas Provincial Co-operative Bank.

Cooperative bank governance

This is where things start to get a little tricky. Now that the provincial cooperative banks were on their own, the cooperative banking ecosystem was also brought under the federal government’s control. At first, the Federal Bank for Co-operatives (FBC) was established in 1976 as a regulator for cooperative banks. The FBC used to arrange financing by borrowing from the SBP. And while the central bank was lending to them at a nominal rate, the benefit was not being passed down to the end consumers.

Resultantly, neither the benefit of cost-free funds reached the ultimate users nor did it in any way help in the promotion of the co-operative movement in the country. Eventually the SBP was sick and tired of this and suggested the FBC be dissolved in June 2000. During the 24 years it was on the scene the FBC managed to damage the cooperative movement in Pakistan significantly. The Sindh and Balochistan chapters of the bank had barely gotten any of the SBP money and end-consumers were given very little as well because of poor products and policy decisions.

The banks operated as government departments running on typical federal handouts. From here on out the SBP stepped in and directly financed provincial cooperative banks. The banks were happy with this as well. The state bank would provide cost-effective funds which would be used to grant loans. But then other problems began emerging. Because the banks had been so lax for the past three decades, many of their clients were giving them a bad name. As a result, the SBP halted funding.

“The government of Punjab had to step in and extend loans. Eventually, these loans were transformed into equity amounting to Rs 7.8 billion, as you can observe in our balance sheet,” says Tahir Yaqoob Bhatti, CEO of PPCBL. All the provincial cooperative banks had serious financial and management problems, partly, because of insurgencies made in their operations by the co-operative bureaucracy and partly because of the political influences. Consequently, all except Punjab Provincial Cooperative Bank dissolved.

After the SBP’s decision to stop financing, it emerged that many of these banks would shut down. The Frontier Cooperative Bank of KP was abolished in 2001 and the Sindh Cooperative Bank was absorbed into the Sindh Bank in 2011. In between this all of the other cooperative banks closed down one by one except the one in Punjab.

The PPCBL’s slump story

So how did the PPCBL manage to survive while all other cooperative banks in the country perished? The answer lies in the fact that the Punjab’s chapter of the bank was always sort of independent. The bank’s primary focus has been on the agricultural sector. They have an array of agricultural loans tailored for purchasing essential crop inputs such as seeds, fertilisers, pesticides, and other related expenses, all within shorter time frames.

But aside from this the PPCBL also gained the status of a scheduled bank as early as 1955 taking on a dual identity and serving also as a regular commercial bank. Because of this the bank became one of the preferred banks of the agriculturalists in Punjab. With a notable presence spanning over 151 branches across 9 zones, encompassing various tiers from Tehsil to Sub-Tehsil levels, this historic institution has run on its own inertia for most of the past few decades.

The biggest blow to cooperative banking in the country came in 1997. Back then an anti-corruption investigation banned the registration of new cooperative societies. This was tied directly to the real estate market in Pakistan. A number of real estate developers over the years had established “cooperative” housing societies. Most of these went to the cooperative banks because of the good terms. A large number of those were fraudulent. Once a ban was placed on the establishment of all new cooperatives the banks also lost out on a number of new customers. Remember, this was also around the time where the SBP was mulling over whether to abolish the FBC as well.

“We were serving customers (borrowers) from previously registered cooperative societies, but the halt in registration of new cooperative societies created a significant gap in our lending activities”, lamented Asma Shakeel.

Consequently, the bank obtained authorisation from a competent authority to begin offering agricultural loans directly to individual farmers. The bank’s CEO told Profit that as a result society members simply began borrowing as individuals. “This led to the establishment of a favourable reservoir of customers for us. This move played a crucial role in ensuring our survival during that period. If we had remained solely reliant on the cooperative societies, our prospects would have been severely constrained.”

Despite this, governance issues persisted because of government control. “If you look at our shareholding, 95% of the share is with the Government of Punjab and the remaining 5% is with the Cooperatives Society. This increased bureaucracy led to delays in approvals”, lamented Shakeel. “Besides, each entity has a board that takes decisions regarding key matters of the organisation. However, the Punjab Provincial Cooperatives Board was dissolved in 2005 by the State Bank of Pakistan,” adds Shakeel.

These political issues, and inefficiencies that continued to exist led to the accumulation of non-performing loans (NPLs). And according to the bak’s management this was a constant drain on their market share. Perhaps the final nail to the coffin came around in 2020 when the SBP imposed sanctions on the bank, citing non-compliance with Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) conditions. As a result, the SBP directed the bank to halt its lending activities. During this time, no new accounts could be opened, and no new credit limits could be issued.

“This situation, where a financial institution cannot initiate new business or open accounts, essentially marks the end of its operations. A penalty of Rs 124 million was also imposed”, lamented Bhatti.

A change in guard

So here is where the situation stood. Cooperative banking as a concept started off during the British Raj. After partition there were some successes but largely the banks sort of just stuck around and did very little. Around the year 2000, many of them started shutting down. The only provincial cooperative bank to survive was in Punjab where the government decided to bankroll it rather than let it die. But that decision proved disastrous when the SBP imposed sanctions on the bank and essentially forced it into a position where it had no choice but to shut down.

That is where the survival story begins. In 2021, then prime minister Imran Khan directed the Punjab law ministry to activate the Punjab Cooperative Department (PCD) to ensure financial assistance to farmers. Thereafter, the Punjab Provincial Cooperative Bank (PPCB) was slated for substantial restructuring to actively contribute to agricultural enhancement and farmer welfare.

In December of the same year, Tahir Yaqoob Bhatti took over as CEO of PPCBL. A career banker with over three decades of experience, Bhatti had been part of the senior management teams of Askari Bank, Allied Bank Limited, and Faysal Bank. Within a week of joining, Bhatti presented a comprehensive proposal to the SBP to remove the existing embargo on the bank. The SBP responded positively, offering a conditional six-month monitoring period during which the bank’s performance would be assessed. If the bank demonstrated improvement, further assistance would be considered.

“When I assumed the role in December 2021, my primary challenge was to lift these restrictions,” recalled Bhatti. “The embargo was put in place for three main reasons: first, to appoint a professional president, as there had been no president for the past seven years before I joined; second, to address AML and CFT issues by implementing specified transaction management systems; and third, to constitute a new board. Over a short span of time after my arrival, almost all three conditions were fulfilled. The first condition was met upon my appointment”.

Implementation challenges

Recalling the time when he joined, Bhatti told Profit, “Following my arrival, I assessed the bank’s situation and immediately initiated the implementation of a core banking system. This task was complex given the existing data challenges and the decentralised nature of the bank’s operations, with no information sharing.”

However, the bank successfully introduced this system and also made strategic personnel appointments. “Implementing a system is not possible without a proper team. And you need experienced people who have worked in different fields and have banking experience. So we brought 7 people – 5 in the head office. These include Operations Head, Business Head, Strategy Head, Compliance Head, Chief Financial Officer who is a chartered accountant. And 2 Zonal Heads from the market”, added Bhatti.

Apart from that, the new CEO empowered its human resources and initiated incentives that improved the morale of people. Salaries and pensions after a very long time were increased in July 2022. This resulted in an extra Rs 27 crore cost for the bank. However, these factors led to increased motivation.

The bank also lacked talent density. Employees lacked relevant qualifications. “Some of the managers had only studied till matriculation. Although their skills had improved with experience, qualification also matters”, remarked Bhatti. Most of the employees that were working in the bank were those that had been working in this organisation since they started working. “By 2025 most will be retiring and by 2030 all will be retired. So we needed to onboard more people. Especially young people that are more familiar with IT. Consequently, we hired 2 batches of 100 each on merit basis through tests. This young force is helping us in implementing core banking and other systems because older generations’ IT skills are very weak”, he added.

“We strategically positioned employees in their hometowns.This meant that someone originating from Haroonabad was appointed there only, leveraging their deep connection with the community. This approach proved highly effective for us”, Bhatti further explained.

The road to profitability

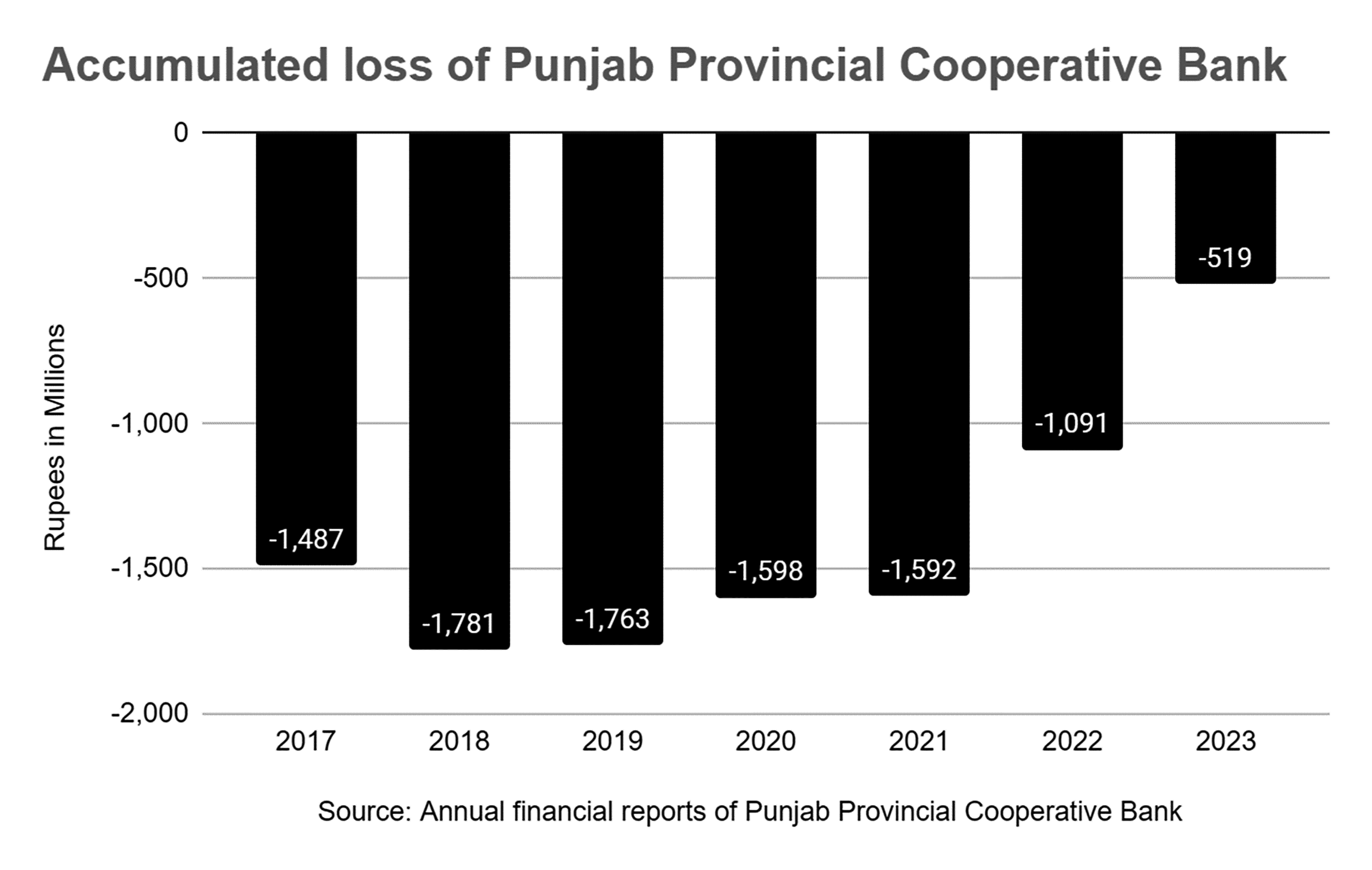

This bank had been accumulating losses yet if you look at the income statement of the bank, it would show you profits. So what is going on here?

“Some of the entries were mistreated,” Shakeel told Profit.

PPCBL’s pension fund woes contributed to the accrual of these losses. “The history of these accumulated losses is that in 2013, when the bank prepared its financial statements, it failed to account for the pension fund,” explains Shakeel. Banks typically create financial statements with certain provisions. However, this bank did not. It was incurring losses. To mask these losses and show a profit, the bank only made provisions for that year, neglecting to set aside provisions for the following years. “If we deducted these provisions from the financial statements of those respective years, we would have been revealed as a loss-making entity,” elaborated Shakeel.

“As I’ve mentioned before, there was a gap in the financial competence of the senior team. For many years, we did not have a chartered accountant overseeing the accounts,” explained Bhatti.

“We are addressing this issue now. However, it’s important to note that there are no major issues that could threaten the bank’s continuity”, he added. “When I joined, the interest income earned on loans was categorised under ‘other assets’ and ‘other liabilities.’ It was merely done to inflate the balance sheet’s size. We have rectified what needed to be corrected. In the coming days, you will observe improvements in the balance sheet.”

The Bank has also hired a qualified Chief Financial Officer from A. F. Furgosen who will oversee these matters.

- Recovering bad debts

“When I joined this bank I had 2 targets – first to recover the NPLs as much as we can because it is the lifeline of the bank. Liquidity can only be generated by recovering NPls since no other organisation would inject capital. Second, generating enough revenues to cover operational costs and run the business. There were about 1500 to 1600 employees and around 1200 pensioners. That makes around 2700-2800 people. Their salaries and pensions accounted for approximately Rs 1.3 billion a year which has now increased to Rs 1.5 billion.”

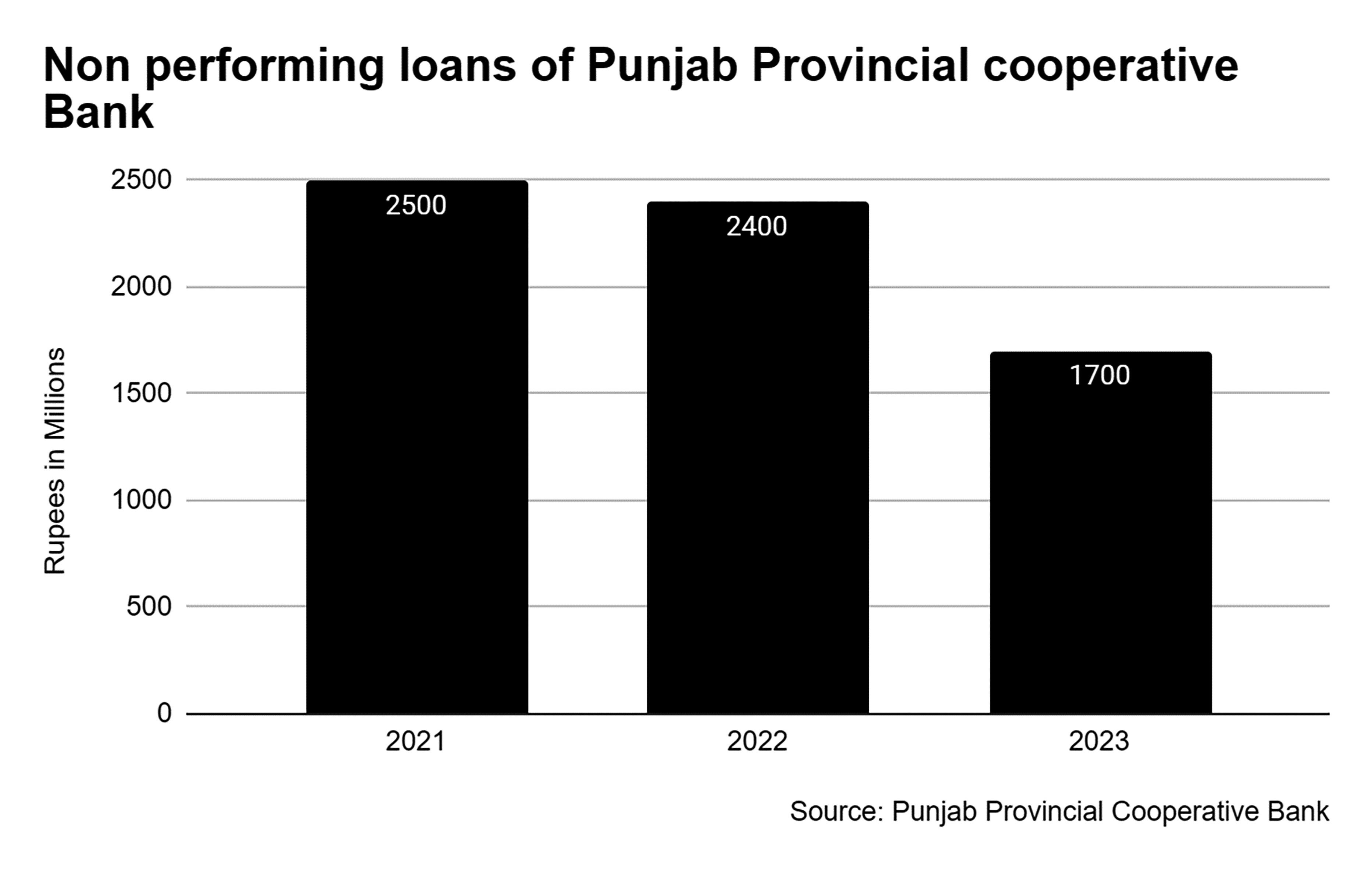

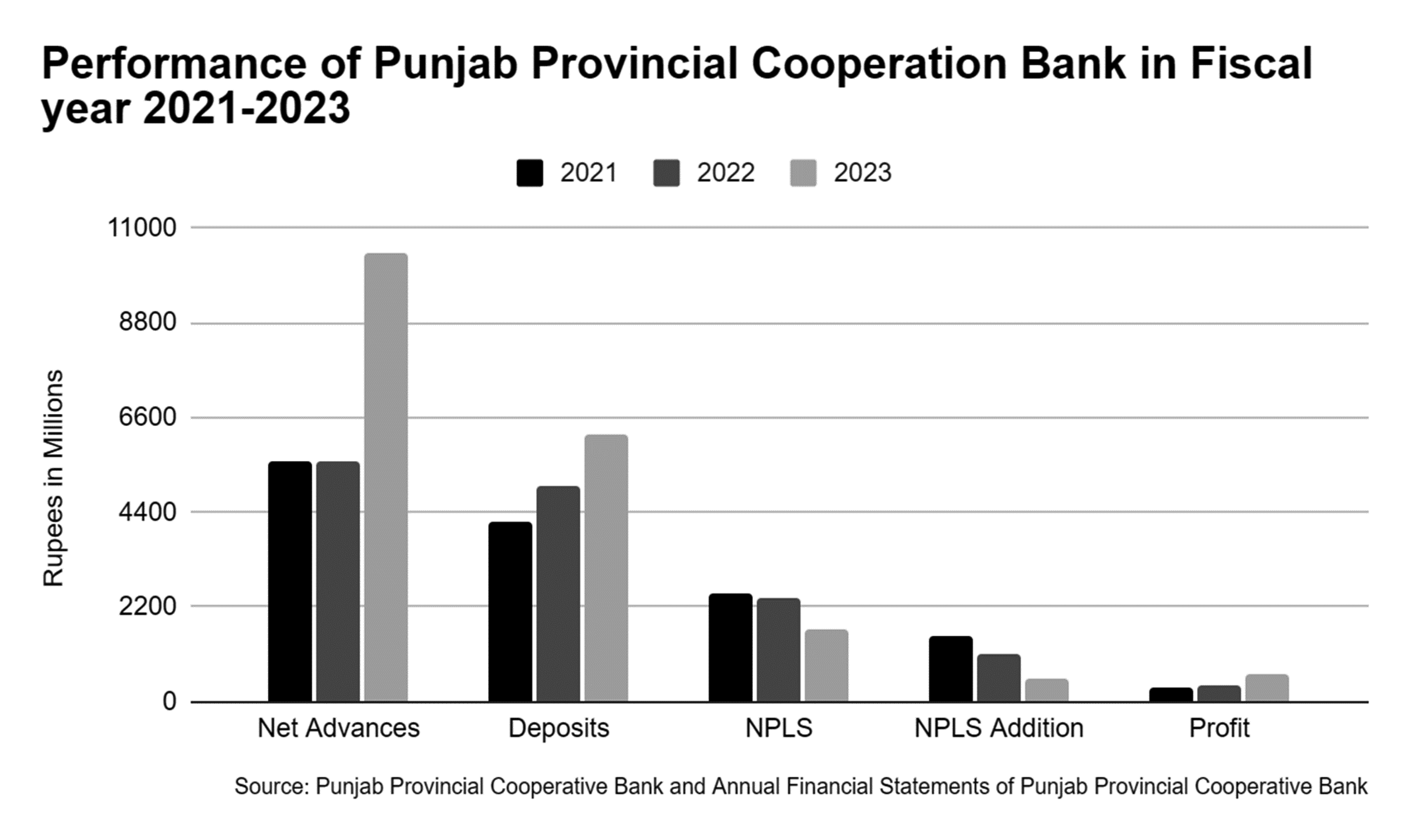

Thus, PPCBL orchestrated a synchronised strategy to start recovering NPLs. “Our NPL principal was around Rs 2.5 billion which had started piling up in the last 20 years. So we made a strategy – we forged recovery teams for recovery. We forged synergies with our branches and dispatched teams into the field without distinguishing which personnel had given this loan or whether this loan was given 10 years ago or 25 years ago.” The result? A triumphant recovery of these long-dormant loans.

“Every week, I monitored the whole team – including all zones and all division heads – at each step and each branch. We would discuss progress in each fortnight or 10 days.”

This granular approach bore fruit, and by the time June 2023 arrived, the daunting figure of Rs 2.5 billion had elegantly dwindled to a resurgent Rs 1.7 billion. With palpable enthusiasm, Bhatti conveyed, ‘We not only reclaimed substantial principal amounts, but also recouped accrued interest. This greatly helped us with profitability”.

- Gains from property revaluation

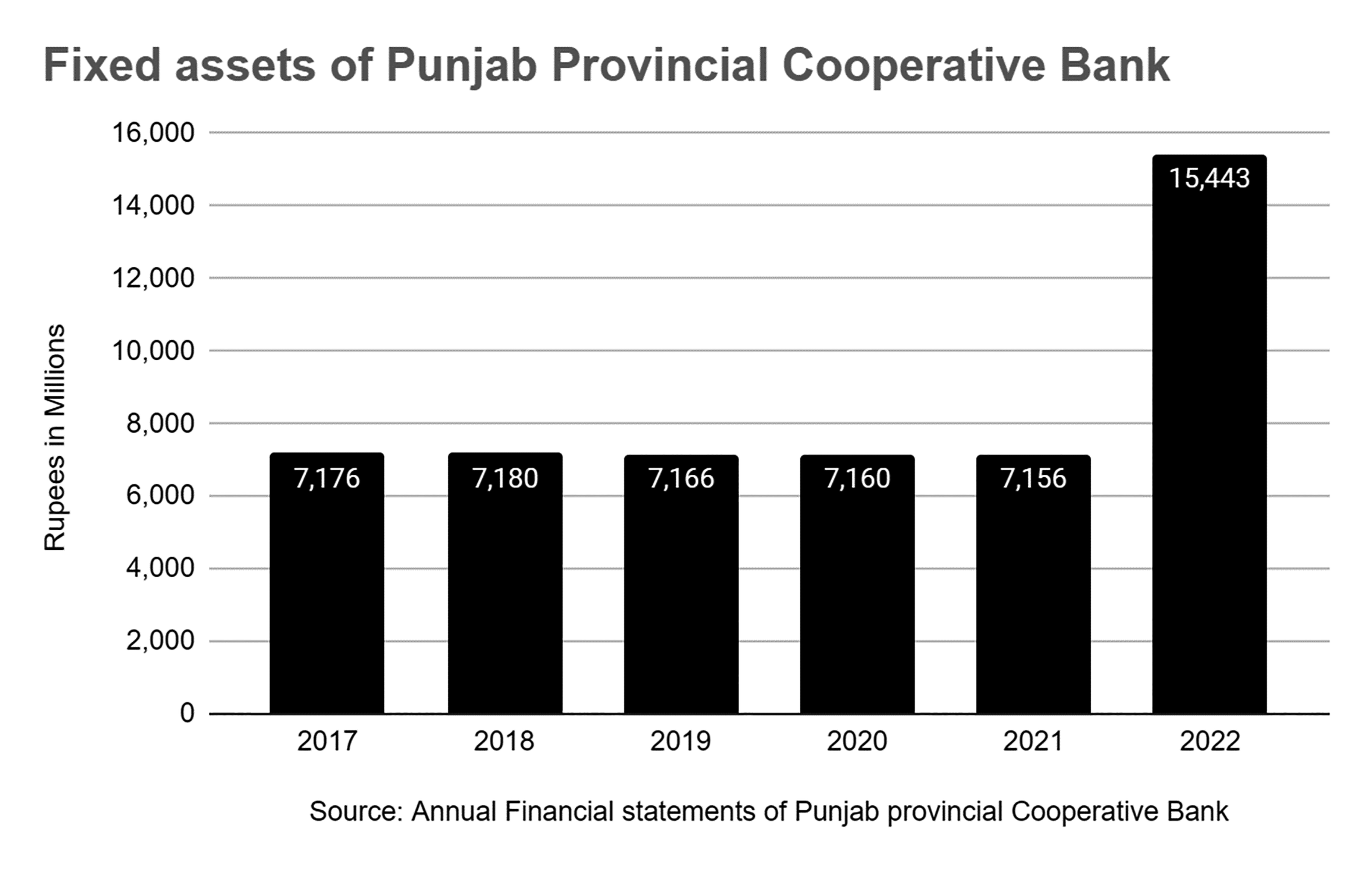

Beyond these achievements, a treasure trove of gains emerged through the revaluation of our fixed assets.

“One of the biggest strengths of this bank that was not realised earlier on was that we have close to 116 properties all across Punjab – all very lucrative and expensive. When I got these assets revalued, they more than doubled and went up to Rs 15 billion from Rs 7 billion. This figure only includes the price of the land, and not the buildings”, stated Bhatti.

Illustrating with a vivid instance, Bhatti chimed in, “We sold one property in a small town. Its book value was Rs 50 lakhs but we sold it at Rs 2.1 crore. So that’s how we made capital gain”.

Hence, the bank was generating profitability from various sources apart from the markup income. Recovery of previous loans resulted in immediate reversals as the provisions decreased.

What worked for PPCBL that does not seem to be working for other banks catering to the agriculture sector?

As we mentioned earlier, Punjab Provincial Cooperative Bank is focussed on the agricultural sector. Microfinance banks also cater to this sector and are supposedly their competitors. While PPCBL managed to not only remain profitable but also decrease their non performing loans, microfinance banks are swamped with losses related to non-performing loans, so much so that after writing off their loan books, most of them are looking for capital injection to improve asset quality.

How come PPCBL has not only remained profitable but also managed to recover previous loans?

Bhatti explained, “Our presence is around 100 years old, whereas microfinance banks are a recent phenomenon. Besides, people working with us are in their fourth generation now. Our staff knows the market and the market knows our staff. Similarly, we have a Cooperative department which has also been here for around 100 years. There are 1500 sub-inspectors in this department. Their main job is to recover the loans disbursed by PPCBL”

The Cooperative department is a body under the provincial government. The Registrar of this department registers the cooperative societies. Their role is crucial as loans, and renewals if loans are granted on their recommendations

Bhatti weighed in on the pricing aspect, expressing his concern over the sky-high rates imposed by microfinance banks, which hover around a staggering 50%. “This is a recipe for disaster as nobody would be able to pay back their debts”, he commented. He proudly highlighted his own institution’s markedly different approach, boasting interest rates are less than 25%.

Adding another layer to this financial conundrum, Bhatti emphasised the unique challenges his customer base faces. “Our customers’ lack financial literacy. They can neither calculate nor comprehend markup rates. So they find out after taking loans that they do not have the capacity to pay”.

He added, “We exercise meticulous discretion in the selection of our customers, relying on the trusted recommendations of the Cooperatives Department. Moreover, our front-line staff comprises local individuals who are intimately acquainted with the ebb and flow of the market, enabling us to make informed decisions. You will be surprised to know that of the fresh loans extended, the overdue portion is hardly 2%”.

Future of PPCBL

Within the arsenal of this bank lie remarkable strengths.

- Spearheading Financial inclusion

The bank has a significant opportunity for advancing financial inclusion.

“Our mission is not to make a profit. Our main job is the economic uplifting of rural communities. Our bank holds the unique advantage of being able to achieve levels of inclusion that no other bank can owing to our presence at the grassroots level in tehsils and sub tehsils, and our legacy of 100 year. We are actively pursuing this goal and making strides in that direction.

- Financial prospects

“Balance sheet wise, this is one of the strongest banks in the country”, declared Bhatti. The bank’s liabilities include deposits of Rs 6 billion only. Against this figure, the bank has investments of around Rs 6 billion in government securities, advances of Rs 10 billion and fixed assets of Rs 15 billion. “The bank’s capital adequacy ratio stands at an extraordinary 62%, which is a rarity in this industry”, added Bhatti.

“Steering the bank away from losses while expenses were rising was a significant challenge. However, thanks to our dedicated employees, we are on a path to recovery. The SBP’s decision to lift the embargo was a pivotal moment, and we haven’t looked back since,”exclaimed Bhatti.

Prior to the embargo, there were no new loans issued, but in the two years following its lifting, the bank successfully disbursed Rs 6 billion, encompassing both rollovers and new loans. However, a noticeable gap remains, particularly in deposits. Despite achieving a record deposit figure in fiscal year 2023, marking our 99-year journey, there is still ample room for improvement.

Bhatti shared with Profit that the SBP recently conducted a thorough audit of their bank, spanning three months and involving visits to every branch. Initially, their Composite Risk Rating (CRR) was at the lowest level. However, they have now progressed to a moderate rating, which serves as a testament to their improvements and acknowledgement of their accomplishments.

- Conversion of Non-banking Assets to Banking assets

The bank is in the process of converting non-critical non-banking assets into banking assets. Being a cooperative bank, PPCBL adheres to cooperative society bylaws, which not only allow the bank to own non-banking assets but also generate income from them.

While the bank has leased around 80 shops, it’s important to note that property isn’t their primary focus. Thus the bank plans to convert non-critical non-banking assets, such as buildings, into banking assets. The generated funds will be directed toward their core activities: lending and investments. Although this process will take time, they are actively working on it.

The way forward

The bank is currently in the midst of a significant transformation. It is enhancing their database, upgrading existing branches, and constructing new ones. It is implementing a centralised core banking system.

“PPCBL was a member of 1LINK, but our membership was suspended. We are now going to renew our membership so that we can introduce digital banking services like Interbank fund transfer (IBFT), RAAST, and Real time gross settlement (RTGS),” shared Bhatti. Other initiatives include establishing ATMs and mobile banking.

The bank has also engaged in negotiations with the Pakistan Credit Rating Agency (PACRA) and is poised to initiate the credit rating process once the audited financial statements become available in September. The bank is optimistic about receiving a favourable rating from PACRA.

To turn thing in right direction your bank need a qualified statistical analyst . Who will gather proper required data , tell you factual challenges and many other things to improve your system and track you to way of success.