Shell Pakistan has become a coveted prize. It has been wrested from the grasp of local investors, and foreign interest seems to be surging. The company heralded the dawn of the week starting on October 16 with the news that a global oil behemoth has expressed interest in making a bid for the company. The revelation came on the back of a weekend full of whispers that the world’s largest oil company is also eyeing Shell Pakistan.

How are Shell Pakistan and Shell International reacting to all this?

“On 14 June 2023, Shell Pakistan Limited (SPL) informed that the board had been notified by Shell Petroleum Company Limited (SPCo) of its intention to sell its 77.42% shareholding in SPL,” stated the company.

“SPL has been informed by SPCo that SPCo is conducting a targeted sales process which will entail further due diligence and negotiations with potential buyers, and at this stage is witnessing robust interest from both international and domestic parties. As SPL is a listed company, during the course of the sale process, some potential buyers may issue a statement of public announcement of their intention to acquire SPCo’s shares in SPL pursuant to Pakistan securities and listing rules,” they added.

“Any sale by SPCo of its shares in SPL remains contingent on the execution of binding documentation and the subsequent receipt of regulatory approvals, and further announcements will be made by SPCo and SPL at those times,” they concluded.

So, what’s up?

Who is Prax, and why would they want Shell?

Headquartered in London, Prax is a British multinational, independent global energy conglomerate dealing in crude oil, petroleum products and bio-fuels, with a complete integration across the oil value chain, from upstream to downstream.

At the core of Prax Group’s operations are exploration & production, refining, logistics, and integrated supply & optimisation. The Group’s assets and investments are strategically designed to complement and enhance these activities. The Group employs a robust workforce of 1,450 individuals, spread across 8 offices worldwide. The Group’s downstream marketing and distribution businesses bear the Harvest Energy brand.

Meanwhile, its midstream and upstream businesses, encompassing refining, blending and exploration and production, carry the Prax brand. Collectively identified as the Prax Group, it encompasses a total of 66 companies within the corporate structure and 3 subsidiaries. The company has a global footprint with operations spanning across the United Kingdom, Belgium, the United States of America, Singapore, Kazakhstan, Switzerland, China, the Netherlands, Nigeria, and Albania.

The company, led by its transaction advisor AKD Securities, has set its sights on acquiring an impressive 77.42% – equivalent to 165.7 million shares – through an agreement. This ambitious move could potentially result in a total acquisition of 88.71%. In executing this strategy, they will not only have bought out SPCo’s share (the 77.42%) in SPLn but will also have bought out additional shareholders (the 11.29%) to consolidate their position.

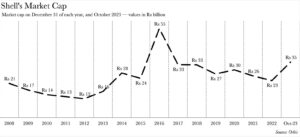

As of this writing, SPL’s market capitalisation stands at a substantial Rs 34 billion or $127 million. This acquisition strategy is not only ambitious but also makes perfect business sense.

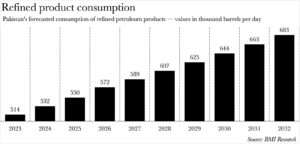

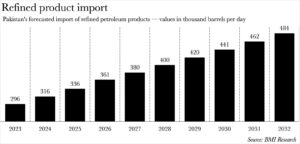

Despite grappling with high prices and rampant inflation, Pakistan’s demand for refined petroleum products is projected to increase at a compounded annualised growth rate of 3%, reaching 682,970 barrels per day (bpd) by 2032. This trend provides Prax with a sustained demand for their product for at least a decade. Moreover, as an oil marketing company (OMC), SPL provides Prax with a significant footprint in the Pakistani market.

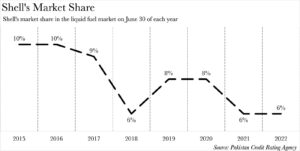

SPL’s market share in the OMC segment has unfortunately plummeted from 10% in fiscal year 2015 to 6% in fiscal year 2022. However, with over 600 filling stations scattered across the country, there is still potential for growth.

Most importantly, however, the majority of demand for petroleum products in Pakistan is set to be met with imported petroleum products. Imports are set to rise in a similar vein to general consumption. What does this mean? Prax can acquire the imported petroleum products from their own global subsidiaries to meet their Pakistani OMCs needs.

More importantly, the deal works for Shell.

Shell’s need for a foreign buyer

SPCo announced its parent company’s intention to divest from the Pakistani market in June of this year. This publication has already provided an extensive analysis of the reasons behind the company’s decision to sever ties with Pakistan.

Read more: Shell is exiting Pakistan. What does it mean and what could the transaction look like?

However, the decision to exit the Pakistani market boiled down to two identifiable reasons: Pakistan-specific risks to which the company was exposed, and its plans for global restructuring across various different markets. One of the key topics of discussion that has risen since the announcement is how SPCol would actually extract its funds from Pakistan.

The company is a multinational, and therefore all money that it would want from the transaction would have to be given to it in the form of US Dollars, or perhaps Pound Sterling or the Euro. All of which Pakistan is short of, and whose flow out of the country we have actively tried to stem over the past year in various different ways.

“The major impediment to the company’s exit would be finding a way to arrange the dollars that would have to be paid to Shell abroad,” explains Mustafa Pasha, Chief Investment Officer at Lakson Investments. “If it was a domestic buyer, then the regulator would probably say that, fine, if you want to execute this transaction, then do you have the ability to arrange dollars from abroad so that Shell can be paid off and the net outflow from Pakistan is negligible,” Pasha adds

This is exactly what Pakistan Refinery (PRL) did earlier this year when it made a bid to buy out SPCo. Amongst its various different plans to make the payment, it also entertained the idea of settling the transaction entirely abroad. This was also perhaps the main reason why it partnered with a mobile manufacturing and distribution company with offices outside of Pakistan.

Read more: Pakistan Refinery Limited, and Airlink make joint play for Shell

In any capacity, PRL would have had to finance a dollar-based transaction with Pakistani Rupees and therefore add pressure to the country’s already precarious foreign currency reserves. However, SPCo seemingly wants nothing to do with the Pakistani regulator altogether.

Confidential sources intimately acquainted with the situation have revealed to Profit that SPCo has, in fact, dismissed the joint venture of PRL and Airlink. The rejection was primarily due to dissatisfaction with the proposed financing mechanism. Moreover, when viewed in conjunction with the notes from Attock Petroleum’s recent corporate briefing, it becomes clear that Shell is seeking a foreign buyer.

Although Attock did mention that SPCo appeared to have already chosen a buyer, Profit has been informed of additional bids on the horizon — particularly from overseas. The only plausible explanation for this scenario is that SPCo is resolute in its decision to secure a foreign buyer for SPL.

This apparent preference for a foreign buyer not only bolsters the likelihood of Prax’s bid being accepted but also substantiates the whispers about Saudi Aramco’s interest in SPL. The question arises — why would Aramco be interested in SPL? The answer lies in the fact that such an acquisition could potentially resolve numerous challenges for the Kingdom that operates this state-owned oil behemoth.

An outlet for the Saudi refinery

The Petroleum Refining Policy, formally known as the Pakistan Oil Refining Policy for New/Greenfield Refineries 2023, was unveiled earlier this summer. This policy has been tailored specifically for a single project – a greenfield deep conversion integrated refinery and petrochemical complex with a crude oil processing capacity of 300,000 bpd. This project is being established in collaboration with Saudi Arabia to the tune of $10 billion.

The policy does not permit any future refinery projects that utilise a different oil refining process or technology other than deep conversion, or have a capacity less than 300,000-bpd. Moreover, it stipulates that it must be an integrated refinery and petrochemical complex, regardless of feasibility. Refinery projects with a capacity of less than 300,000-bpd will be considered under a separate package offering lesser incentives and concessions.

With a theoretical refining capacity of 400,000 bpd, Pakistan is woefully inadequate to meet its petroleum needs. Consequently, it imports a staggering 70% of its motor gasoline (petrol) and 60-65% of its high speed diesel (diesel). The Saudi refinery, however, promises to be a game-changer. It will not only double Pakistan’s refining capacity – considering how our local refineries seldom reach the 400,000 bpd mark – but also offer a full conversion facility. Unlike our local refineries, which are hampered by the furnace oil production, the Saudi refinery will exclusively produce petrol, diesel, liquified petroleum gas, and petrochemicals.

This means that once operational, the Saudi refinery will significantly augment the supply of petrol and diesel in the country. Furthermore, the aforementioned advantages of having an OMC in Pakistan over the next decade also apply to Aramco — and to a larger extent too.

Naturally, Aramco would prefer to have its own OMC to distribute its product rather than depend on other players. The reasons are obvious: better planning and higher margins. All refineries with an OMC arm leverage it to boost their core sales. These wings enable them to forecast better, minimise inventory losses, maximise inventory gains, and capture the total integrated margin a refinery could earn. This entails internalising the refinery margin, the OMC margin, and even the dealer margin if they directly own their pumps.

This brings us to the elephant in the room. How would the Saudi government benefit from all this?

The kingdom on a buying spree, and the country that needs capital injections

Let’s get one thing clear. If the company placing the bid is Aramco itself — not its trading subsidiary or any of its subcontractors — then this implies that the transaction has received sovereign approval. One might wonder, why would the Saudi government have an interest in acquiring Shell in Pakistan, of all places?

“This transaction aligns with Saudi Arabia’s interests on several fronts,” articulates Haroon Sharif, the Former Chairman of the Board of Investment. “Primarily, they can reassure Pakistan of their support for its balance of payment needs, however modest they may be.” He further adds, “Secondly, they can implement their strategy of broadening their regional footprint.”

Sharif continues to explain the strategic importance of this move. “Thirdly, and perhaps most significantly, they can exert greater diplomatic influence in the region by increasing their stakes here.” He concludes by saying, “Lastly, under the current recessionary conditions, they might secure a lucrative asset price.”

In essence, the Saudis will have communicated to Pakistan that they are increasing their stake in the country and bolstering the Government’s coffers — albeit through the PSX, rather than physical assets.

There are limited assets that can be evaluated and traded through the market. Therefore, Shell Pakistan, OGDCL, and other listed companies are easier to divest and purchase because a corporate governance mechanism is in place. It is a stock market transaction and financial advisors might find it more comfortable than working on pricing mechanisms for hard assets. Furthermore, it provides the Saudis with a more straightforward mechanism to liquidate their investment if necessary.

When it comes to listed companies, it might be more beneficial for the Pakistani government to have Shell act as a conduit for investment rather than sell off OGDCL in its current state. After all, they would still be receiving a financial injection and replacing one repatriation stream with another rather than creating an entirely new one.

The real advantage for Pakistan in Shell being bought out by Armaco lies in the potential spillover effects that it might generate.

“The fact that Aramco is a prospective bidder lends credibility to the view that the Saudis are keen on Pakistan and are looking to increase their stake here,” states Pasha. He further adds, “I think overall that’s a positive for Pakistan because the Saudis have been on a buying spree; they’re flush with liquidity and have their 2030 vision.”

Pasha continues his analysis by saying, “If Pakistan even figures as part of that vision in a small way, it can result in significant dollar inflows over the next six months to a year.”

This is crucial because we have pinned many of our hopes on the Saudis coming to Pakistan in a big way — whether it is in the form of deposits, foreign direct investment, refinery, Reqo Diq or corporate farming.

Why Pakistan needs a foreign buyer for Shell

First, and foremost, settling the transaction abroad will not only save Pakistan from a foreign exchange outflow but might even bring a small chump of change in terms of foreign exchange too.

Any time there’s a change of ownership in excess of 30%, it requires a tender or bidding process for minority shareholders where the acquirer has to bid for at least 50% of the outstanding float that is not being purchased from the majority buyer.

SPCo owns 75%of SPL and it’s open to exit its entire stake, that means the float is around 2%. So whoever ultimately makes the acquisition they would at minimum have to bid for 50% of the minority float, right, which is 12.5% of SPL’s shares. Subsequently, the minority shareholders that might be frothing at the mouth with all these developments will also be the reason for an ever so slight foreign exchange injection into Pakistan.

The other thing that having a foreign buyer, irrespective of who buys it in the end, is that there’s also the positive image building that it could potentially do for the country. “If a foreign player comes here, it’s indeed a reassuring factor that an international company has confidence in Pakistan’s market,” explains Sharif.

This is particularly important when you’ve witnessed the exit of HSBC, Eli-Lily and are currently overseeing the exit of Lotte Chemical and Telenor.