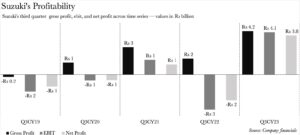

Suzuki Pakistan, formally known as Pak Suzuki Motor Company, released their earnings for the ninth period ending September on October 19. The verdict? The company has registered its most dismal performance for the ninth month over the last half-decade. Suzuki has been dealt a crushing blow across all major financial performance indicators.

The company’s earnings before interest, and net profit have plummeted to five-year lows. If it weren’t for the company’s revenue and gross profit marginally surpassing their counterparts during the pandemic-ridden 2020, this would have been a complete financial meltdown over a five-year span. Intriguingly, this downturn also coincides with Suzuki recording the best July to September earnings over the past five years.

“Suzuki is essentially a casualty of the relentless economic storm. That has hopefully ended now,” Yousuf Farooq, Director of Research at Chase Securities, articulates. Echoing his sentiments, Faizan Kamran Khan, CEO of FRIM Ventures, adds, “The automobile sector has arguably borne the brunt of the economic meltdown that’s swept the country.”

Before we dissect how Suzuki found itself ensnared in this predicament, it’s worth spotlighting that the company performed exceptionally well from July to September. In fact, Suzuki has outperformed its own expectations over the past quarter. The company’s net profit of Rs 4 billion marks a record-breaking July to September profit in the company’s ledger over the last five years. So, what’s their secret?

“A significantly low tax rate this quarter was bolstered by utilisation of its deferred tax asset while margins improved due to efficient inventory procurement. The company also recorded finance income instead of a charge, possibly due to exchange gains resulting from the Rupee’s appreciation,” Khan elucidates.

Now, onto Suzuki’s woes.

Demand destruction

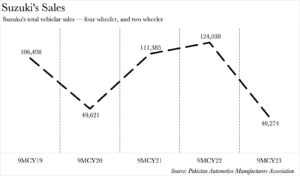

Much like the rest of the industry, Suzuki’s total sales have taken a nosedive. The combined sales of four-wheelers and two-wheelers stand at a mere 40,274 units. This represents the lowest inventory of vehicles that Suzuki has managed to sell by September in any year over the past five years. Alarmingly, the current figure is even lower than what Suzuki recorded during 2020, at the peak of the Covid-19 pandemic.

The culprits behind Suzuki’s sales slump? From a demand perspective, it’s the rampant inflation and the relentless upward price revisions due to the Pakistani Rupee’s continuous depreciation against the US Dollar. One way to gauge the impact of the economic crisis on automotive demand is by examining automotive lending. “Auto financing accounted for 44% of total personal loans back in August 2021, while it currently stands at 33%,” Khan reveals with a hint of exasperation.

There’s also been a shift in Suzuki’s sales composition that further intensifies the inflationary pressures wreaking havoc. Customers are essentially gravitating towards either Suzuki’s most expensive offering or its most affordable.

A whopping 36% of Suzuki’s total nine-month sales are attributable to the Alto. While this figure is lower than the 39% of total sales the Alto achieved over the same period last year, it still surpasses the previous year’s average of 29%.Moreover, Suzuki’s Swift and its motorcycles now account for 9% and 31% of total vehicular sales respectively. This is the highest contribution these two have ever made in relative terms. What does this imply?

The rest of Suzuki’s lineup — the Wagon-R, the Cultus, the Bolan, and the Ravi — have been virtually obliterated. The substantial middle ground of sales that Suzuki achieved between its price points has evaporated, and Suzuki has undoubtedly felt the impact. While a greater number of customers on the more expensive end buying their Swift and motorcycles might have cushioned it against inflationary shocks to buying, these buyers are minuscule compared to the buyers for the aforementioned middle-ground vehicles. Similarly, while the Alto has been Suzuki’s cash cow for several years now, such high reliance on the Alto leaves Suzuki vulnerable to future inflationary waves.

Despite all this, the more pressing issue plaguing Suzuki for the entirety of the year has been the supply-side constraints and the capital controls that precipitated them.

Supply side bottlenecks, and capital controls

Beyond the dwindling demand for Suzuki’s vehicles, the company found itself ensnared in a predicament where it couldn’t sell as many vehicles as it would have liked this year. Suzuki was simply hamstrung, unable to import the necessary raw materials needed to keep the wheels of production turning. As a result, the company was hit by over ten plant shutdowns, thereby imposing self-inflicted bottlenecks on its sales capacity.

Now, let’s dissect the most critical reason why Suzuki finds itself in its current quagmire: its losses in the first quarter of the year. Suzuki kicked off 2023 on a grim note, bleeding a loss of Rs 12.9 billion from January to March. The lion’s share of this loss was attributable to the staggering Rs 12.8 billion paid out as cost of financing. What led to this astronomical cost of finance?

In addition to the costs associated with borrowing, Suzuki’s cost of finance includes costs related to mark-up on late delivery, demurrage and detention charges, and exchange losses.

“The way this business operates is that you procure your inputs from your supplier on credit terms for anywhere between three to four months,” Farooq elucidates. He further adds, “So, what transpired is that they ordered goods, manufactured a car and sold it. Yet, when they tried to remit payment to their overseas supplier in the corresponding foreign currencies, they found themselves barred from doing so. This restriction was a direct consequence of Pakistan’s precarious foreign exchange reserves at the time. Consequently their payable remained in limbo, and when they finally had the opportunity to make the payment, they had to disburse a higher amount due to the Rupee’s depreciation over that specific time period.”

In essence, exchange losses are what Suzuki is still wrestling with. Now, Suzuki is not an anomaly. The majority of Pakistan’s companies suffered exchange losses over the past year due to the Government of Pakistan’s imposition of capital controls and foreign exchange rationing. Suzuki just happens to be an extreme case.

Beyond the financials

Now, let’s address the elephant in the room. Alongside the release of their financials, Suzuki made another significant announcement: their board has decided to push through the decision to delist the company from the Pakistan Stock Exchange.

What does all of this mean? More importantly, what’s led them to do this? Profit has covered this matter in a separate article on our website, and Pakistan Today for those interested.

The woes of Pakistan economy are that it has allowed foreign investment but that ventures are 200 % import dependants hence no real benefits to Pakistan economy’s even if they are in profit.

This is bad news for Suzuki. If the conditions will continue next year, mass lay-off for their workers are expected and closing some of their branches is inevitable. Hope Suzuki recover this coming Christmas Season!