If you are a reader of Profit, you will know by now that everyone is taking the digitization of the economy very seriously. Much of the efforts for this digitization can be attributed to the adventures of technology companies – aka, the venture-funded startups. Some of them are taking small retailers online by helping them create online stores. Others are focused on digitising payments and procurement. The list goes on.

And the regulators have noticed. The State Bank of Pakistan (SBP) has rolled out numerous regulations to prop up fintech companies to digitise payments. Numerous directives from the central bank are focused on increasing the adoption of digital payments. And to that end, the instant payments system Raast was launched last year.

The kicker here is that banks, too, now seem to be convinced that if they don’t propagate digitisation, someone else [read: startups] will, challenging the banks’ status quo. If you’re wondering how a tech startup, say in logistics, threatens banks, remember that payments are at the center of everything. In the words of Angela Strange of the storied venture capital firm Andreseen Horowitz, ‘every tech company is a fintech company’.

One bank has taken notice, as evidenced in the recent partnership announced in November 2023 between Bank Alfalah and Chikoo. The latter is a prominent technology company that provides an app-based digitisation to micro, small, and medium enterprises (MSMEs) in Pakistan. It is now set on providing the same digitization to Bank Alflah’s hardware devices.

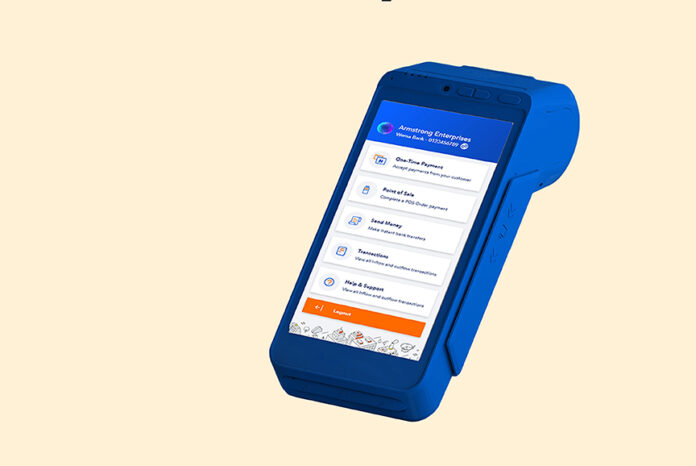

The Chikoo app can now be downloaded on Alfalah’s point-of-sale (PoS) devices, facilitating the digitisation of orders, payments, and customer management directly from the Bank Alfalah PoS device. Now, any offline retailer that records its inventory through the Chikoo app, can also immediately create an eCommerce site to sell goods online.

Broadly speaking, both Bank Alfalah and Chikoo believe that digitizing small and medium scale businesses is a big opportunity: one that can bring big business and impact the entire economy.

“Our aim at Bank Alfalah is to help merchants be able to increase sales and business through such digitisation,” says Ammar Naveed Ikhlas, head of retail payments solution at Bank Alfalah. Ikhlas is one of the key people behind this scheme.

For a bank, it can bring in more payments revenue and financing opportunities in the long run. For a company like Chikoo, any partnership that helps it achieve greater scale brings more revenue in from fees collected from using the platform.

The opportunity

Logically, MSMEs is where the opportunity also exists. There are an estimated 5 million MSMEs in Pakistan that mostly have manual operations and use paper and pen to record transactions, which becomes time consuming and costly. If these operations are digitised, these businesses can become more efficient, grow their sales and make operations more profitable by making smart business decisions based on data collected through digitisation.

One aspect of such digitisation is enabling small businesses to record inventory on a digital platform so that tracking inventory becomes easier. To illustrate with an example, let’s say that you are a home-based baker who sells cookies and doughnuts online. Every time you bake your products, you can record the quantity you have baked on the Chikoo platforms on either the phone or a computer so that when an order is processed, also via the Chikoo app, the quantity sold and the quantity remaining are automatically adjusted on the platform. If you use a website to sell your products, and the next time someone orders and you are out of stock, the product on the website will automatically reflect as out of stock.

This way, inventory management improves and you as a seller do not have to worry about manually recording how much you sold in a day, or getting on calls back and forth to inform customers that a certain product is no longer available.

This is just one aspect of digitisation. Others could be digitisation of invoices and payments. The main end of such digitisation is to bring the focus of a small company towards growing the business by, say improving their products instead of wasting time and money on managing inventory and invoices or collecting payments and then reconciling them.

Chikoo is already focused on such digitization at small retailers, but only through an app to give them inventory, sales management, payments and eCommerce functionalities. While Bank Alfalah is focused on increasing the penetration of PoS machines in the market for acceptance of digital payments. What if the two were combined? That is to make the Chikoo app available on the Bank Alfalah PoS.

Rather than going at it alone, it’s better for both to do it together. A bank does not have either the technology capabilities or the mindset to build offerings such as inventory management and invoicing, so stands to gain if retailers have these options. Similarly, a company like Chikoo can perhaps never create its payments acceptance business, so it also will gain if it is able to accept payments through its platform.

Raza Matin, chief executive officer and co-founder of Chikoo, says, “Our platform is available in a multitude of ways, so customers who are not currently utilising digital payments can still use their smartphones to access Chikoo’s services, while businesses with a certain volume of customers, who use digital payments or will benefit from digital payments will be eligible to get the PoS machine.”

Winners and losers

But is this partnership really worth its salt? Consider that solutions like this already exist in the market. For example, retailers of sizable scale use their own PoS hardware on which Shopify provides the same inventory management tools. What is so special about this partnership, and will retailers accept it?

For starters, the size and scale of the business that matters. Ikhlas explains that firstly, their target market is not the retailers that have already digitized their retail operations. Take CarreFour, for example. The hypermarket giant has customized hardwares and softwares to digitize operations as per their scale. So targeting these retailers does not make sense either for Chikoo or Bank Alfalah.

On the other hand, small businesses that need to be targeted would like to save as much as possible while carrying out such digitization. Any such digitisation will come with a hefty purchase of hardware, whether it’s a computer, a barcode scanner or a handheld tablet, along with accompanying software. Pains of the economy aside, these retailers are old fashioned and have been working in a set way for decades. They haven’t seen the benefits of such digitization and therefore they have less willingness to go for it. The best way to get them to digitise their operations is by giving them this digitisation at the lowest cost possible.

Which is why, Ikhlas explains, the hardware costs in the case of Bank Alfalah are not charged to these retailers.

“Instead, the cost of the machines are built into the transactions in the form of a fee charged every time a payment is processed on these machines,” says Ikhlas. These machines are currently only used to process card payments.

But with the Chikoo app now built into these machines, retailers will now have access to Chikoo’s services such as inventory management, invoice generation and payments acceptance. This will serve the larger goal of eliminating inefficiencies, enabling the collection of reliable data, and providing context for business growth.

These machines currently only accept card payments, but could do much more because of their android functionality. Bank Alfalah already has an estimated 15,000 PoS machines in the market.

“All the functionalities have been embedded into Bank Alfalah PoS,” says Matin. “It marries the payment experience and business management system. When you combine customer data, invoice data, and payment data, that is less paper and more information can be extracted from it, which can be used to make better business decisions and help merchants grow.”

Some up and coming startups such as SnappRetail and Aladdin are also focused on such digitization, but achieve it through proprietary hardware and software, charging the merchant a monthly rental fee. Chikoo’s advantage is that it is not focused on such proprietary hardware.

That being said, the arrangement is not exclusive: Bank Alfalah can later potentially make SnappRetail or Aladdin’s app available on their machines, leaving it to the merchant to decide which one they would like to use. Likewise, Chikoo is also free to partner with other banks and integrate its app with their PoS machines.

On the other hand, Chikoo can help drive the adoption of the bank’s PoS machines and market them to merchants that currently use only the Chikoo app. But it is going to be a rough journey.

Matin admits that training retailers – who are often rigid when it comes to changing their attitudes as they have been working in a set way for decades – is going to be a tough task. That is why Chikoo will have its own people on the ground, and will leverage the distribution network and sales teams at Bank Alfalah to educate merchants about the Chikoo app and its benefits.

“You can’t acquire these customers digitally,” Matin says. “To get merchants to do this is going to require a lot of handholding. They have to see that they have to realise the benefits that are going to come out of this and this is going to require people on the ground.”

Boots on the ground has been a consistent focus of other startups as well. SnappRetail and Aladdin Informatics, for instance, have also deployed teams that acquire grocery merchants and then train them to use their hardware and software.

How will Chikoo make money from this partnership? Matin explains there are multiple revenue streams for them. Any merchant that uses the app will pay a very small recurring fee of a few hundred rupees, a small transaction fee on orders that are processed on the app, a cut from the merchant discount rate, and income from providing value added services to merchants. The app on the PoS machine will also be able to integrate offerings from other players, such as lending services from other financial institutions, to give a holistic customer experience.

This partnership is significant in one other way, explains Adeel Rasheed, co-founder at SnappRetail. Startups that are focused on such digitisation of grocery operations have been having a hard time explaining to investors that the need for such services existed. So if a tech company was able to partner with a major bank, this validates their idea and positions them better in front of relevant stakeholders.

Rasheed sees this as a positive for Chikoo, and refutes the idea that it would be a competition in any sense. “The market is currently too big and multiple players can exist peacefully,” he said.

Amer Pasha, the CEO of Aladdin Informatics also had a positive view about the partnership. “This is good news for the digitization of the economy and this will also open new avenues of partnerships.”

The documentation problem

There is still one problem that might outweigh all the positives of this partnership, that neither Bank Alfalah nor Chikoo will be able to solve by themselves.

Small businesses historically have resisted becoming part of the documented economy, in an effort to avoid being taxed. Walk to a small breakfast place in your neighborhood’s commercial area today and you will most likely find no option for making a payment digitally. Ask the owner and he will very likely complain that either the charges (the MDR charged by banks) are too high for a small business like them to keep a PoS machine, or that they don’t even know what options they have to accept such payments.

That is to say no bank has taken the initiative to go to these businesses and present their offerings. Ask a banker and he will tell you that it is an expensive endeavor and a futile one. This is because small businesses are often not registered, and SBP regulations prevent any bank from carrying out business with unregistered businesses.

It could turn out to be very expensive for the bank to onboard unregistered merchants because of the heavy penalties imposed by regulators – in case they find out. So any mass adoption of such solutions for digitisation is going to require a consistent effort from the government to document businesses first, and then leave it to the banks to see such digitisation through. Perhaps then, this partnership will bear fruit.

My first thought on reading this was , tax net, was covered in last paragraph, non runner.

Bank will end up spending money on 300$ POS. For enabling retail solution with share revenue. More use of POS hardware life will get reduce.

What is bank thinking.