Tensions were running high at the Economic Coordination Committee meeting on Tuesday the 13th of February. The query on hand that was raising the temperature of the room was a proposal to increase the price of gas for domestic and industrial consumers by up to nearly 70% in some cases.

One could say that reaching consensus on the agenda item had gone past its deadline. You see, the IMF had instructed the government to revise the price of gas for different kinds of consumers by the 1st of February. The caretaker cabinet, perhaps too busy managing the load of the 2024 election, conveniently forgot to make a notification announcing the increase. The IMF then sent a gentle reminder that an announcement should be made by the 15th of February. Not only that, the fund specified that the increase in gas prices would be effective from the 1st of February even if the actual prices were announced on the 15th. Meaning that for all intents and purposes consumers using gas for the first half of February were doing so with no clue as to what rate they were buying it at.

But what choice did the government have? The IMF is dangling a vital $1.2 billion tranche over Pakistan’s head. And if the price of gas is not increased the fund will not be happy with Pakistan’s progress and not release the money. Despite the urgency of the matter, the ECC meeting on the 13th failed to reach consensus on what should have been a relatively simple decision.

So what was going on? According to a source privy to the meeting, at least four members of the ECC either opposed the proposal to increase the price of gas or wanted to delay the decision. At least two of those opposing the proposition raised objections about the increase in prices for domestic consumers. Our source from within the cabinet claims that some of the members opposing the increase in price were those that had interests in industrial connections of gas as they were themselves industrialists.

The meeting was adjourned without a resolution, and another meeting of the ECC called on Wednesday the 14th of February to finalise the gas price hike. This second meeting ended up finalising the price increase which will be counted effective from the 1st of February.But what final shape did this increase take?

The increase has hit industrialists and in particular the fertiliser industry. But as the details become more apparent, it is clear that some in the fertiliser industry are more directly affected than others. Companies like Engro and Fatima Fertilizers will be affected more directly compared to Fauji Fertiliser. So how does this work?

The increase in question and circular debt

There is a reason the IMF wants to increase gas prices in Pakistan. Very briefly put, Pakistan does not have a lot of gas but we use it like we do. The IMF, as part of the ongoing programme, wanted to increase the price of gas for all domestic and commercial consumers.

You see, Pakistanis have gas cross subsidised. This means that the natural gas we produce is given to different consumers at different rates. There is one category of protected consumers which get it at the cheapest possible rate. These are small domestic consumers that use gas below a certain amount and tandoors that make rotis. Even within this protected category there are slabs and everyone is charged differently based on how much they consume. Essentially, bigger consumers end up subsidising smaller consumers.

And while this is a people friendly policy and popular for political decision makers, it is also unproductive. Because we don’t have a lot of gas available, the IMF and other bodies such as the World Bank have always felt that gas should be used by industries for productive purposes rather than by domestic consumers to power stoves and heat water. This particularly becomes a problem in the winters, when the domestic need for gas increases, governments end up cutting it to industrial users.

The gas industry circular debt is a relatively new situation caused by rising LNG costs and delays by the government in announcing the new and higher tariff consistent with the international gas price hikes. Another contributing factor is the government’s inefficient utilisation of this commodity coupled with untargeted subsidies.

The fundamental cause of the circular debt is the unpaid government subsidies intended for residential and export-oriented consumers for the consumption of LNG. This has hampered Sui Northern Gas Pipelines (SNGPL) and Sui Southern Gas Company’s cash flows (SSGC) as they are not able to recover the actual cost of importing LNG from their respective customers.

To make the point clear, LNG costs a lot more than domestically produced gas, therefore naturally the price should be set at a level that would allow the recovery of the costs. But that is not the case as the government diverted the expensive LNG to domestic consumers which cannot afford to pay for it. This has resulted in ballooning receivables from the twin gas distributors on the balance sheets of energy exploration corporations, primarily the Oil and Gas Development Company (OGDC) and Pakistan Petroleum Ltd (PPL). To summarise it, the government has not paid up the subsidy amount it owes to SNGPL and SSGC for providing gas at lower rates than what it actually costs. The debt is parked within other state owned enterprises, as is the common practice of the government.

The new rates

The IMF ideally wants gas to come to its original price instead of being cross subsidised, which might result in domestic consumers in particular switching to electricity. In fact, one of the most ideal scenarios for the IMF and indeed for industrial consumers is that domestic consumers switch from using gas to cook their food and heat their water to using electricity. The only problem is that domestic consumers are used to cheap gas. Electric cooking ranges, for example, are a rarity in Pakistan. Similarly electric geysers and water heating systems have simply not developed. This is despite the fact that at their real prices, and particularly with solar solutions, electricity is much cheaper than gas.

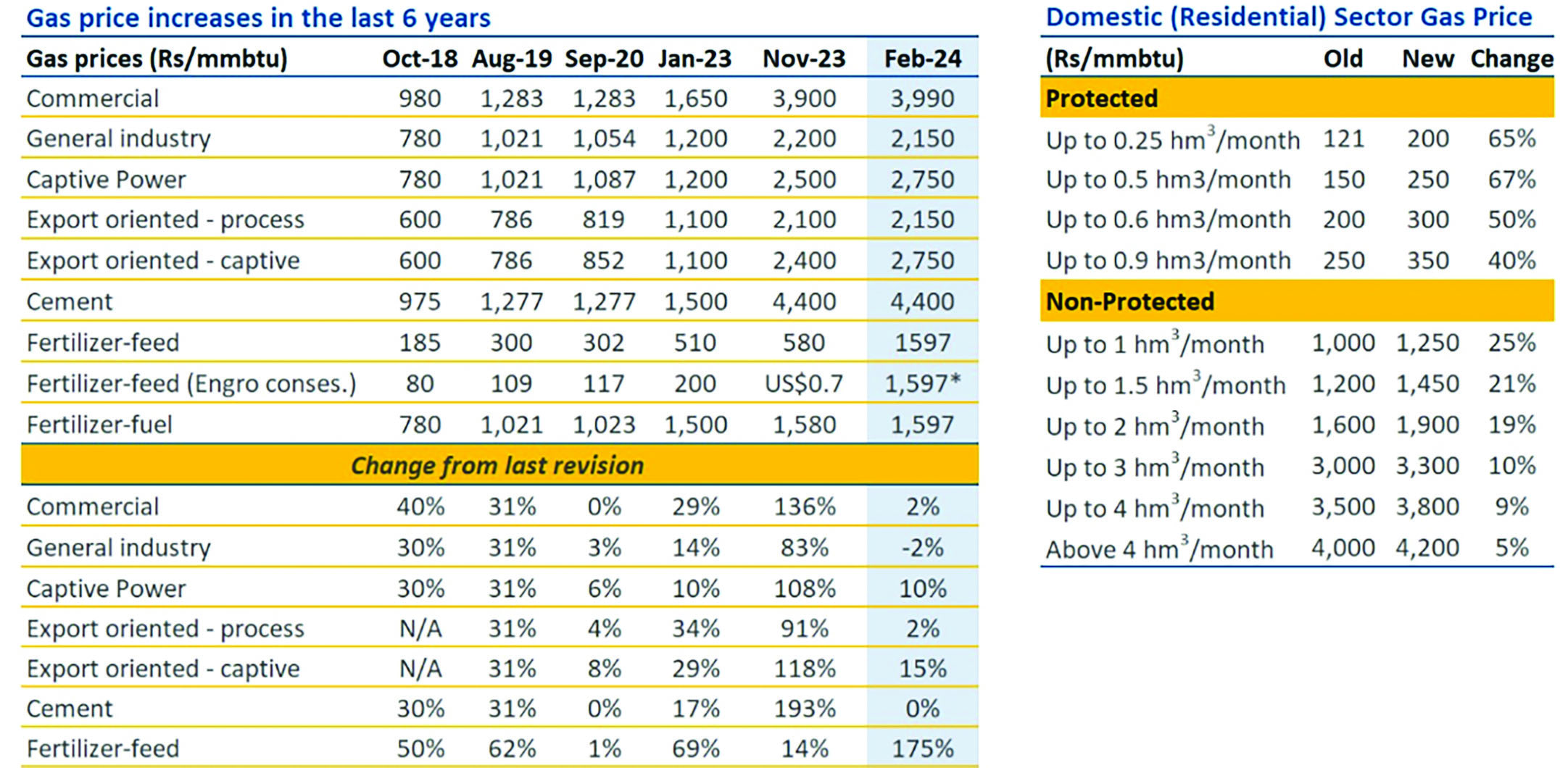

The gas price hikes reflect this. Just take a look at how the prices have increased. Domestic protected consumers and tandoors have had their rates hiked by up to 70% in some cases. Similarly the non-protected category has seen an increase in prices of up to around 25%.

But the real shift is in the subsidies that were being provided to industrial consumers. The first round of gas price increase took place back in November 2023. Back then commercial connection rates were raised by 136%, and the biggest increase was in the cement sector which saw a hike of around 193%. The fertiliser industry was still protected, however. This particular price hike has been gentler on these sectors and has instead focused on the fertiliser industry which has seen an increase of 175% in gas prices.

The ECC Chairman and Finance Minister Dr Shamshad Akhtar stated in the meeting that gas prices should be rationalised for the fertiliser plants that were availing the subsidy being paid by bulk, power, industrial, cement and compressed natural gas (CNG) consumers. The subsidy of Rs 39 billion on feed and fuel gas for Engro Fertilisers was withdrawn and the ECC approved a new rate of Rs1,597 per mmbtu.

At the same time, certain quarters also complained of the price hike. The Chairman All Pakistan Textile Mills Association (APTMA) North Kamran Arshad has strongly opposed the proposed increase in gas price for Export Oriented Units (EOUs) from Rs2400 to Rs2950/MMBTU, saying that this increase would be disastrous for the textile industry. He was addressing a hurriedly-called press conference at the APTMA Lahore office on Wednesday. He was accompanied by Senior Vice Chairman Asad Shafi, Former Chairmen Adil Bashir, Rahim Nasir and Secretary General APTMA Raza Baqir. Chairman APTMA said that the gas tariff was Rs1100/MMBTU in January last year which was uplifted to Rs2400/MMBTU in November 2023 and is now expected to be raised to Rs. 2950/- MMBTU from the current month.

The fertiliser sector and Engro’s good fight

And then there is the other Big Kahuna that has experienced a major price hike. This revision sees the removal of subsidies for fertiliser manufacturers using gas from the SNGPL network, affecting 60% of the industry’s production capacity. The new policy raises the feedstock gas price from Rs580 per million British thermal units (mmbtu) to Rs1,597 per mmbtu, marking a significant increase in production costs for the affected manufacturers.

What does this mean? Well, the first thing to understand is that the fertiliser industry runs on subsidies from the government. The government provides the industry with cheap gas so they can produce cheaper fertiliser and the benefit is passed on to farmers. But this subsidy on Urea is often unproductive. For example, since it is given through fertiliser manufacturers, large farmers and landowners end up getting more benefit from it than smaller farm owners that need it more simply because they can buy more.

There has long been advocacy that this subsidy should be restructured and possibly given directly to smaller farmers, and that fertiliser manufacturers should be given gas at the regular rates (WACOG as it is known in the industry) and they should be allowed to raise their prices. Smaller farmers would simply be given cards that would allow them to buy directly at subsidised rates.

That is why perhaps Engro was quick to express its happiness at the revision of gas prices even as other industrialists complained. In a press release issued by Engro Fertilisers, it is stated that ”Pakistan’s current financial position is distressed, it is in a debt crisis, with the debt-to-GDP ratio already above 70 percent and more than $27 billion of foreign debt to be repaid by November 2024. The country cannot afford further fiscal pressures or half measures that do not go all the way in solving Pakistan’s problems. The dependence on government subsidies must end, for Pakistan to really move forward and break away from the vicious cycle of debt.”

But there is a big problem here. You see, Pakistan’s fertiliser industry gets its gas from a couple of different sources. There is, of course, the SSGC. This is the natural gas that everyone gets and it is the price of this Sui gas that has been so increased. But then there is another source of gas for the fertiliser industry: Mari.

There are 10 fertiliser plants in Pakistan, and six of them receive dedicated supplies from Mari’s network. The six fertiliser plants on Mari network include three plants of Fauji Fertiliser Company (FFC), one old Engro fertilisers plant, one plant of Fatima Fertiliser, and the Pak-Arab Fertilisers Limited plant.

Essentially what this means is that Mari provides gas majorly to Fauji Fertiliser and in some small capacity to Fatima and Engro. The Mari gas is cheaper, and the government is yet to notify an increase in gas price for the six plants that are connected to Mari. This will unduly give Fauji Fertilisers a boost.

Engro Fertilisers has highlighted the partial nature of this policy change, noting that the remaining 40% of the sector’s capacity, which relies on gas from the Mari network, continues to benefit from the previous subsidised rate of Rs580 per mmbtu. The company argues that a complete removal of subsidies across the entire fertiliser sector is essential for the financial health and autonomy of the country. “With this complete removal, the government is expected to collect Rs 50 billion, which can then be used for targeted agricultural projects and initiatives that generate economic activity and growth in the country.” the company says further.

HOW I RECOVERED MY LOST CRYPTOS FROM FAKE BROKER ONLINE. I had lost over $152,000 by someone I met online on a fake investment project. After the loss, I had a long research on how to recover the lost funds. I came across a lot of Testimonies about, GEO COORDINATES HACKER. I contacted them providing the necessary information and it took the experts about 27hours to locate and help recover my stolen money. To anyone looking for a Recovery firm to Recover your lost Crypto. You can contact GEO COORDINATES HACKER. I hope this helps as many out there who are victims and have lost to these fake online investment scammers. You can contact GEO COORDINATES HACKER. By usingEmail: [email protected]; https://geovcoordinateshac.wixsite.com/geo-coordinates-hack

TRUSTED CRYPTOCURRENCY RECOVERY COMPANY—REVENANT CYBER HACKER

If you’ve ever dabbled in the world of cryptocurrency, you know that losing access to your Bitcoin wallet can be a nightmare. The rising value of Bitcoin has made it a valuable asset for many, and losing it can have far-reaching consequences. That’s why the ability to restore lost Bitcoin is nothing short of a technological marvel. Imagine the sinking feeling in the pit of your stomach when you realize that your hard-earned 45,000 worth of Bitcoin is trapped in a digital void. It’s not just about the financial loss, although that alone is enough to cause sleepless nights. It’s also about the emotional toll it takes on you. The frustration, the anger, and the sense of powerlessness can be overwhelming. So, how does Revenant cyber hack work its magic? The process of restoring lost Bitcoin involves a series of meticulous steps that Revenant cyber hack experts undertake. From analyzing blockchain data to identifying wallet vulnerabilities, every detail is scrutinized to ensure a successful recovery. Hurry now and get in communication with Revenant cyber hacker to assist you restore your bitcoin. Email: revenantcyberhacker ( @ ) Gmail ( . ) com

Website: revenantcyberhacker ( . ) net

Whatsapp: +1(272) 770-8654

fantastic article with important information.