Moody’s has changed its outlook on the banking sector to stable from negative. The rating previously had been Caa3 negative which has been revised upwards to Caa3 stable. The Caa rating still means that the sector is of poor standing and carries a substantial credit risk. In simple terms, Moody’s is saying that the credit quality of the sector is still considered to be poor, however, the outlook has become better marginally. The outlook is a view presented by the rating agencies as a predictor for the period going forward.

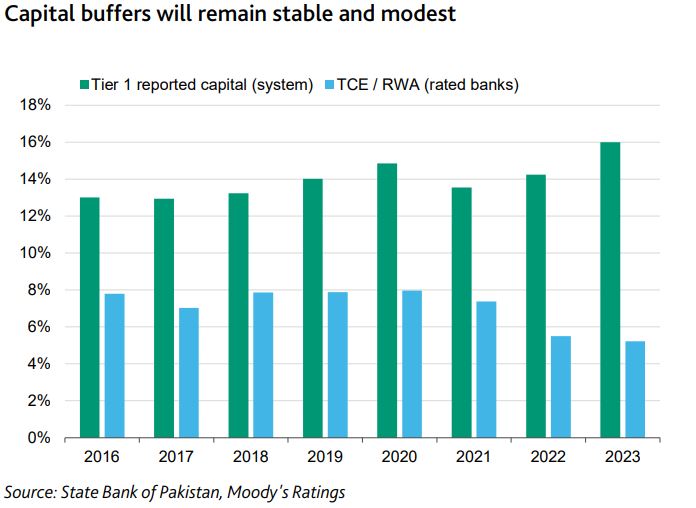

The outlook revision is based on the solid profitability that has been seen by the banking sector and the fact that there is considerable capital and liquidity. This protects it from the macroeconomic challenges and political instability that is being experienced in the country. The buffer created means that in case of any economic or political shock, there is enough leeway in the sector to be able to absorb such a shock.

The recent inflation figures are also quoted where the inflation was recorded at 29% on a year-on-year basis and it is expected to go down to 23% by the end of the year. Similarly, growth is expected to return to 2% for the year which had been much lower in 2023 due to lack of economic activity.

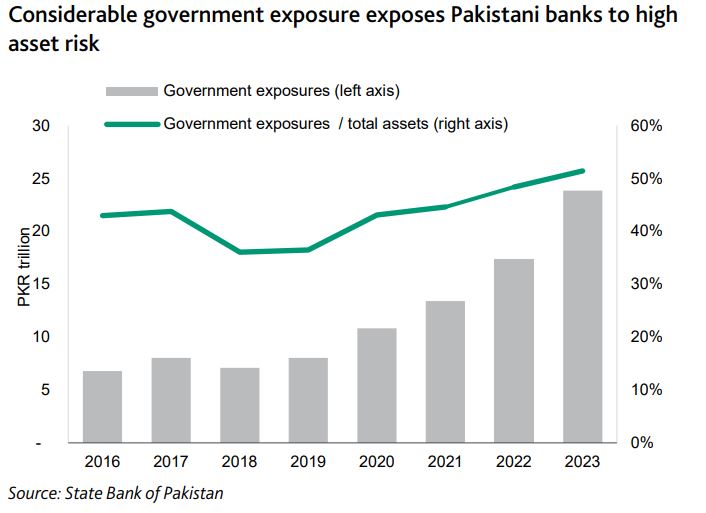

There is still a word of caution in the report which states that banks are mostly exposed to government debt as more than half the assets of their balance sheets are made up of debt taken by the government. This means that the banks and their credit quality is dependent on the credit quality of the government. The ability to pay off its creditors is highly linked to the credibility and ability of the government to pay off its debts.

Sector Snapshot

The banking sector recently closed out its financial year in December with the sector posting record profits. This was due to the high margins or spread that exists between what the bank is earning on its assets and giving out to its depositors and creditors.

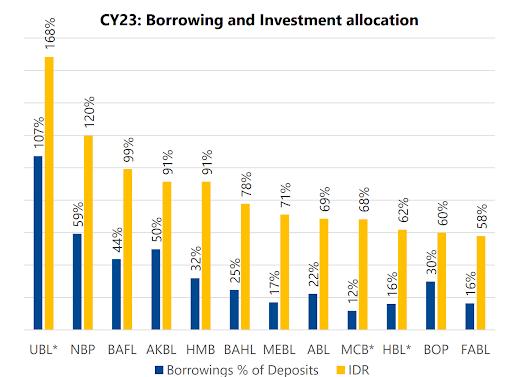

Banks being able to access the State Bank for liquidity also means that they can acquire the funds at a much lower cost and then lend it out to the government at historically high rates. It is expected that this trend will continue in 2024. Even if interest rates fall, the banks are expected to maintain their net interest margin which will guarantee another profitable year.

“The year CY23 ended with another record-high profitability year for the banking sector owing to a 600bp increase in interest rates and a +30% YoY jump in asset base. Where increasing leverage to avail the high yielding papers amid anticipation of monetary easing cycle was the theme of large asset base expansion for some banks, high deposit mobilization continued across the sector,” read a report by JS Global.

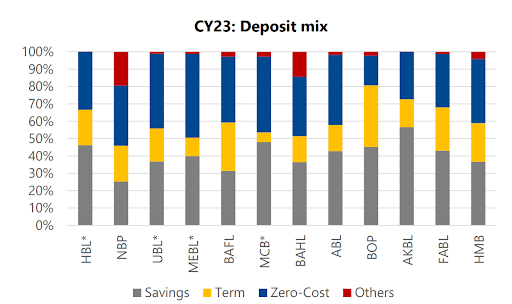

The sector performed well in maintaining zero-cost deposits in the current interest rate environment, ensuring that margins not only remained intact but also expanded.

Additionally, with the suspension of the tax incentive for high Advances to Deposit Ratio (ADR) in 2023, the gross ADR decreased for most banks. Consequently, asset allocation shifted further towards investments, particularly risk-free government securities, in response to the high-interest rate environment and macroeconomic obstacles.

The government’s significant appetite for financing coupled with the financing available from the central bank meant that the increasing leverage to avail the high-yielding papers amid anticipation of a monetary easing cycle remained the theme of large asset base expansion for some players in the sector.

Although non-performing loans showed a slight improvement compared to last year, the textiles segment experienced pressure, as it remains one of the largest beneficiaries of bank lending in Pakistan.

Downside Risk Remain

A caveat presented by Moody’s is the fact that credit demand for the private sector has been on the decline and all-time high interest rates mean that there will be little interest from the private sector to take any credit. In such a situation, the government will look to absorb much of the credit available in the economy. Due to the increased dependence on the government, the key risk identified is that the risk of banks is closely linked to the sovereign debt itself. This also impacts the liquidity of the banks as more longer-term government instruments are being invested in.

One red flag that has been raised in Moody’s report is the fact that, even though capital is adequate in terms of the systems being in place, capital ratios are low considering the current environment. The banks are maintaining the Tier 1 Capital ratios that are mandated on them, however, the rating company feels that additional cushion should be in place.

The rationale behind it is that sovereign risk is not currently factored into the capital adequacy calculations. However, in the event of domestic debt restructuring, this could have significant implications for the sector’s asset base, potentially rendering capital buffers insufficient.

As per the rating agency’s analysis, 51% of the assets of the banking sector are government securities and come to around nine times the equity of the banks. This means that even an 11% fall in any government security can wipe out all the equity of the banking sector. This is the highest level for any banking sector in any country that Moody’s covers. In the words of the report, “our high-stress scenario projects a severe impact from material losses on government securities that would render the banking sector insolvent.”

I promised Dr Kala to share to the entire public if he could help me to get my ex wife back which prompted me to write this beautiful testimony for the amazing things Dr Kala did for me by getting my ex wife back to me after she filed for a divorce. I love my wife so much and i could not accept the fact that i am loosing her, so i went into research to get some tips on how i could get my wife back and i saw a comment on one of the forum, a lady testifying how she was able to get her ex back by reaching out to Dr Kala and i also contact Dr Kala on email and explain my problem to him and he helped me to get my wife back within 2days and my wife stopped the divorce and return back to me, promising me that she will never leave me again and also beg for me to forgive her which i did and right now i am enjoying my marriage and all thanks to Dr Kala the great spell caster who is capable of bringing back ex lover and put an end to your divorce, marriage and relationship problems. You can as well reach out to Dr Kala on email: kalalovespell@gmail. com or WhatsApp +2347051705853

Good works deserves good recommendation, I was heart broken when my husband left me and moved to California to be with another woman. I felt my life was over and my kids thought they would never see their father again. I tried to be strong just for the kids but I could not control the pains that tormented my heart, my heart was filled with sorrows and pains because I was really in love with my husband. I have tried many options but he did not come back, until i met a friend that directed me to Dr.Excellent a spell caster, who helped me to bring back my husband after 11hours. Me and my husband are living happily together again, This man is powerful and if you have any problem? just tell him your situation and he will help you… Here his contact. WhatsApp him at: +2348084273514 “Or email him at: Excellentspellcaster@gmail. com ..