The last week has been an eventful period for the country, with major economic developments keeping analysts glued to their screens. The week commenced with the State Bank of Pakistan (SBP) announcing its decision to maintain the policy rate at a record high of 22% for the sixth consecutive time.

Following this announcement, the markets welcomed the news of the country reporting a current account surplus of $128 million for February 2024. The improvement in the current account position can be largely attributed to the ongoing demand suppression measures implemented over the past several months.

However, the highlight of the week occurred the next day, with Pakistan and the IMF reaching a Staff-Level Agreement on the second and final review of the 9-month Stand-By Arrangement (SBA).

The sequence of events effectively encapsulates the economic strategy anticipated for the upcoming fiscal year. The approach prioritises fiscal consolidation and demand compression to safeguard reserves, complemented by a prudent monetary policy aimed at controlling inflation. These measures align with the roadmap to stability outlined by the Fund, albeit entailing increased austerity measures.

However, we will refrain from commenting on the ramifications of these policies on the macroeconomic outlook for the country, at least not in this article. What we are more interested in is the fallout of the monetary and fiscal position for Pakistan’s glorified hedge funds aka commercial banks.

“Banking” on a cut

Profit, over the past month, has extensively covered how banks and financial institutions have benefited from the advantageous repo borrowings available through the SBP. However, recently the predicament facing banks is that the borrowings used to invest in government securities are now proving to be a costly endeavour.

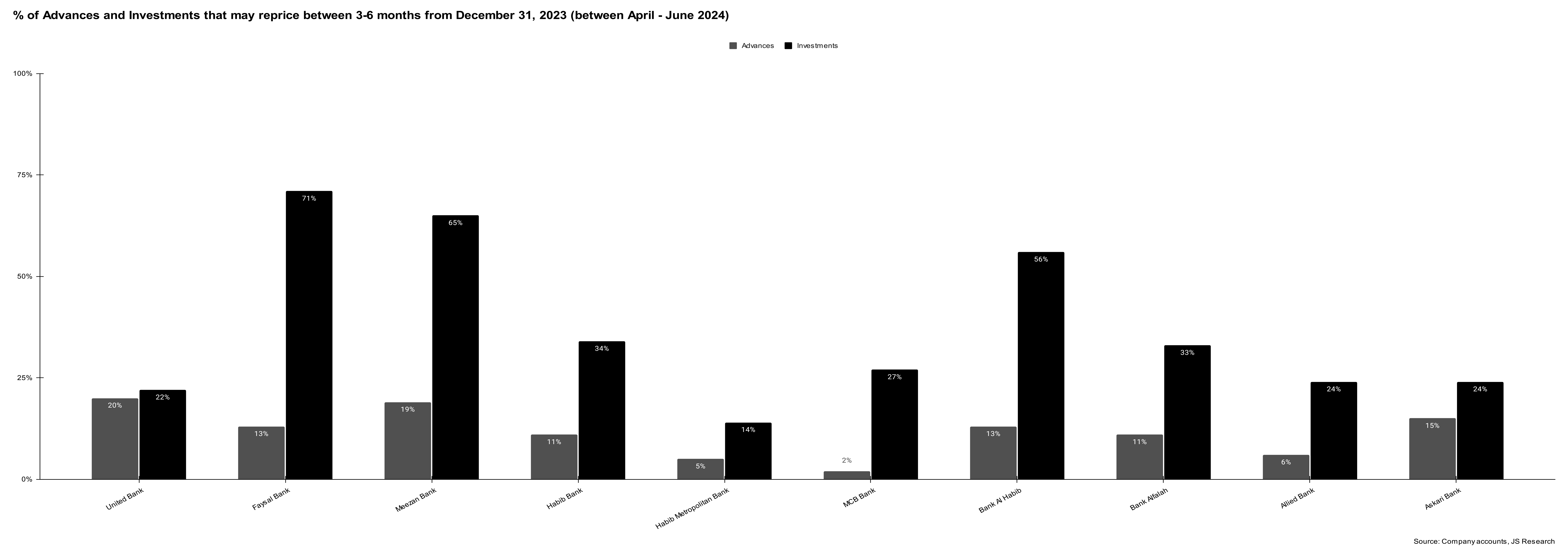

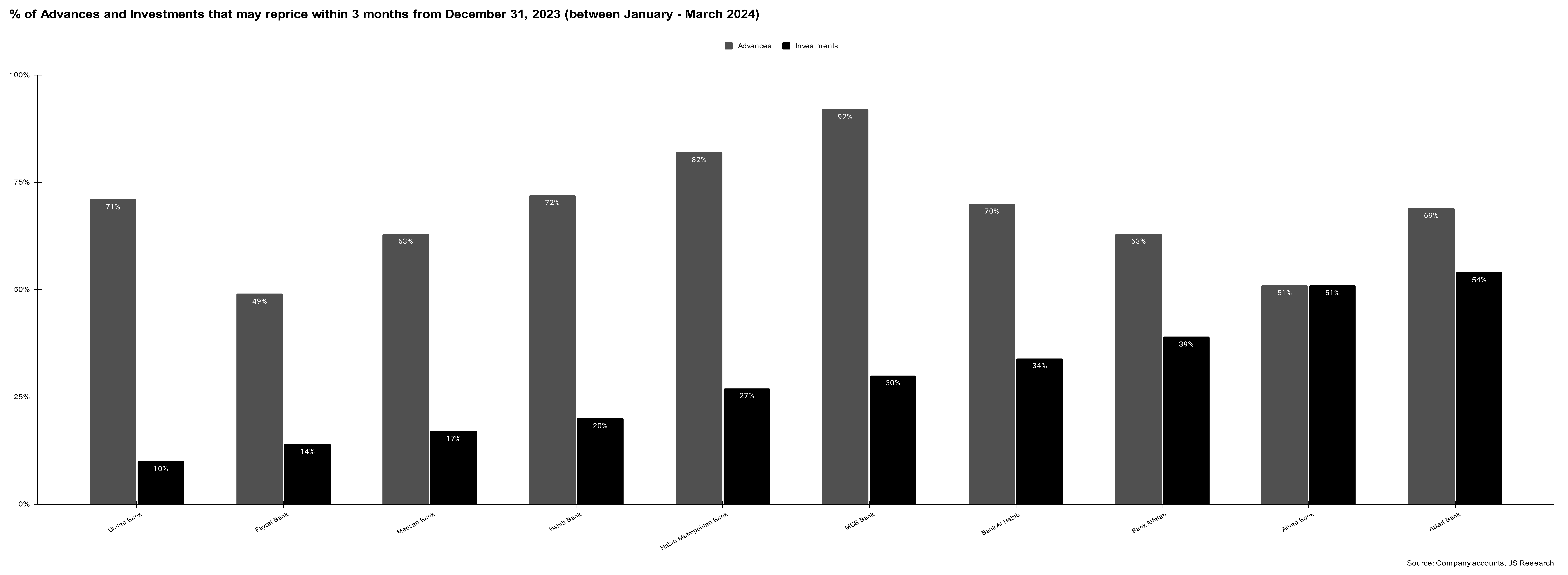

The cost of borrowing and the interest paid on deposits held with banks are linked to the policy rate. On the other hand, returns on banking assets; investments and advances, are influenced by secondary market sentiments, as demonstrated by the Karachi Interbank Offered Rate (KIBOR) and the secondary market yields on T-bills and PIBs.

“Higher interest rates typically benefit the banking sector, where the same was witnessed during 2023 with record-high core income and profitability reported by the sector, despite high inflation and 50% tax rate. The ongoing drop in yields, secondary market yields and KIBOR would impact revenue from banking assets. On the other hand, as in Pakistan, the savings deposit rates and the borrowing rates are pegged to the policy rate, the banking sector’s cost of funds would remain unchanged. This would result in contraction of core income from the first quarter of 2024 till the monetary easing cycle initiates and reduces cost of funds,” explains Amreen Soorani, Head of Research at JS Global Capital, in her post-MPC analyst note.

This means that the longer the rate cut is delayed, the more banks will suffer in terms of their profitability.

Reiterating similar concerns, Mustafa Pasha, Chief investment officer at Lakson Investments, pointed out the issue with banks lies in the mismatch between their assets and liabilities. He highlighted the negative spread resulting from borrowing at 22% through OMOs and investing in treasury bills at 20.5% or 21%. This negative spread, ranging from 0.5% to 1%, could have a significant impact on their earnings per share (EPS) depending on the size of the repo position. If the rate cut is further delayed, banks may face greater losses on their profit and loss statements.

However, the issues are not confined solely to the investment book but also extend to the loan book of the sector. Recent reports indicate that the corporate clients of commercial banks are experiencing the impact of the record-high policy rate. Prominent sectors affected include textile (particularly spinning and weaving), steel rebar manufacturers, and poultry feed mill businesses.

The concern for these sectors is not only the high financing costs but also the fact that demand-suppression measures, as mentioned earlier, have significantly impacted their revenues.

Resultantly, a deteriorating loan book and negative spreads on investments could pose a double whammy for commercial banks if interest rates do not decline soon.

“If the risks highlighted by the MPC statement materialise and the policy rate remains unchanged for the fiscal year, the banking sector could face some challenges. Increased inflation stemming from IMF demands for tax hikes, energy sector reforms driving up energy prices, and external factors like fluctuations in global oil prices could elevate borrowing costs for consumers and businesses, potentially leading to higher defaults on loans and eroding the asset quality,” remarked Saad Hanif, deputy head of research at Ismail Iqbal Securities.

Downside risks remain

The risks Hanif is referring to cannot be underplayed. The recent MPC meeting and the governor’s responses during the briefing session further emphasise that the confidence expressed in January regarding the erosion of price pressures has diminished considerably.

Further, external conditions including global oil prices and high interest rates being maintained by Western central banks also do not present a strong case for a rate cut currently.

US officials on Thursday, as reported by Bloomberg, reached a unanimous decision to maintain the benchmark federal funds rate within a range of 5.25% to 5.5%, marking the highest level since 2001, for the fifth consecutive meeting.

The US Federal Reserve also adjusted its estimate to three reductions expected in 2024, down from the four cuts forecasted back in December according to the median projection.

As per the global news agency, the Fed’s post-meeting statement closely mirrored that of January’s, reiterating that rate adjustments will not be considered until officials are more confident that inflation is effectively progressing towards the 2% target.

This also leads us to the third and probably the biggest impediment for a monetary easing cycle. In the chain of events explained at the beginning of this article, we described how the sequence perfectly sums up Pakistan’s economic predicament. The last of those events was the completion of the IMF review.

Customary to every review is the Fund issuing a press release on the completion. Two noteworthy statements in the recent press release were: (i) restoring the energy sector’s viability by accelerating cost-reducing reforms including through improving electricity transmission and distribution, moving captive power demand to the electricity grid, strengthening distribution company governance and management, and undertaking effective anti-theft efforts; (ii) returning inflation to target, with a deeper and more transparent flexible foreign exchange market supporting external rebalancing and the rebuilding of foreign reserves.

These statements underscore the ongoing challenges in the energy sector, implying that addressing circular debt would lead to upward revisions of energy tariffs by the government. Additionally, the SBP may adopt a more cautious approach towards monetary easing to align with the Fund’s objectives as the country aims to close a new medium-term IMF program in the coming months.

However, analysts are of the opinion that when it comes to a rate cut, we are almost there.

“The chances for the policy rate remaining unchanged are very low. There are two upcoming MPC meetings scheduled in the current fiscal year 2024: April 29 and June 10 and the street consensus suggests a total of 400 bps cut by the end of calendar year 2024,” remarked Nida Gulzar Siddiqui, Economist at Ktrade.

Naveen Ahmed, an investment banker and a development consultant from Karachi also shared a similar opinion. “With the yield curve downward sloping, rates are anticipated to decrease later in the year, possibly beginning around budget time. If the high policy rate prevails, it bodes well for the banking sector, which is projected to perform exceptionally. High-interest rates typically limit private sector activities, but being the primary client of the banking sector, the government is less affected by interest rate fluctuations. Consequently, the banking sector is expected to achieve record profits once more.”

It remains to be seen if the predictions about the policy rate will materialise, but it is safe to say that there would be some anxious individuals in the banking treasuries hoping the central bank sticks to its forward guidance.

Its a good and knowledgeable article.