In the labyrinthine world of startups, Pakistan’s budding entrepreneurs face a formidable array of challenges as they strive to carve their niche in the global marketplace. From economic volatility and regulatory hurdles to funding constraints, the landscape is fraught with obstacles that test the mettle of even the most seasoned founders.

As the spectre of a global downturn looms large, Pakistani startups find themselves at a critical juncture, grappling with the harsh realities of an unforgiving market. To put things into perspective, global startup funding has slowed down to a record low level, dropping to $285 billion in 2023, marking a 38% drop from $462 billion invested in 2022, according to Crunchbase News. This is the lowest point for VC investments in the last five years.

The first quarter of 2024 saw $75.9 billion invested in startups, which was the lowest amount of such investments since the first quarter of 2019, as the US Fed keeps the interest rates at record high of about 5.3% to fight stubborn inflation. The US Fed is expected to keep the rates unchanged until the end of this year, meaning that new VC investments will remain low for some time.

The cut down in funding meant that startups were required to prove their sustainability and generate their own profits. This would ideally lead to a better chance at fundraising for these startups as investors would consider them less risky bets if they had proven their sustainability.

But things seem to be very very difficult for Pakistan. Officially no new investments came into Pakistan in Q1 of 2024. The startup funding has seen a drastic drop in Pakistan. From its peak of over $380 million in 2021, startup funding dropped to $332.4 million in 2022 and stood at a meagre $75.6 million in 2023. As the second quarter of 2024 has kicked off but Profit has learned some announcements could be coming soon. Nonetheless, investors and founders predict a bleak funding outlook for the entire year.

In the background though, as per Profit’s findings, while the investment was extremely scarce for startups in Pakistan, startups were also struggling with achieving profitability and despite some level of profitability, startups were struggling with fundraising. Why is that the case and how are startups trying to navigate this scenario? Profit explains.

Profit’s findings

Profitability

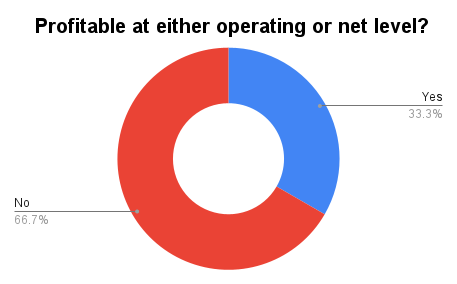

In a survey carried out by Profit in which 46 startups responded, only 8 (17%) startups said that they were profitable at operating level. Most of these startups shared this info confidentially and requested not to be named hence none of the names are mentioned. The startups shared this info with the understanding that the data would be aggregated.

On the net profitability side, only four said that they had achieved net profitability. Two of them, Pakwheels and Rozee have been around for over a decade or more and have been generating profits for a while now. Profit was able to verify Rozee’s profitability after tax directly with the company which showed its audited financial accounts to confirm their profitability. The other two, PriceOye and PostEx that claimed net profitability, are recent companies and are navigating the downturn on the back of funding raised in 2021 and 2022.

Fundraising

A majority of these startups, 36 (82%) out of 44 that responded, said that they were not actively fundraising for the reasons explained below. But what was rather more surprising was that most of the startups that had claimed operating profitability were also not actively fundraising. But through investors, Profit has learned that some of these startups were actively raising funds and were even close to closing rounds.

Expansion Abroad

Interestingly, 16 (36%) out of 44 of these startups had expanded abroad mostly to the countries in the Middle East. What’s in such expansion is explained below. Some of the names that had expanded abroad were Trukkr which has expanded to Bahrain, MedIQ which has expanded to Saudi Arabia, edtech Outclass has also expanded to the Middle East, and EzWifi, which has expanded to Europe as well as the US. Savyour, which offers cashbacks and discounts, was also in the process of expanding its presence in the Middle East.

Pivot

Out of 44 startups that responded, six (13%) had pivoted from their core business altogether and were now working on different models. A prominent name in this list is DGlobal, which in an earlier interview with Profit, had disclosed that it had moved towards building a banking software platform called DCore. DGlobal had earlier planned to become a digital bank and was one of the first applicants for the digital bank license that they were unable to get.

Another pivot is of Truckistan which has moved out of the transportation business and has moved towards a SaaS (Software as a Service) model.

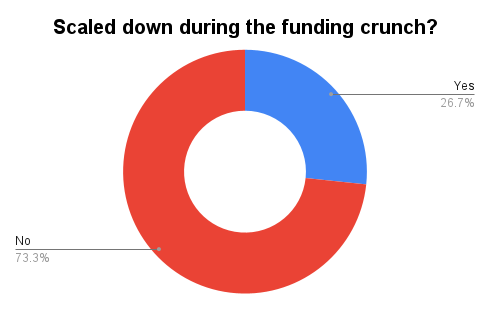

Scale downs

Surprisingly, out of the 45 startups that responded to this question, only 10 (22%) said that they had scaled down their operations during the investment downturn. None of these startups said that they were looking at a situation where they would have to shut down their operations. Earlier Profit has covered shutdowns of notable startups such as Airlift, TAG, Munchies and Cheetay. Some of the scale downs that have happened earlier and covered by Profit include ones at Dastgyr, Retailo, Paymob and Daraz.

Why are startups struggling with profitability?

On a case by case basis, startups had different reasons why their startups were not profitable, mainly pertaining to milestones that they had set for themselves. But the general complaint was the Pakistan baggage. That somehow, things have not been working for them in Pakistan where there is an economic uncertainty and slowdown.

To a great extent, that is true. Rising inflation is bound to take a hit on the topline and bottomline of companies. But what is also true is that every startup that started during the near zero-interest rate VC boom took the money to keep growing and try to outcompete the others, with hope that incremental capital will keep on coming, giving rise to unsustainable models.

When such funding is raised, startups set milestones that with a certain amount of funding raised, they would be able to achieve a certain growth milestone. Investors would also invest with the understanding that the capital would be spent on growth. That the startup will penetrate the market without worrying about profits, with the understanding that once these milestones are achieved, the money raised in the next round would be raised with the objective of monetizing.

“When such expansion had been achieved and it was time to focus on profitability, the market dried down. On top of that, Pakistan’s economic situation also started deteriorating,” said a founder in background conversation with Profit. “The foreign VCs had predicted that they would give money to the Pakistani market based on growth metrics, just like they would do in America, without realising that if things go down, they would go down very badly in Pakistan.”

Faisal Aftab, founder of Zayn VC said that investment with such a mindset can work in countries like the US where the business cycle runs for around 10 years and there is certainty around how things would work out. In countries like Pakistan, the business cycle goes on for around 36 months. That is to say that there is more certainty in VC circles in the US about the business cycles and how they would play out. In Pakistan, that certainty is lacking.

Because the VCs were investing on growth metrics, it meant that unstable companies were incentivised. When things got tough and the money started drying, converting unsustainable business models into sustainable ones was always going to be a tough task, hence the high number of companies that haven’t been able to achieve profitability in Pakistan.

“So this was a major problem on the side of VCs as well that they did not forecast correctly. Converting a product and a service that you were offering on negative economics for a long time to positive economics is not an easy job.”

This again is happening in an economy that is not functional. Would things have been better if the economy was working well? A founder explained that to a certain extent, things would have been better but unsustainable models would collapse at one time or another.

What’s happening on the investment front?

When the investment downturn started, investors started looking for profitable companies and it was a belief that if you turn profitable, you had a better shot at securing investment. But that is not turning out to be the case. Founders that Profit spoke to say fundraising is coming with extremely harsh terms despite profitability. Hence the number of startups that are actively raising is low.

To hear directly from two prominent founders, both of whom chose to respond anonymously, in their experience, investors had backed out of investing not in their startup but investing in a startup in Pakistan after signing SAFE documents. Their primary concern being that Pakistan had suddenly turned into a risky country to invest in because of the political and economic uncertainties.

For those that had some investments in the pipeline, bureaucratic hurdles had prevented them from coming to Pakistan. One of the founders explained that his company tried to secure venture debt for his company from foreign investors that could not come into his startup because the founder could not guarantee if the debt payment, in dollars, would be allowed out of the country at the time of repayment.

“We tried to do a transaction from an earlier debt that our parent company had raised. We couldn’t transfer a single dollar back to Singapore even after almost a year of efforts with multiple banks,” said a founder. “So the regulations are there but on ground execution is very difficult.”

“As a consequence, we told that investor that we can not guarantee if we would be able to send the debt back or not. And obviously if you can not guarantee, the investor is going to back off.”

In another case, the startup was promised a tax exemption by the government but the startup’s respective tax office did not know that these exemptions existed and has been unable to get it still. The founder was of the view that foreign investors have also had a change of opinion about the Pakistani market since the 2021 funding boom. That things do not work out the way they were told they would and this dampened the enthusiasm of investing in Pakistan.

Kalsoom Lakhani also explains that Pakistan only startups are having a very tough time with fundraising even if their economics are good. “Most investors are just not interested in Pakistan only,” she explains. In her experience, it is because of the tough macroeconomic situation of the country.

On the other hand, local VCs are not rich enough to invest in startups all on their own and are reportedly struggling with raising new money. Interestingly, there has been a growing interest among rich industrialists to become part of the tech investment community but according to one founder, they are reluctant to take the initiative because tech investments in startups are done in dollars. But with earnings in rupees, a currency that has depreciated over the years, investments in tech in dollars is a tough task from industrialists, limiting local sources of investments in Pakistan.

Expansion abroad

A sizable number of startups that were surveyed by Profit said that they had either expanded outside of Pakistan, were in the process or were thinking about doing so. Because one of the risks for startups is that their revenues take a hit in dollar terms because of the continuous decline in value of rupee against the dollar.

With revenues taking a hit, investors that are already cautious about inflated valuations and are bringing them to a more realistic level, spook off when they see revenues that have declined in dollar terms because the company was making revenues only in rupees. So if founders want to build valuations in dollar terms again, they have to seek sources of income other than in Pakistani rupee.

That could be achieved through expansion to a country outside of Pakistan or through exports. “So the expansion abroad is a hedge against currency devaluation in Pakistan,” the founder explained.

Most of the startups surveyed had expanded to countries in the Gulf. One of the reasons why was because there was certainly opportunity in those countries but these countries are also flush with cash and have rich local sources of capital to support companies that operate in these countries.

Take Saudi Arabia, for instance, where the government last year launched a $200 million fund to invest in local as well as foreign startups. If Pakistani founders expand into any of these countries, not only does it provide them a different source of revenue, it also helps them with securing funding there. “When you have a presence in a country like Saudi Arabia, within six months or a year, you would be able to raise funding in that country. Foreign investors also look kindly towards these countries as compared to Pakistan.”