On June 26, 2024, JS Bank Limited announced via a filing at the Pakistan Stock Exchange that Syed Mumtaz Ali Shah, an Independent Director at JS Bank Limited, had resigned from his position effective June 14, 2024.

Shah resigned to take up his new role as the Federal Insurance Ombudsman. “This is a full-time role with the Government.

Hence, he resigned from the BoD of JS Bank Ltd,” bank officials told Profit. Mumtaz Ali Shah had been serving as the Chairman of the Board HR, Remuneration & Nomination Committee, and Board Risk Management Committee at JS Bank. He joined the bank’s board of directors as an Independent Director on March 30, 2022.

The Federal Insurance Ombudsman website stated, “Mr. Mumtaz Ali Shah, newly appointed Federal Insurance Ombudsman, took oath on 13th June 2024 at Aiwan-e-Sadr from the Honorable President of the Islamic Republic of Pakistan, Mr. Asif Ali Zardari.” Shah’s resignation from JS Bank, despite announced after a two week delay, is appropriate since Jahangir Siddiqui & Company Limited, which holds a 75% stake in JS Bank, also holds about a 20% stake in EFU Life Assurance.

This dual involvement could have led to a conflict of interest for Shah had he not resigned from JS Bank’s board.

Federal Insurance Ombudsman

The Federal Insurance Ombudsman was established by the Federal Government under the Insurance Ordinance, 2000. The first Federal Insurance Ombudsman (FIO) and the Federal Insurance Ombudsman’s Secretariat were established in 2006. The preamble of the Insurance Ordinance 2000 aims to regulate the insurance industry, protect the interests of policyholders, and promote the industry’s sound development. The Federal Insurance Ombudsman’s functions and powers were further enhanced by the Federal Ombudsmen Institutional Reforms Act, 2013. The institution aims to establish a modern, fair oversight system to address maladministration in Pakistan’s insurance industry and protect stakeholders’ interests. Since its inception, the Federal Insurance Ombudsman has been delivering timely, cost-free justice to individuals affected by insurance company maladministration.

Insurance sector complaints

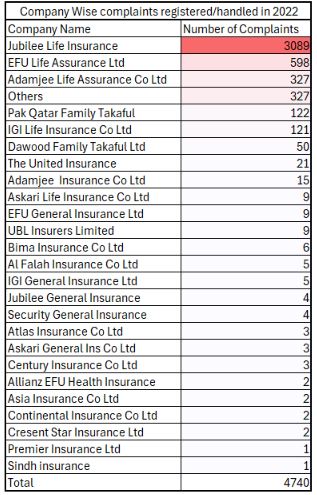

According to the FIO 2022 report, a total of 4,740 insurance complaints were registered and handled in 2022, the latest period for which the annual report is available. Jubilee Life Insurance had the highest number of complaints, amounting to 3,089, which accounted for 65% of the total complaints registered in 2022. EFU Life Assurance followed with 598 complaints, amounting to 13.6% of the total complaints.

Source: Federal Insurance Ombudsman 2022 annual report

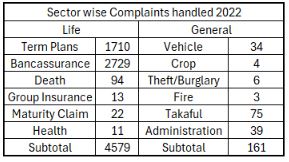

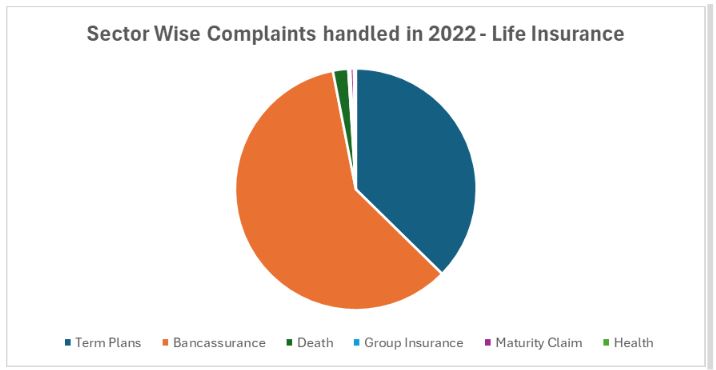

Among these complaints, life insurance accounted for around 97% of the complaints while general insurance accounted for the remaining 3%. Within life insurance, bancassurance complaints were the highest, amounting to 2,729, or 60% of total life insurance complaints. Bancassurance is an arrangement between a bank and an insurance company through which the insurer can sell its products to the bank’s customers. Often, customers are mis-sold insurance products as investment opportunities. It is worth noting that JS Bank is a bancassurance partner of EFU Life Insurance Limited.

Source: Federal Insurance Ombudsman 2022 annual report

Previous stints

This is not Shah’s first stint with the government. Syed Mumtaz Ali Shah, who holds a master’s degree in English and Economics, is a retired Pakistan Administrative Service officer who served as a Federal Secretary and then Chief Secretary of Sindh, the highest civil service position. He retired as the Chief Secretary of Sindh in March 2022. Right after his retirement, he was appointed to the Board of Directors as an Independent Director of JS Bank on March 30.

His journey began in 1984 when he became the youngest officer in his batch to qualify for federal service. Initially, he served in the province of Punjab as Assistant Commissioner and then as Deputy Commissioner and District Magistrate in the Districts of Thatta, Umer Kot, and Mirpur Khas in the province of Sindh. Some of his notable achievements include building a 5-year education and development plan in collaboration with IUCN, establishing a campus of the University of Sindh, and the Thalassemia Center in Badin.

After promotion to the provincial secretary, he headed many important provincial departments, including Information and Archives, Population Welfare, Home and Anti-Corruption. Furthermore, as Chairman of Anti-Corruption, he brought a turnaround in the organisation’s performance through initiatives that focused on the training and development of staff. He also implemented strict monitoring systems, which increased corruption control at the provincial level. During his tenure as Home Secretary Sindh, he made major policy-level decisions that improved the province’s law and order.

Syed Mumtaz Ali Shah also had a good mark in public sector organisations. Starting as Managing Director of the Sindh Small Industries in 1994, he turned the organisation into a self-sufficient entity from its dire straits through structural reforms. He focused on the core functions of establishing and improving small industrial estates through technical and financial support. Between 1994-1997, he spearheaded initiatives fostering industrial growth.

In addition to serving as the CEO and Executive Director for National Insurance Company Ltd. (NICL), he also headed the Export Processing Zone Authority, as CEO and Chairman of the Board. Furthermore, he also served as Chairman and CEO of Pakistan Steel Mills and Chairman of Karachi Port Trust from 2017-2018.

In the later years of his career, Syed Mumtaz Ali Shah moved on to serve as Federal Secretary for the Ministry of Maritime Affairs. He also served as Federal Secretary for Religious Affairs briefly.