The government raised Rs716 billion through the auction of treasury bills (T-bills) on Wednesday, surpassing its pre-auction target of Rs400 billion.

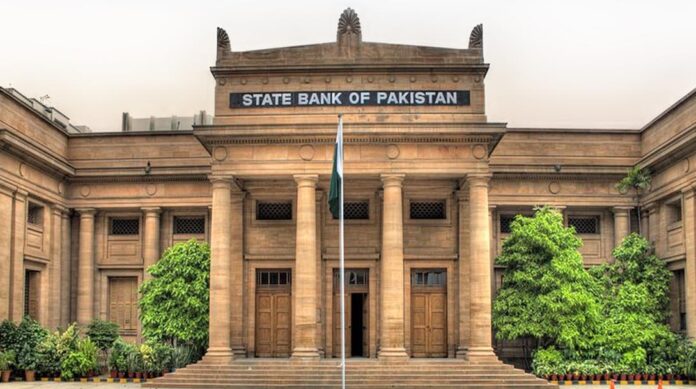

The State Bank of Pakistan (SBP) announced that the raised amount also exceeded the maturing amount of Rs1.04 trillion, reflecting continued strong demand for government securities despite marginal yield reductions.

The cut-off yields for the three-month and six-month tenors were reduced by five basis points to 15.29% and 14.34%, respectively, marking their lowest levels since April 2022.

However, the yield for the 12-month tenor remained unchanged at 13.73%.

In the auction, the 12-month tenor attracted the highest bids, with Rs692.5 billion offered, resulting in an accepted amount of Rs268.6 billion.

The three-month and six-month tenors saw bids worth Rs232.6 billion and Rs215 billion, respectively. Total bids for the auction amounted to Rs1.313 trillion.

Market analysts noted that the flattening yield curve, with stable rates for longer-term securities, signals high demand for longer-tenor investments.

Additionally, the government has initiated a T-bill buyback program to reprofile its debt and reduce debt servicing costs. Two buyback auctions totaling Rs826 billion were held by the SBP to retire T-bills maturing in December.

With inflation expected to remain in single digits, analysts anticipate further interest rate cuts by the SBP. Many expect the central bank to reduce rates by up to 200 basis points during its upcoming November and December monetary policy meetings. The SBP has already slashed rates by 450 basis points since June.