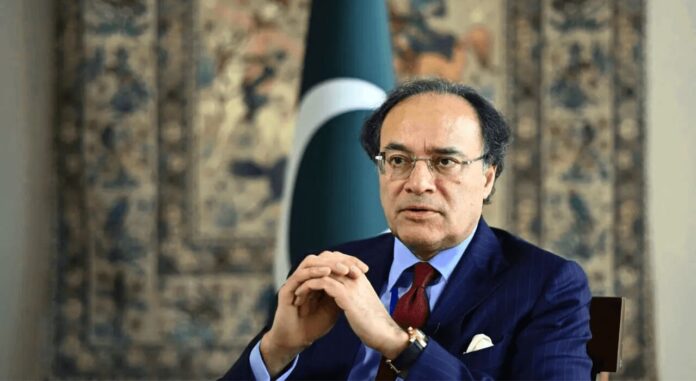

ISLAMABAD: Finance Minister Senator Muhammad Aurangzeb held a virtual meeting today with the Governor of the State Bank of Pakistan (SBP) and the Chairman of the Pakistan Banks’ Association (PBA) to review progress on financing initiatives for priority sectors.

PBA Chairman Zafar Masud shared with the minister several proposed initiatives aimed at fostering an inclusive and sustainable financial ecosystem. These included electronic warehouse receipt financing, an SME index, corporate farming financing, a venture capital fund for fintechs, the revival of agricultural cooperatives, and the creation of a financial data exchange. Masud also suggested more immediate measures, such as fan financing, electric vehicle (EV) financing, solarization of tube wells, and markup subsidies for SMEs, which could provide quicker benefits to the economy.

The SBP Governor updated the meeting on the progress of these initiatives, emphasizing that some of the proposals from PBA were already being implemented, with necessary regulatory notifications issued. He called for more proactive consultations with stakeholders, particularly telecommunications and power companies, to enhance data collection and build scorecards for the agriculture and SME sectors.

The Finance Minister commended both the SBP and PBA for their efforts in designing meaningful initiatives and urged that priority be given to those with immediate impact. He stressed the importance of compressing the timeline for these initiatives, aiming for completion by December and rollout by early next year.

The Minister also offered full support for facilitating consultations between relevant stakeholders, including ministries, to ensure broad consensus and effective implementation of these initiatives.