The Pakistan Stock Exchange (PSX) made history on Thursday, with the benchmark KSE-100 surging past the landmark 100,000-point level.

“A remarkable 150% return from 40k to 100k in just 17 months!” Topline Securities said in a post on X.

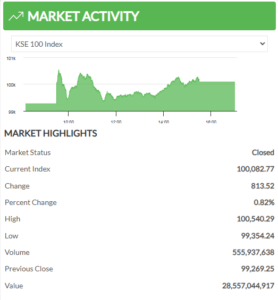

According to the PSX website, the market opened on a bullish note and the benchmark index reached its historical highest level of 100,540.29 points and a low of 99,354.24.

Trading volume stood at 555.94 million shares, with a total value of Rs. 28.56 billion. The index’s previous close was 99,269.25, marking a strong recovery during the day.

The 100,000-point milestone marked a dramatic recovery after the market’s sharp decline of over 3,500 points on Tuesday amid violent protests in Islamabad.

On Wednesday, the PSX staged a remarkable recovery, with the KSE-100 Index surging by 4,695.09 points, or 4.96%, to close at 99,269.25.

The market’s bullish momentum is primarily driven by sustainable economic recovery, the removal of the Minimum Profit Rate (MPR) requirement for conventional banks on deposits and an easing of political noise.

Topline Securities said that the new IMF loan coupled with fiscal and monetary discipline improved investors’ sentiments. Moreover, faster than expected, a fall in inflation and interest rates added cash liquidity to the stock market.

Reflecting on the market’s journey, the brokerage firm noted that the index has grown 100 times since the late 1990s, rising from less than 1,000 points to 100,000. Over the past 25 years, the stock market has delivered an annual return of 20% in PKR and 13% in USD, showcasing its resilience through periods of both optimism and economic challenges.

Despite the rally, Pakistan’s stock market is trading at a price-to-earnings (PE) ratio of 5x compared to its historical average of 7x, highlighting the potential for further growth, according to the brokerage firm.

According to the Ministry of Finance’s Monthly Economic Update and Outlook for November, Pakistan’s economy is witnessing a sustained recovery, driven by declining inflation, surging remittances, and a rebound in exports.

During the first four months of FY2025, inflation fell sharply to 8.7%, a significant drop from 28.5% in the same period last year. October’s YoY inflation was recorded at 7.2%, indicating continued price stability.

Analysts attribute this to easing global commodity prices, stable energy tariffs, and prudent monetary policy, with the State Bank recently cutting the policy rate by 250 basis points to 15%.

On Tuesday, the State Bank of Pakistan (SBP) announced the removal of the Minimum Profit Rate (MPR) requirement for conventional banks on deposits from financial institutions, public sector enterprises, and public limited companies.