To curb fraud and ensure transparency, the Benazir Income Support Programme (BISP) has announced plans to introduce a new banking project. The announcement was made by BISP Chairperson Senator Rubina Khalid during her address at the 2nd National Social Protection Conference held at a local hotel.

Senator Khalid revealed that the new banking initiative is designed to prevent illegal deductions, commissions, and fraudulent activities that have plagued the program in the past. She emphasised that the project would further enhance transparency in BISP operations, ensuring that financial aid reaches the intended beneficiaries without exploitation.

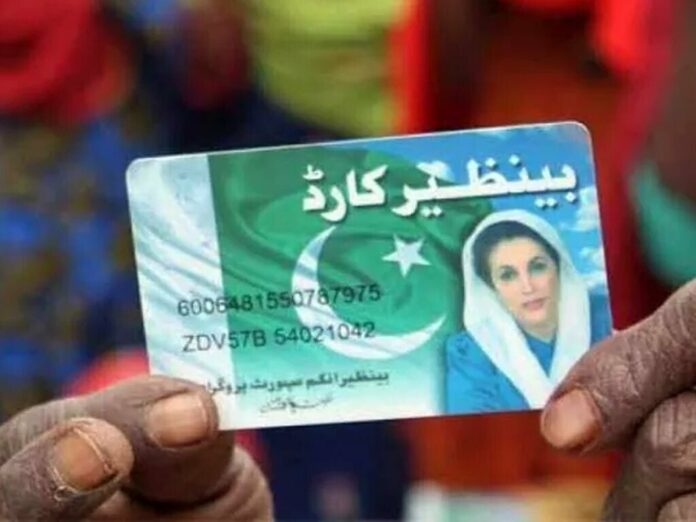

BISP, Pakistan’s flagship social protection and poverty reduction program, was established in 2008 under the vision of former Prime Minister Shaheed Benazir Bhutto. It provides financial assistance to millions of low-income families across the country. Currently, 9.4 million beneficiaries receive Rs. 13,500 per quarter, an amount recently increased to combat rising inflation and economic challenges.

Senator Khalid also addressed past controversies, stating that the program had faced politically motivated attempts to remove deserving individuals from its beneficiary list. Despite these challenges, she reaffirmed BISP’s commitment to its mission, calling it a vital lifeline for Pakistan’s most vulnerable populations.

The 2nd National Social Protection Conference, a three-day event, brought together stakeholders from across the country to collaborate on improving Pakistan’s social protection framework. The conference aimed to make the system more adaptive and resilient, particularly in the face of economic and environmental crises.

Special Assistant to the Sindh Chief Minister on Social Protection, Sarfaraz Rajar, also spoke at the event, underscoring the importance of social safety nets in reducing poverty and inequality. He highlighted Sindh’s efforts to complement federal initiatives like BISP with provincial programs aimed at uplifting marginalised communities.

The new banking project is expected to be rolled out in collaboration with financial institutions and technology partners, leveraging digital solutions to streamline payments and reduce human intervention. This move aligns with global trends in social protection, where digital platforms are increasingly used to minimise corruption and improve efficiency.

The conference concluded with a call for stronger collaboration between federal and provincial governments, as well as international organisations, to build a more inclusive and effective social protection system.

This development marks a significant step forward in Pakistan’s efforts to strengthen its social protection mechanisms, ensuring that aid reaches those who need it most.