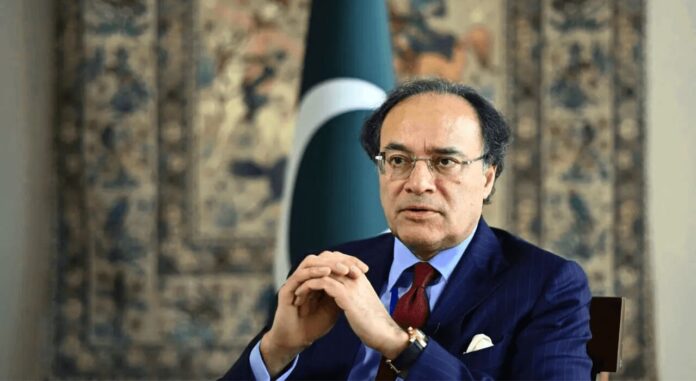

Pakistan’s current account is expected to remain in surplus through the ongoing fiscal year 2024–25, Finance Minister Muhammad Aurangzeb said on Wednesday, diverging from the more cautious estimate issued by the State Bank of Pakistan (SBP).

Speaking at a pre-budget seminar organized by the Federation of Pakistan Chambers of Commerce and Industry (FPCCI) in Karachi, the minister said that the government remained upbeat on macroeconomic trends, even as the SBP forecast a possible small surplus or a deficit of up to 0.5% of GDP in its own projections for the fiscal year.

Highlighting the government’s fiscal priorities, Aurangzeb said that Pakistan’s tax-to-GDP ratio was set to reach 10.6% by the end of FY25, with a target to lift it further to 13.5% over the next three years through broad-based tax reforms.

“This will be the last IMF programme for Pakistan,” Aurangzeb declared, underlining Islamabad’s commitment to structural reforms aimed at reducing reliance on international lenders.

He assured the business community that the government would aim to provide targeted tax relief to both businesses and salaried individuals, “where possible,” while ensuring that economic momentum was sustained in FY26.

Aurangzeb acknowledged, however, that the IMF’s conditions might constrain short-term fiscal flexibility, especially in the upcoming federal budget. He noted that the government was carefully designing the FY26 budget in line with international best practices and with consultation from independent economic analysts.

Calling for a fairer tax system, he stressed that every sector must contribute equitably to revenue generation.

“Every sector must pay its share of taxes to ease the burden on the salaried class and manufacturing industry,” he said.

The minister identified high taxation, elevated energy prices, and expensive financing as key impediments to private sector growth. But he pointed to recent monetary easing as a source of relief, noting that the SBP’s 10-percentage-point policy rate cut since June 2024, which brought interest rates down to 12%, had improved credit affordability for businesses.

“We are headed in the right direction, but there is more to be done,” Aurangzeb remarked, adding that the government continued to review further areas for potential tax relief.

Pakistan entered its current stand-by arrangement with the IMF in July 2023, and discussions are currently underway for a possible longer-term Extended Fund Facility (EFF) programme. The finance ministry has repeatedly expressed the desire to make the next IMF programme the country’s last by enacting enduring reforms across the fiscal, energy, and tax systems.