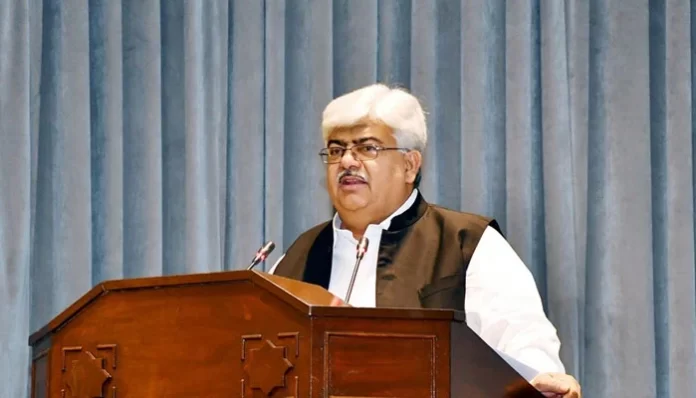

ISLAMABAD: The Federal Board of Revenue (FBR) Chairman Rashid Mahmood Langrial said Pakistan must seek International Monetary Fund (IMF) approval for any tax exemption, rate change, or modification to the tax regime.

He made the statement during a briefing to the Senate Standing Committee on Finance and Revenue.

Langrial said the IMF had accepted FBR’s plan to raise Rs389 billion through enforcement measures in the upcoming fiscal year. He added that IMF is closely tracking Pakistan’s tax collection and that weekly meetings between FBR and IMF officials will be held to monitor the outcomes.

The matter surfaced when a private stakeholder raised concerns over the expiry of tax exemption for Real Estate Investment Trusts (REITs) one year ago. Langrial requested more time to review the senators’ suggestions, which Finance Minister Muhammad Aurangzeb also supported.

The commerce ministry’s secretary briefed the committee on the government’s new trade policy, which includes four tariff slabs of 0, 5, 10, and 15 percent. The policy aims to assist local industries by reducing import duties on raw materials and intermediate goods in the first year.

Aurangzeb said the reduced input costs would help cut production expenses. He noted that previous efforts to lower imports through high tariffs produced limited long-term gains. Langrial added that earlier tariff hikes had protected non-performing industrial units, hurting competition and innovation.

The Senate Finance Committee chairman said it was critical to lower production costs compared to regional competitors such as India and Bangladesh, where electricity tariffs are lower. He said high energy costs continue to challenge Pakistani exporters in global markets.

Aurangzeb told the committee that the government is working to ease business costs. He said electricity tariffs for industries had been cut and interest rates are expected to fall below 10 percent in the next fiscal year.

He also mentioned that the government is resolving tax-related issues for industries. A committee led by the prime minister is working on tariff reforms to make the structure more competitive and supportive of growth.