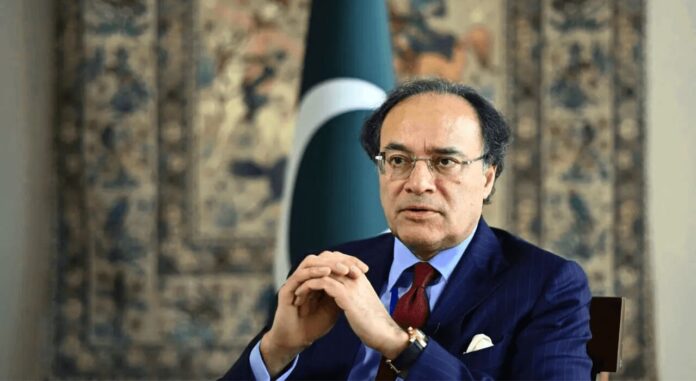

ISLAMABAD: Finance Minister Muhammad Aurangzeb announced that the government will meet with business community leaders on July 15 to clarify the reasons for the recent tax-related amendments. In his address to the Overseas Investors Chamber of Commerce and Industry (OICCI) on Monday, Aurangzeb emphasized that the government intends to engage in constructive dialogue, not pressure, and explain the rationale behind the tax changes.

This announcement comes as chambers of commerce and trade associations plan a nationwide strike on July 19 in response to the new tax reforms. Business leaders have been invited to Islamabad for discussions on the proposed changes, including the retail tax and other fiscal matters.

Aurangzeb assured the media that Pakistan’s fiscal situation had improved, with a reduction in the government’s borrowing needs. He also highlighted that debt buybacks had enhanced liquidity in the banking sector, allowing more private sector lending.

The finance minister emphasized the importance of banks supporting the government’s privatization and restructuring efforts and working to revive underperforming businesses. He also pointed to a positive trend in business confidence, referencing a recent survey by OICCI.

The government, Aurangzeb noted, had successfully repatriated around $2.3 billion in dividends and profits during the last fiscal year. He also mentioned ongoing structural reforms at the Federal Board of Revenue (FBR) and said the new sales tax law includes safeguards to prevent tax evasion.

In an effort to simplify tax filing, the government has introduced an electronic income tax return form and is seeking recommendations from stakeholders to improve the process. Aurangzeb also discussed tax relief for the salaried class, stating the government aims to further reduce taxes in the future.

Regarding exports, Aurangzeb informed that Rs75 billion in sales tax refunds had been issued to exporters this month. He also mentioned that the government is monitoring commodity prices monthly and urged sectors such as real estate, agriculture, and wholesale to contribute more to the GDP. Additionally, he praised the pharma sector for its recent performance.