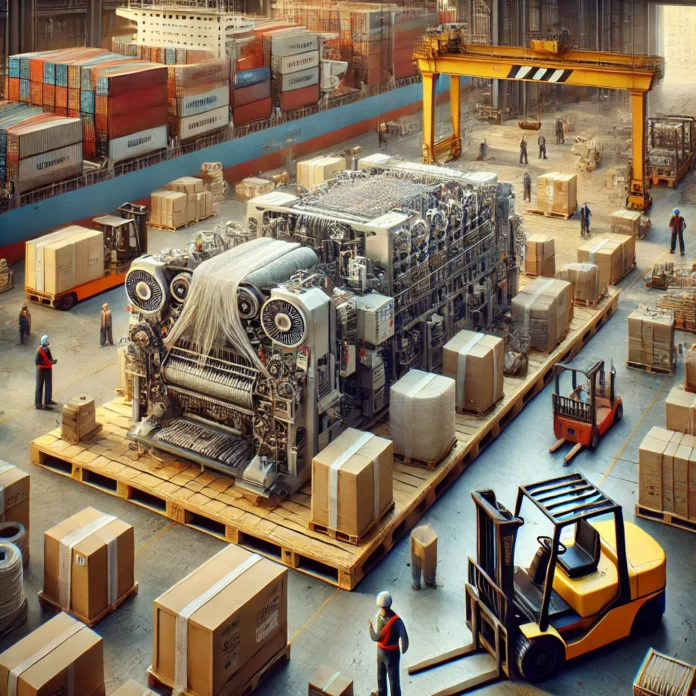

ISLAMABAD: Imports of machinery in Pakistan saw a significant increase of 29.37% during the first month of the current fiscal year (July 2025-26), compared to the same period last year. This surge in machinery imports is expected to enhance productivity, drive technological advancements in key sectors, and contribute to economic growth and infrastructure development.

According to official data from the Pakistan Bureau of Statistics (PBS), machinery imports for July 2025-26 totaled $927.534 million, up from $716.945 million in July 2024-25.

Key sectors driving the growth include agricultural machinery, which saw an increase of 123.94%, rising from $6.435 million to $14.411 million. Textile machinery imports rose by 115.42%, from $31.151 million to $67.107 million, while power-generating machinery grew by 62.52%, from $34.995 million to $56.876 million. Imports of construction and mining machinery increased by 8.88%, from $10.094 million to $10.990 million. Other machinery imports rose by 54.19%, from $149.843 million to $231.038 million, and office machinery saw a notable increase of 97.93%, from $31.700 million to $62.743 million. Additionally, mobile phone imports surged by 125.65%, from $64.413 million to $145.345 million, and telecom-related equipment saw an 86.89% rise, from $102.734 million to $191.999 million.

However, the import of electrical machinery and apparatus decreased by 16.46%, dropping from $349.992 million to $292.371 million during the same period.