Qatar’s Al-Thani Group has signalled its intent to divest its 49% shareholding in the 1,320 MW Port Qasim coal-fired power plant, joining the growing list of foreign investors retreating from Pakistan amid financial bottlenecks and policy uncertainty, Business Recorder reported, citing government sources.

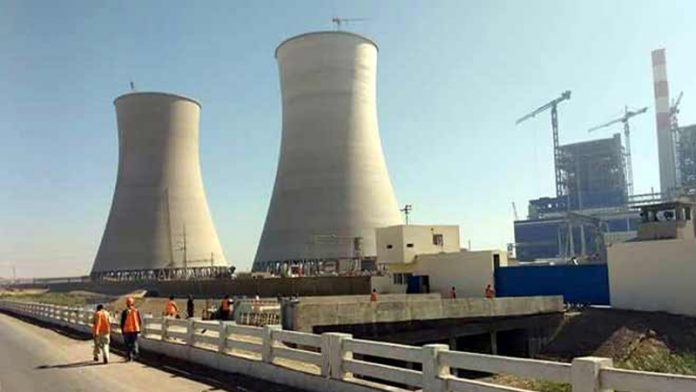

The Port Qasim Power Project, developed under the China–Pakistan Economic Corridor (CPEC), comprises two 660 MW supercritical coal units established through a $2.09 billion joint venture between Qatar’s Al-Mirqab Capital and China’s Power Construction Corporation, a subsidiary of Sinohydro Resources Limited.

The project, built over 330 acres near Karachi, received more than $1 billion in investment from the Al-Thani Group, which is seeking ways to pull out.

As per BR report, Al-Mirqab Capital has formally conveyed its “Notice of Intent to Divest” to senior government officials, including Federal Minister for Power Sardar Awais Ahmad Khan Leghari and Minister for Economic Affairs Senator Ahad Khan Cheema. The company has advised that any coordination on the matter should continue through official diplomatic channels.

The decision follows longstanding disputes over unpaid dues. The Port Qasim Electric Power Company (PQEPC) has repeatedly raised concerns about chronic payment delays from the Central Power Purchasing Agency–Guaranteed (CPPA-G). Outstanding receivables owed to Chinese CPEC power producers are estimated at around Rs400 billion.

In a recent letter, PQEPC’s management warned of a potential suspension of operations if CPPA-G failed to clear its obligations under the Power Purchase Agreement (PPA). “A project suspension would be a lose-lose situation that all parties must work to avoid,” company representative Mr. Dongfeng reportedly told government officials, urging immediate financial support to prevent defaults under Pakistan’s sovereign guarantees.

Last year, former Qatari Prime Minister Sheikh Hamad Bin Jassim Bin Jaber Al Thani wrote to Prime Minister Shehbaz Sharif, seeking payment of $450 million owed to PQEPC. Despite the involvement of the Prime Minister’s Special Assistant on Foreign Affairs, Tariq Fatemi, the issue remains unresolved.

Al-Mirqab Capital, headquartered in Doha, serves as the family office for Sheikh Hamad Bin Jassim Bin Jaber Al Thani and manages a global portfolio spanning equities, real estate, and private investments.

The group’s exit adds to Pakistan’s widening foreign investment crisis. Over the past four years, nine multinational companies have either exited or divested from the country.

These include pharmaceutical manufacturers Pfizer, Sanofi-Aventis, and Eli Lilly, consumer goods giant Procter & Gamble, and service-sector firms Shell, Total, Telenor, and Uber/Careem.

All is not well on govt policies. That is why we are seeing exit of foreign investors from Pakistan.

Foreigners are not comfortable in investing in Pakistan.How can foreigners invest when locals are investing abroad. Govt must try to address issues ,distrust of local investors.