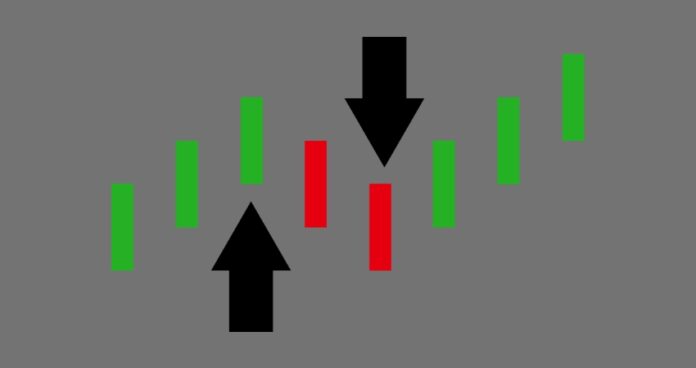

Selling pressure continued to weigh heavily on the Pakistan Stock Exchange (PSX) on Monday, with the benchmark KSE-100 Index plummeting by more than 1,500 points during the early hours of trading.

According to the PSX website, the market opened on a bearish note, and the KSE-100 plunged to the 182,811.05 level, shedding 1598.62 points as of 09:40 am.

This dip came amidst broad-based selling across major sectors, including automobiles, cement, chemicals, commercial banks, oil and gas exploration companies, oil marketing companies (OMCs), power generation, and refineries. Despite the overall negative sentiment, some index-heavy stocks like ARL, HUBCO, OGDC, MARI, POL, PPL, PSO, SSGC, MCB, MEBL, and UBL showed positive movement.

This dip followed a week of strong performance for Pakistan’s equity market, during which the KSE-100 index advanced by 5,375 points, or 3%, reaching 184,410 points, marking a positive start to the calendar year 2026. The upward momentum was driven by sustained domestic buying, easing monetary conditions, and favorable global cues.

The KSE-100 was hovering at 183,822.83 points as of 10:27 am, down by 586.84 points or 0.32% from the previous close of 184,409.67 points.

Meanwhile, global markets faced mixed reactions following comments from Federal Reserve Chair Jerome Powell, who stated that the Trump administration had threatened him with a criminal indictment, raising concerns about the Fed’s independence.

As a result, US equity futures slid by 0.5%, and the US dollar fell by 0.2%, sending the currency below 158 yen and to $1.1660 per euro. While the full implications for interest rates remain uncertain, the dollar’s weakness reflected investor unease.

S&P 500 futures fell by 0.5%, while European futures slipped by 0.1%. Asian markets showed mixed performance, with MSCI’s broadest index of Asia-Pacific shares, excluding Japan, inching 0.5% higher. Japan’s markets were closed for a holiday. The second full week of the year will feature key U.S. inflation data, trade figures from China, and earnings reports starting with JPMorgan Chase and BNY Mellon on Tuesday.

In the commodities market, gold prices surged, hitting a record high of over $4,600 an ounce, driven by geopolitical unrest in Iran, which also supported oil prices.

Gold prices broke through the $4,600 per-ounce level on Monday for the first time, while silver also jumped to a record high, bolstered by geopolitical and economic uncertainties and growing bets of U.S. interest rate cuts.

Spot gold jumped 1.3% to $4,469.49 per ounce by 0203 GMT. Bullion hit a record high of $4,600.33 earlier in the day.

U.S. gold futures for February delivery firmed 2% to $4,591.10.

Oil prices were little changed on Monday as investors eyed potential supply disruptions from OPEC producer Iran amid intensifying protests, although efforts to quickly resume oil exports from Venezuela kept a lid on prices.

Brent crude futures slipped 5 cents to $63.29 a barrel by 0131 GMT while U.S. West Texas Intermediate crude was at $59.06 a barrel, down 6 cents.