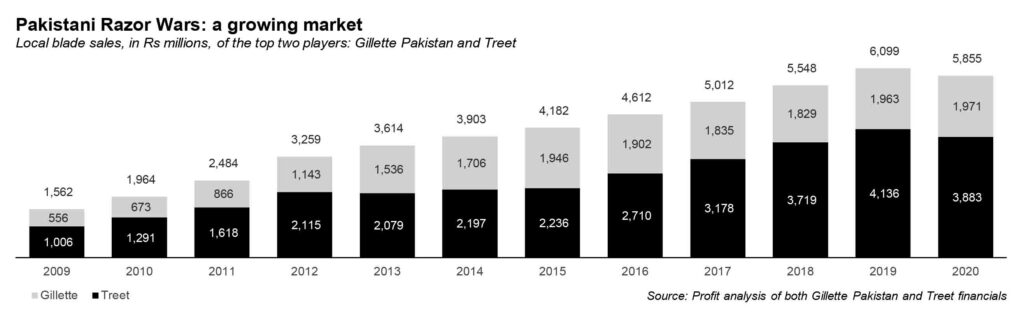

On December 17, 2020, Gillette Pakistan announced that they are going to start manufacturing their eponymously branded razors and blades locally, a move that is likely to cause a significant stir in the duopolistic, Rs6 billion Pakistani razor market.

This is not the first time Gillette has tried local manufacturing for its products, having first done so back in the late 1980s and early 1990s, when it was still a relatively new business in Pakistan. But the new decision is likely to be somewhat different, and perhaps more long-lasting, backed as it is by Gillette Pakistan’s parent company Procter & Gamble deciding to invest heavily in local manufacturing across a wide variety of its brands (see our cover story of this week for further details).

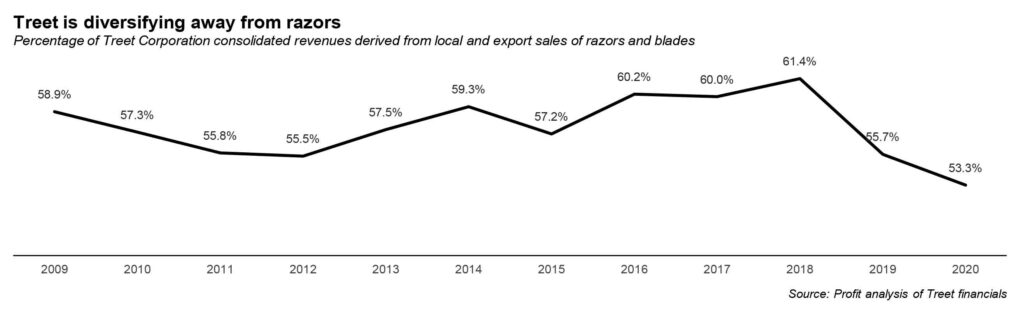

This story takes a look at Gillette’s history in Pakistan, including its historical decision to stop manufacturing in Pakistan, its current market position, and the impact its decision is likely to have on its biggest local competitor: Treet Corporation, which manufactures its own brand of razors and blades and is the current market leader both by volume and by revenue.

Gillette in Pakistan

Gillette’s history in Pakistan starts before the company was even part of Procter & Gamble, back when it was first an independent company. The Boston-based manufacturer of men’s shaving supplies, the Gillette Company was founded in 1901 and rapidly rose to becoming the world’s leading manufacturer of razors and blades for shaving.

The company entered the Pakistani market in December 1986, and became publicly listed on the Karachi Stock Exchange in June 1988. Indeed, the company started off with a commitment to manufacture blades, having first started production of razors and blades at a manufacturing facility in Pakistan in May 1989. And while Gillette Pakistan always had a combination of imported and locally manufactured products, it remained committed to its manufacturing operation in Pakistan for the next decade.

By 1999, however, the company’s global management decided to consolidate manufacturing worldwide, and its plant in Hub, Balochistan, simply did not make the cut. As a result, in May 2000 – almost exactly 11 years after it first started production – that plant closed down and Gillette’s local manufacturing operations were shut down.

Why did that plant not make the cut? Gillette’s management at the time did not state, and its current management declined to comment for this article as a result of the winter holidays, during which both its local and regional management staff are on vacation and thus unable to comment. However, sources in the industry claim it was in part due to stiff competition from low-cost local brands that never allowed Gillette to gain enough of a foothold in the Pakistani market.

In particular, the two companies it competed most against were Supermax and Treet. The biggest competition for Gillette, however, was Supermax, which was able to outdo the global giant in terms of volume and revenue in the Pakistani market. It also did not help Gillette’s cause that smuggled razors were a much bigger problem in the 1990s, which made it difficult for the company to compete in the market for Pakistan’s then even tinier upper-middle class.

So, what happened to Supermax? After all, it has been decades since anyone in Pakistan has shaved using a Supermax razor. According to sources familiar with the matter, Supermax was a family-owned business, and it was killed off by what often kills off family-owned businesses: a family dispute.

And, according to one industry expert who wished to remain anonymous, smuggled razors and blades are a much smaller problem today than they were in the 1990s, which means that the two biggest reasons why Gillette’s local manufacturing operation closed down are now gone.

In the meantime, the Gillette Company – the global parent company – was acquired in 2005 by Procter & Gamble, which meant that Gillette Pakistan and Procter & Gamble Pakistan (which had arrived in the country independently in 1991) were now part of the same consumer goods conglomerate. Gillette Pakistan continues to remain listed in the exchange now known as the Pakistan Stock Exchange, which means its financial statements remain public. Its sister company – Procter & Gamble Pakistan – remains an unlisted company.

Why enter local manufacturing now?

As we state in our cover story, the decision to re-enter local manufacturing by Gillette Pakistan is at least in part driven by an overall strategic decision made by Procter & Gamble to localise as much of its revenue base in the country as possible. The decision to restart manufacturing Gillette-branded razors and blades in Pakistan runs in parallel to decisions to start manufacturing Always sanitary pads, Pampers diapers, and Safeguard liquid soap.

But there are reasons even within just the Gillette business itself that would push the company to start thinking about how to restart local manufacturing, the foremost of which is the impact of currency depreciation on its ability to keep selling razor blades to the Pakistani market.

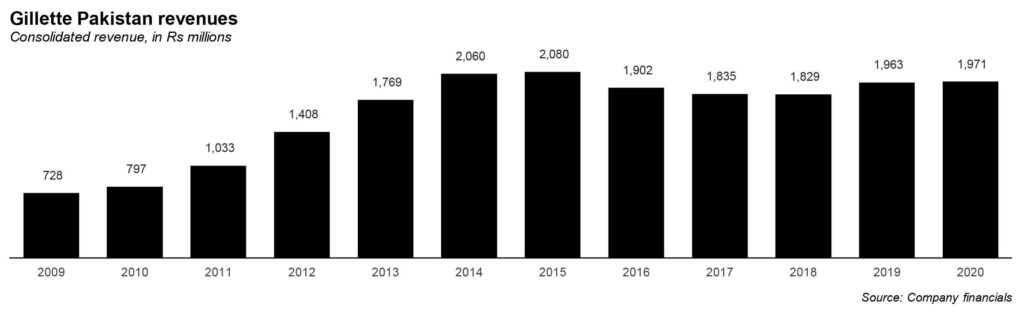

Revenue for the company has effectively stagnated since 2014, a period during which the Pakistani rupee was relatively stable between 2013 and 2017 before slipping dramatically between 2018 and 2020. While the currency depreciation is not the only factor behind the company’s stagnating revenue, it certainly does not help matters

The annual financial statement for the financial year ending June 30, 2020 reads: “In the current year, due to relatively low exchange rate volatility versus last year there is a significant decrease in exchange loss of approximate by Rs18.4 million, mainly because of revaluation adjustment arises in the intercompany payable.”

Foreign currency risk arises mainly where receivables and payables exist due to transactions with foreign undertakings and bank balances in foreign currency. As far as Gillette is concerned, it imports finished goods from its parent company.

What this means is that Gillette remains vulnerable to changes in the exchange rate. What gave them a cushion is the fact that they do not import from a third party. In fact, they import finished goods from Procter and Gamble International Operations SA, Lancy, based in Switzerland. In the financial year 2020, Gillette purchased finished goods worth Rs955 million from Switzerland, whereas in 2019, Gillette imported finished goods worth Rs973 million.

Razors are a profitable business

There is likely at least one other big reason why the company is re-entering the local manufacturing business: it is extraordinarily profitable, and its biggest local competitor – the Treet Corporation – not only produces razors for the local market with high gross margins, it is able to export its razors to other countries in the region.

How high are the margins? Gross margins upwards of 30% are quite common in the industry, and they do not seem to change at all, even in the most trying of circumstances. As Gillette Pakistan’s 2020 annual report states: “This fiscal year was yet another challenging year for the company behind Covid-19, devaluation in local currency and high inflation. Despite these challenges, the company was able to maintain the gross margin of 33.4% vs. 33.2% last year.”

And it is not just Gillette, with its premium brand reputation that is able to command such margins. Even Treet Corporation, which is a lower priced product, was able to command a gross margin of 31% in financial year 2020.

At the expense of using a pun, the margins in the razor business are anything but razor thin. (Yes, we went there. And you know what, we’re not even sorry.)

Current market position: Treet leads, but Gillette is a strong player

Gillette is known to be a high-quality product that is used by more affluent consumers and is not considered a mass market product in Pakistan, given its higher price points. Industry experts estimate that more than 70% of the market is price sensitive and finds Gillette to be beyond their budget.

The mass market consumer, according to those experts, wants a sturdy product that gets the job done, i.e. a plain, clean shave. Gillette obviously manages to get that done with stylish razors and fancy blades which have been developed through significant research and development. But it is by no means the only product that can accomplish that goal, and people who are more price sensitive will likely accept a cheaper blade that might be slightly less comfortable, but nonetheless achieve the same outcome.

For its part, Gillette certainly does not shy away from its upmarket reputation. The way the product is marketed in Pakistan makes it seem like it is catering to the upper middle class and above. However, this is not because the product itself is luxurious. It is just that it is packaged in line with its global branding, which makes it feel “American”, which in the minds of most consumers also means “rich”.

Unfortunately, that also makes it difficult for Gillette to expand its market: any attempts to change its branding results in its core market segment – the upper-middle class – to abandon its products. In India, Gillette launched Gillette Guard and Gillette Vector to try to expand its appeal to lower-income consumers, but that did not appeal to the people with money or the people with little to spend.

Treet, however, has managed to serve the mass market well over the years. Treet’s blade and razor production is the oldest unit of the Treet Group which has been in operation for more than six decades.

The Treet Group is owned by the Wajid Ali branch of the family-owned conglomerate started by Syed Wazir Ali, whose son Syed Maratib Ali then carried on his tradition. Wajid Ali was Maratib Ali’s son, and was the brother of Syed Babar Ali, the more famous of the three sons of Maratib Ali.

Treet is the current market leader, producing 2.15 billion units of blades and razors cumulatively in a year and produces more than 75 stock-keeping units (SKUs) of blades and razors. Treet’s management estimates that they have approximately 85% of the Pakistani razor and blade market by volume.

“Gillette’s 7 o’clock has hardly a 7-10% share and in metro towns only and all other imported brands make a 5-7% market share,” said Shehryar Ali, Executive Director of Treet, in an interview with Profit. “As far as razors are concerned, there are two categories. One is high-end system razors and cartridges which are taken almost 100% by Gillette and Treet is not into it due to lack of R&D and nonavailability of technology to produce. The second segment is disposable razors in which Gillette has about 50-70% share in metro towns only and in the rest of the towns Treet enjoys a 70% share. The basis [of these estimates] is our regular monthly market surveys by the production team.”

Treet’s distribution allows them to reach 380 towns, whereas Gillette is primarily focused in larger metropolitan areas. According to Ali, Treet has managed to maintain this market share over the years due to “high quality, better price strategy, and responding quickly to the moves of low price smuggled and imported brands and by developing a network of 405 distributors in 380 towns.”

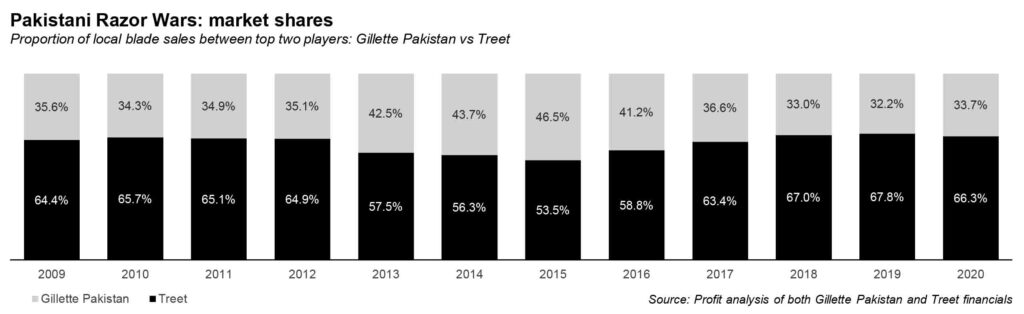

Nonetheless, Gillette’s premium pricing ability means that even though it may have a market share of 15% or less, its share of the revenue in Pakistan’s razor market is twice that number, closer to 33.7% which implies that commanding a significant share of that upper-middle class market is worth more than having a significant presence across the entire income spectrum.

Treet had Rs5.9 billion in net revenues from razors and blades in 2016, but Rs2 billion of that was from export sales. “We have Treet brands in most countries but in a few countries, customers have their brands (private label) developed and sold by Treet,” explains Ali.

The company’s local revenue is growing slightly faster than Gillette’s: between 2009 and 2020, Treet’s local sales of razors and blades grew by an average of 13.1% per year compared to Gillette’s average of 12.2% per year for the same period.

As far as Treet’s market share is concerned, Ali thinks they can manage to preserve it. However, Treet is not taking the competition lightly.

Treet’s advantage: the barbershops

“Gillette is more self-shavers oriented and their business model is market skimming with a high-quality high price strategy they can’t afford going down the market with fewer margins and more hassle,” said Ali.

While Treet does not plan on launching new high-end razors and blades along the lines of what Gillette has to offer, it will continue serving the mass market, primarily through barbers.

“We will continue being a mass-market product as we can further improve a little bit whatever we are producing and can’t introduce specialised products due to the non-availability of technology. Our direct consumption customers are all barbers and salons and the channel is growing and don’t need the kind of products Gillette offers.”

In Pakistan, the culture of getting a shave from a barber is very much still a practice considering the convenience, ease, and more importantly the fact that it is cheap. The salon and barber segment primarily uses Treet considering how it is easy to clean and reuse multiple times, and of course, the pricing.

Moreover, unlike in North America and Europe, a very large proportion of Pakistani men have beards and use razors and blades very sparingly, and some not at all. It is also not considered unprofessional in any profession in Pakistan to have a beard.

When will Gillette start manufacturing in Pakistan?

According to sources familiar with Gillette management’s deliberations, the company will begin local production of blades and razors in 2022. This is in addition to their decision to start local manufacturing of Pampers diapers in Pakistan in April 2021, Always sanitary pads in June 2021, and Safeguard liquid soap some time in 2022.

The fact, however, remains that the industry is plagued with the problem of counterfeit and fake products in addition to smuggled alternatives.

“As Treet is available in far-flung areas where selling counterfeit is comparatively easy, we face this problem. If Gillette goes to such areas with low-priced brands, they may also face this problem. However, Gillette is more of an urbanized brand,” said Ali.

Ali feels “Smuggling, counterfeiting, infringement, increasing dollar rate, poor economy, and lowering the buying power of consumers” are the major challenges to business in this industry. However, Treet is confident that they are in the safe regardless of Gillette deciding to produce locally again. “We have been fighting genuine competition successfully since the inception of our plants.”

I hate paywalls.

Good article. But why Treet is not investing in new technology? Why behave like a Dodo bird, Areeba?…

Good article. Please write more often