Last week, the State Bank of Pakistan (SBP) increased the Cash Reserve Requirement (CRR) by one percentage point to 6pc for scheduled banks in order to contain monetary expansion. The SBP said it has decided to increase the average CRR to be maintained during a period of two weeks by scheduled banks, from 5pc to 6pc and minimum CRR to be maintained each day from 3pc to 4pc.

This move wipes out liquidity of Rs 170bn from the banking sector and has the potential to bring down sector earnings by 3.5%. However, due to the increase in the policy rate by 150 bps, (which we will get to later in this article), the banks that have a higher proportion of current accounts of their deposit portfolio will benefit more since high current accounts exposure will protect banks from higher deposit costs. Banks with a higher exposure towards T-Bills and floater bonds will also tend to witness a quicker improvement in NIMs since yields will re-price upwards faster, whereas banks with high exposure to fixed bonds will be stuck with fixed yields.

Last year, the SBP decreased the CRR by 100 bps to inject liquidity into the market. “With the economy recovering briskly from last year’s acute Covid shock, there is a need to gradually normalize policy settings, including the growth of monetary aggregates,” said the SBP in a statement.

The hike in the CRR was a clear indication that the policy rate was to rise, which it in fact did by 150 bps. It is pertinent to point out that this was done earlier than expected to combat the uncertainty around the policy rate. The last time the SBP increased the CRR was in 2008. This indicates that the SBP is clutching straws to curtail demand and inflation. This is a means of aggressively tightening the money supply.

“The Pak Rupee has been bearing the brunt of a concerning external account position, depreciating by 3.4% since the last meeting. Therefore it became necessary for the SBP to turn to more tools to stop the economy from overheating, such as rate hikes and raising the average Cash Reserve Requirement (CRR) of banks recently, to reduce the flow of money in the economy in order to control aggregate demand. This has been a stance from gradual and measured policy response to ensure the growth remains sustainable while gradually targeting mildly positive interest rates over time,” says Tahir Abbas, Head of Research at Arif Habib Limited.

What is the CRR and SLR?

Central banks have four primary monetary tools for managing the money supply. These are the reserve requirement, open market operations, the discount rate, and interest on excess reserves. These tools can either help expand or contract economic growth and work by increasing or decreasing total liquidity. Total liquidity is the amount of capital available to invest or lend. It’s also money and credit that consumers spend.

The CRR is the minimum percentage of a bank’s deposits that are to be held in the form of cash. It is applicable on demand liabilities and time liabilities with tenor of less than a year. The banks, however, don’t hold this cash themselves. Instead, it is deposited with the SBP. Even though the bank and SBP are separate entities, having the CRR deposited with the SBP is the equivalent of holding cash with themselves. The CRR does not earn interest for the bank.

Essentially, the higher the CRR, the lower the amount that banks can lend. For instance, let’s say a bank’s deposits increase by Rs 100 billion. With the CRR at 6% at present, this means that the bank will put up an additional Rs 6 billion in the form of CRR. The bank can only lend out Rs 94 bn. previously when the CRR was 5%, the bank was able to lend Rs 95 bn.

Through the CRR the SBP is able to control the liquidity in the market by increasing the CRR to reduce the lendable amount. A change in the CRR is harder for smaller banks considering they don’t have as much to lend in the first place. Moreover, the difficulty in modifying procedures means that central banks do not alter the CRR often.

The SLR or Statutory Liquidity Ratio is the minimum percentage of deposits that a bank has to maintain in the form of cold, cash or other approved securities. It is the ratio of liquid assets to the demand and term liabilities or deposits. When the SLR is increased, the bank’s leveraged position is restricted. This pumps more money into the economy and therefore regulates credit growth. Banks are able to earn interest on the SLR.

Why was this done?

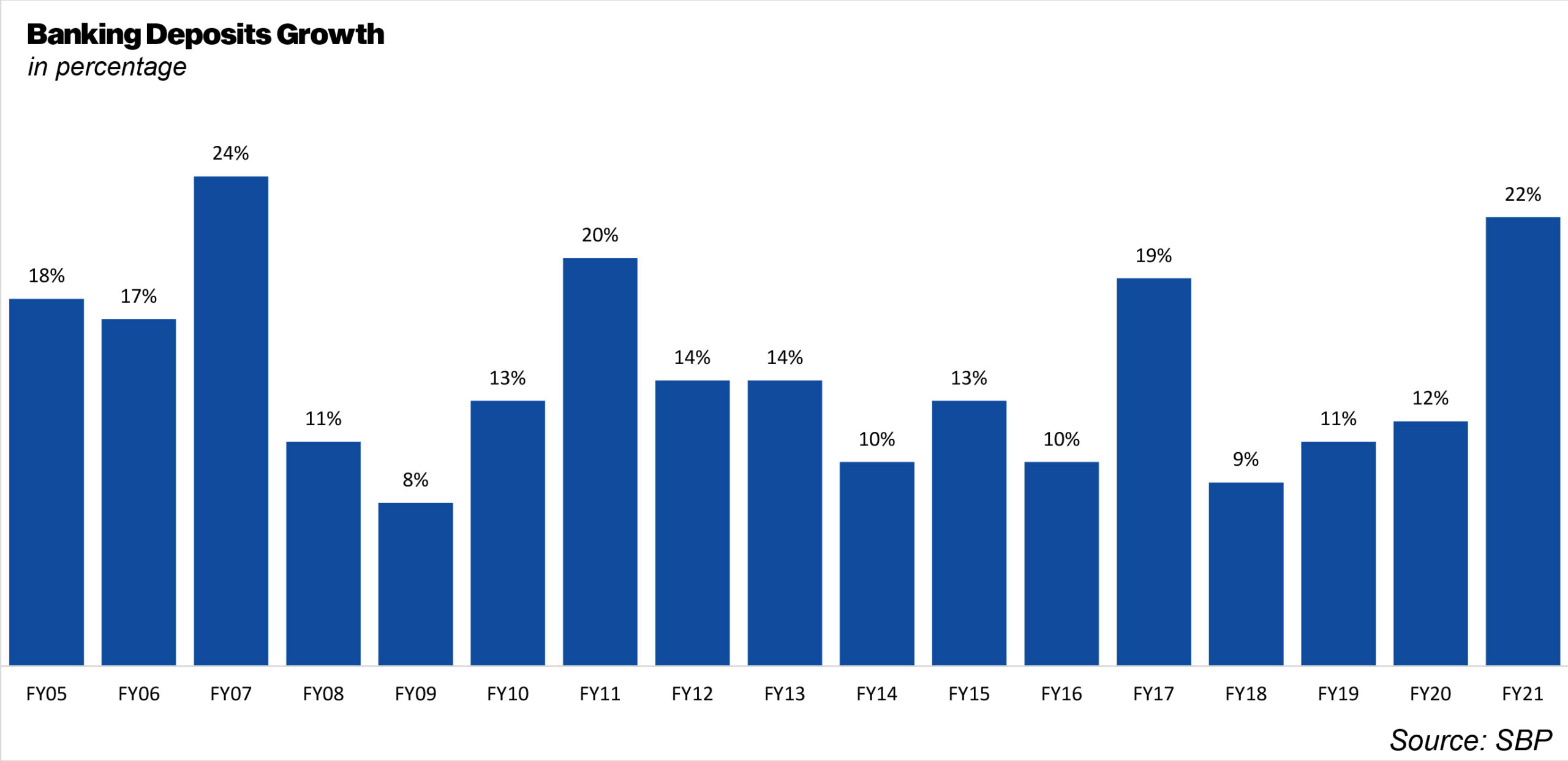

Simply put, the CRR was increased to tighten money supply growth so that domestic demand is sustained at moderate levels whilst being able to sustain economic growth, achieve inflation targets and reduce the pressure on the rupee. The primary purpose of this is to increase the propensity to save considering banks would offer better returns to attract deposits in order to meet the difference in the liquidity.

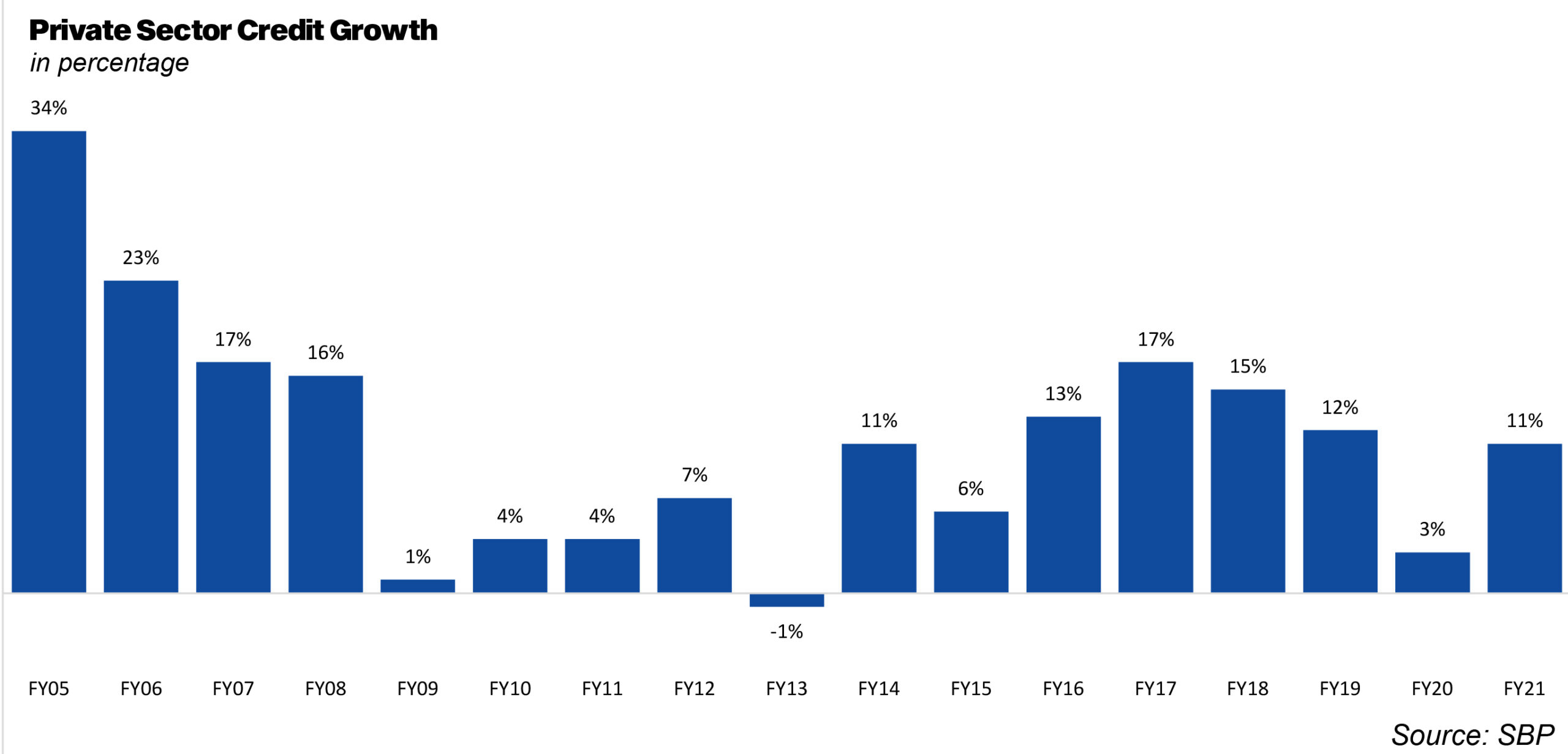

The growth in M2 has been higher than the historical average as of late. M2 growth has been registered between 16-17% during the past two years. This is the highest in more than a decade. The historical average has been approximately 14%. A prime reason for this is due to the NFA flows which have been greater than usual.

What does this mean for Pakistan?

While we do not officially have an example of quantitative easing in Pakistan, you need to understand that most liquidity injections end up in the form of buying T-bills and PIBs. With a low risk appetite by banks, banks generally prefer to lend to the government. This is amplified by the fact that the government can no longer borrow from the SBP. The IMF program restricts the government from borrowing directly from the SBP. Instead, the government borrows from commercial banks.

This rise in the CRR brings it back to the level the CRR was at prior to COVID. Essentially, one could say that this is bringing it back to equilibrium. The impact on the private sector isn’t as drastic as you’d think because like we’ve mentioned, banks already preferred lending to the government instead of the private sector.

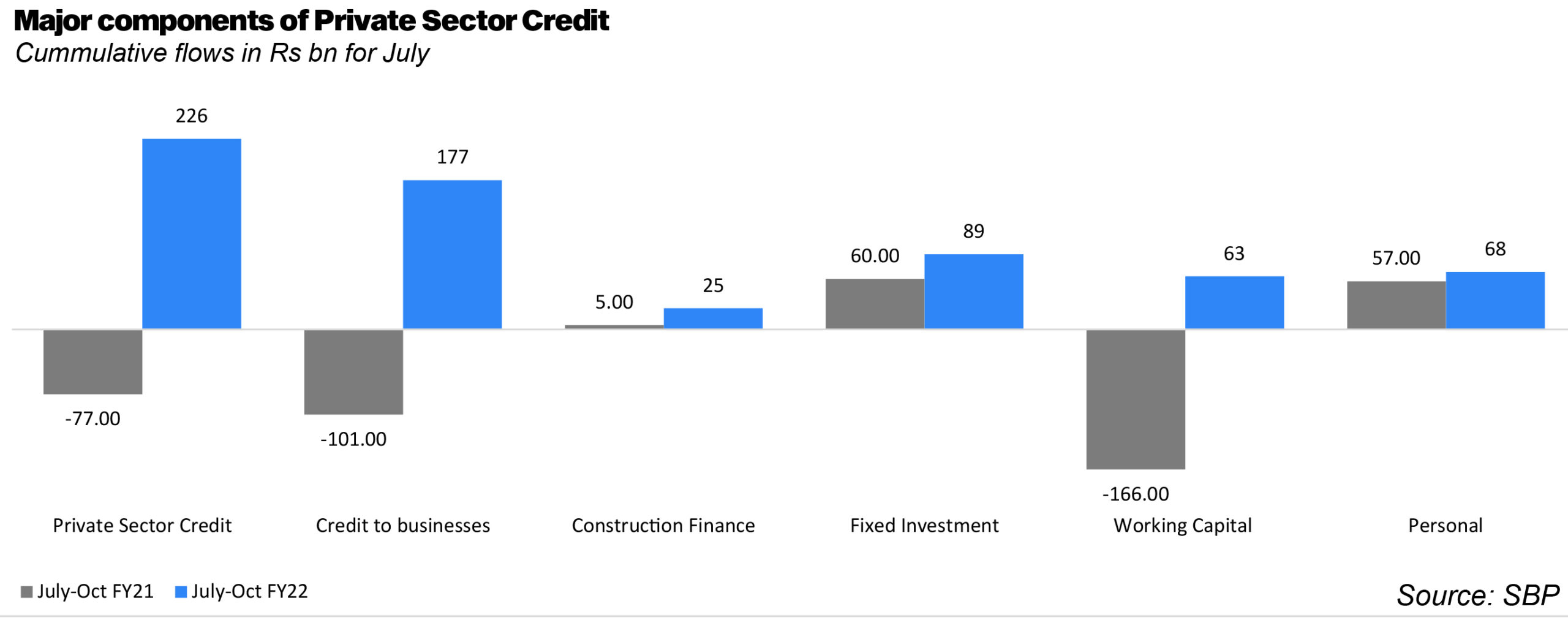

Refinance schemes do not really depend on the liquidity and so they will continue as usual. The demand for private sector credit has been low. In terms of GDP, private credit stock stands at approximately 15%. In the past this has hovered around 25%. Moreover, the SBP has taken notice of the ADR of banks. With banks aiming to increase ADR to reduce tax burden, banks are likely to continue lending.

In an economy where nearly 30% of the money supply consists of cash in circulation, bringing back the CRR to 6% really makes no sense. It is unlikely that you’ll be able to control inflation through this especially when the cash in circulation is a primary source of inflation as opposed to the deposits in banks and the lending that results in growth. The cash, however, primarily fuels consumption led growth.

With this money being moved to the SBP and left idle, one is to wonder whether this is the right move. The timing isn’t ideal either, especially considering the liquidity that would be wiped out following the introduction of a single treasury account as per the IMF’s instructions. The single treasury account system, as explained by Profit last week, means the IMF wants Pakistan to close all bank accounts maintained by public sector entities and the defense ministry in commercial banks. All that money is to be transferred to the central bank in one account. The concept is as simple as it sounds – all public money must be gathered in a single account maintained by the central bank.

In a country where inflation remains a major issue due to rising costs and supply shocks, as opposed to demand pull inflation, reducing the money supply has more of an inflationary implication than you would expect. As a result of this hike, borrowing will be more expensive. If you add on the hike in the policy rate too, this is amplified. Investment, while generally showing a weak relation to interest rates, will likely taper down.

What about the hike in the policy rate?

The fact that the CRR was increased was enough to indicate that the MPC would increase the policy rate. This is because increasing the CRR alone would not curtail demand. As expected, the policy rate was increased. The extent, however, came as a surprise to many. The policy rate was increased by 150 bps bringing it to 8.75% from 7.25%. There was a mixed view in the market regarding the policy rate.

With the SBP imposing cash margin on imports, limiting auto financing, and obviously increasing the CRR, some expected a gradual rise in the policy rate over the next few months. “Consistently high energy prices, incorporation of the same inflation via second round effects is going to push expected inflation in the double digit region. Add another 2% of the long term average of real rates, something which we have not been maintaining since the pandemic struck, and we are looking at 13%. At this level, the USD carry trade becomes remunerative and you get a lot of USD flows, straight out of the central bank’s playbook in 2018,” says Ammar Habib Khan, an economist.

The MPC stands ready to respond appropriately to any medium-term developments in inflation, financial stability and growth. “Looking ahead, the MPC re-iterated that the end goal of mildly positive real interest rates remains unchanged, and given today’s move, expects to take measured steps to that end. Positive real rates mean another 100-200bps increase, considering inflation trend,” says Fahad Rauf, Head of Research at Ismail Iqbal Securities.

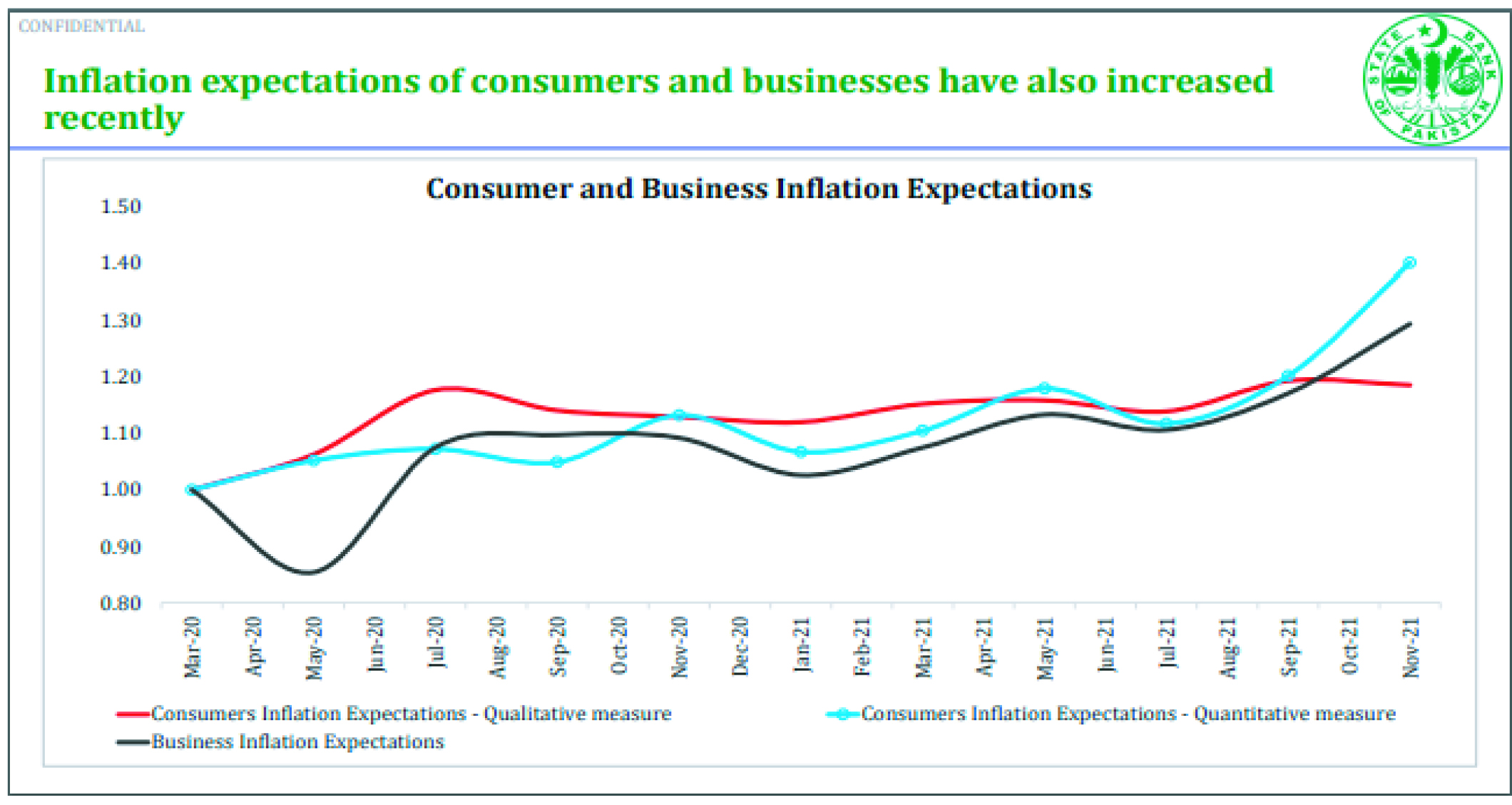

Inflation continues to soar, rising by 1.9% on a MoM basis with headline CPI for October clocking in at 9.19%. It is pertinent to note that demand-side inflation has overshot. Moreover, inflation expectations of households and businesses have also adjusted upwards with further room for upside to the forecast 7-9% for FY22 amid higher energy prices.

With rising commodity prices and robust domestic demand, the CAD stands at USD 5.1bn in 4MFY21, against a positive balance of USD 1.3bn last year. While exports and remittances have shown improvement, the surge in imports has been concerning. The MPC expects the CAD to “modestly exceed” the previous estimates of 2-3% of GDP.