The Pakistani rupee depreciated by 36 paisas (-0.20 percent) against the US dollar for the third straight session on Monday as commodity prices surged globally on the back of the Russia-Ukraine conflict.

According to the State Bank of Pakistan, the dollar opened at Rs177.11 in the interbank market and closed at Rs177.47. The rupee witnessed a trading range of 49 paisas during the session, showing the intraday high bid of 177.55 and low offer of 177.30. Within the open market, the rupee was traded unchanged at 177.50/178.50 per dollar.

Overall, the rupee shed Rs1.25 against the dollar last week, while depreciation remained 75 paisas in February. The local currency devalued by Rs20.04 during the ongoing fiscal year 2021-22 and 96 paisas during the current year 2022.

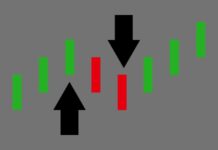

Source: Forextrading.pk

As per the market experts, the surging trend in the global crude oil prices is likely to keep the rupee under pressure, while the deteriorating situation between Russia and Ukraine will continue to take its toll on the currency market. The crude oil prices crossed $100 per barrel mark last week as tension mounted between Russia and Ukraine.

Further, the rupee is bearing the brunt of increasing trade deficit, surging import bill due to rise in oil prices, shrinking reserves, and speculative elements.

The oil import bill recorded a sharp increase in the first seven months (July-January) of 2021-22 compared to the same period last year, owing to rising prices on the international market and massive depreciation of the rupee.

The oil import bill rose by 107.35 percent to $11.7 billion in the first seven months of the current fiscal year. Moreover, the decline in the value of PKR is also attributable to the deteriorating current account balance owing to the increase in imports as the current account deficit (CAD) rose to $2.6 billion in January 2022 from $1.9bn in December 2021.

In addition, the shrinking foreign exchange reserves have also played their due role to put pressure on the local unit as the total liquid foreign exchange reserves dropped to $23.23 billion.