The market breaching the 49,000 level recently has been met with cheer and celebration. The signing of the stand by agreement (SBA) with the IMF has been considered as a positive development with the market touching a low of 39,894 on June 23rd to a high of 49,034 on 8th of August 2023. This represents an increase of 23 percent in a period of 45 days.

This comes in the backdrop of political uncertainty, record high interest rates and a challenge of belt tightening signalled by the IMF in regards to fiscal and monetary policies. The market has met with considerable selling pressure as it tried to move past the 50,000 mark. Is this the end of the rally or is the market taking a breather before another substantial rise? Profit tries to answer.

The good old days of 2017

The last time the market touched and sustained levels above 50,000 was back in 2017. From January till May 2017, the market stayed above the 50,000 mark touching a high of 53,127 on 25th of May 2017. As the streets were reverberating with “Muhjay kyun nikala”, the market was echoing with the sounds of “Lao Maal” (this is local slang for a bull market). The market was flying high on an optimistic sentiment and it was felt that the market trend will continue for the period going forward.

Just a year ago, the PSX had given returns of 46 percent for 2016 which was the highest return seen in any equity market of Asia and it was felt that the music would never stop. As the market entered 2017, this feeling was carried forward with people projecting that the index would cross 55,000 by the year end.

This was buoyed by the fact that Pakistan was expected to go from the MSCI frontier market index to MSCI emerging market. Through such a classification change, the market would have seen an influx of foreign investment and the index was touching all time highs based on this expectation.

Fundamentals then and now

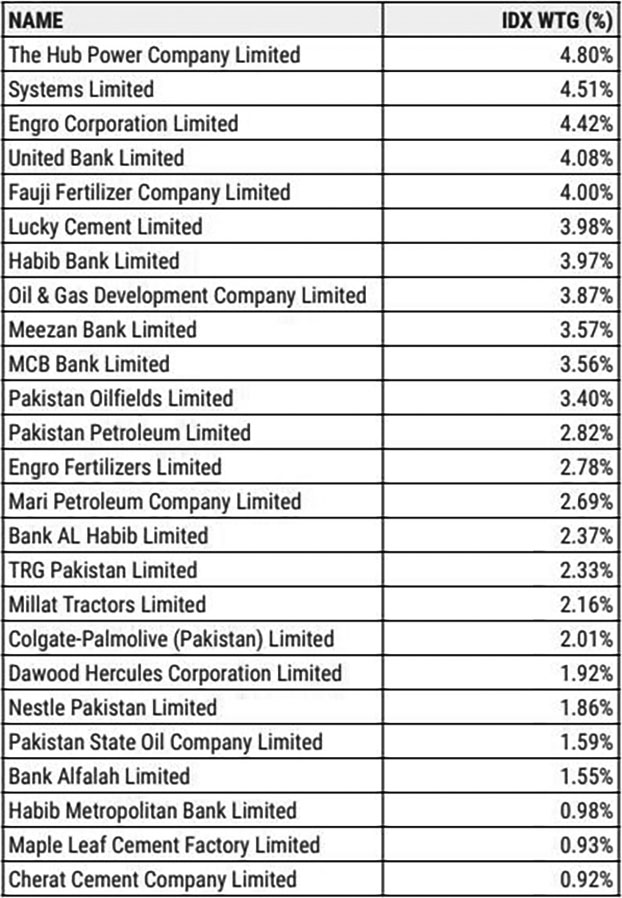

The rally was important, primarily in the context of the companies which were seeing their rates reach new heights. Companies like Hub Co Power, Engro Corporation, United Bank Limited and Lucky Cement reached prices that had never been seen before. The companies chosen for this analysis include the top 25 companies making up the KSE-100 index which make up around 71 percent of the weightage.

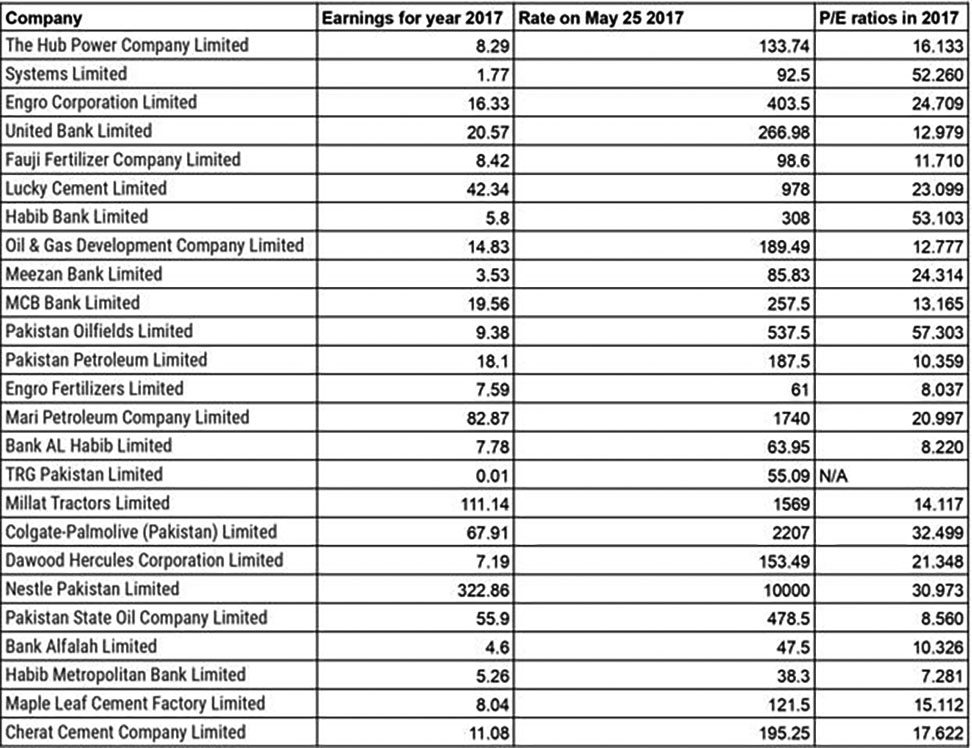

Based on the prices prevailing in the market on 25th May 2017, the P/E earning ratio can be calculated for the highest weighted shares in the KSE-100 index.

Based on this P/E (Price to earning) ratio analysis it can be seen that the price multiple was hovering around 20 then. This means that if a company was making a per share profit of Rs 1, on average investors were willing to pay Rs 20 to get that one share.

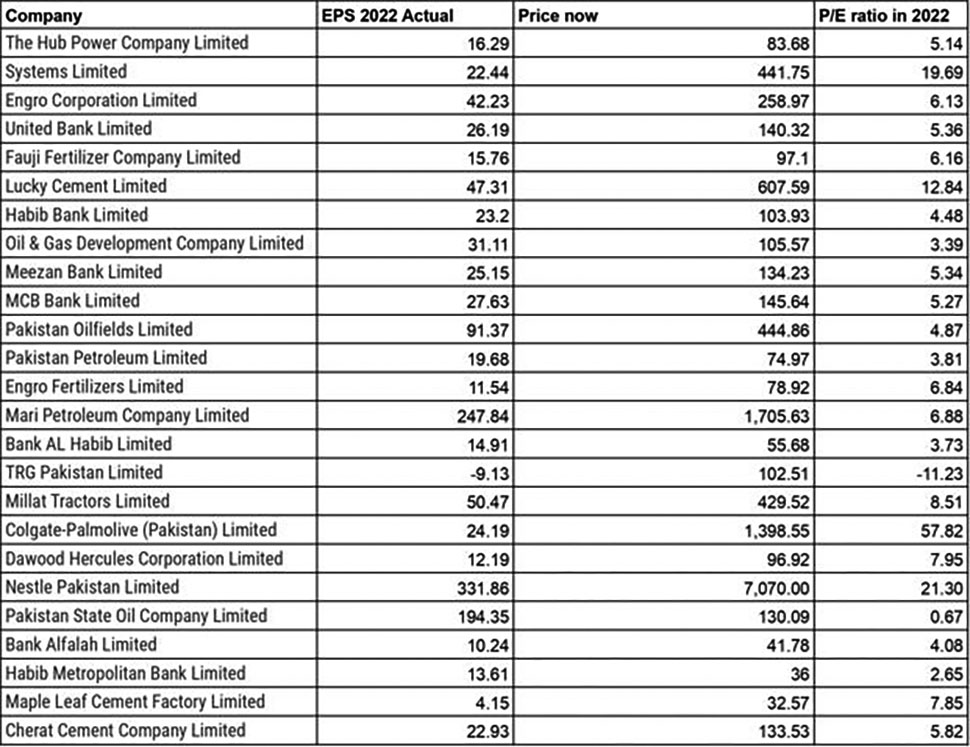

When a similar analysis is carried out for the most recent results of the same companies, it can be seen that the corporate sector had a stellar year in terms of their performance.

The analysis shows that the average price multiple for these companies has gone from 20 to around 8 times the earnings. This means investors are now paying only Rs 8 for a company’s share that made a profit of Rs 1 per share.

The multiple has more than halved and for most market experts this means that the market is currently highly undervalued.

Reason behind the gap?

Yousuf Saeed, head of research at Darson Securities feels that “the market was trading at a greater P/E in 2017 than it does now, owing to higher profitability from many sectors, particularly banks and the oil and gas sector, both of which are considered heavyweights.”

There is a need to understand whether the valuations that are being seen are actually undervalued. Consider the fact that some of the macroeconomic variables have changed. The interest rates were at 5.75 percent which was the lowest they have been for more than 20 years before that.

Currently they stand at 22 percent with a possibility of at least remaining at this level for the foreseeable future due to the IMF’s pressure. This can be a reason for the level of pessimism which is bearing some pressure on the index. In addition to that, the inflation rate for 2017 was at 4.09 percent which peaked at around 38 percent in June of 2023. This could be taken as a reason why the valuations are low compared to where they were in 2017.

Mohammad Aitazaz Farooqui, head of research at Providus Capital states how “the market was at P/E multiple of ~12x in 2017 due to exuberance related to conversion towards MSCI emerging markets index. Current multiples are around 4x. Average multiple of the Pakistani market has been around 8x. The movement towards that level depends on the solution to structural problems which might take time.”

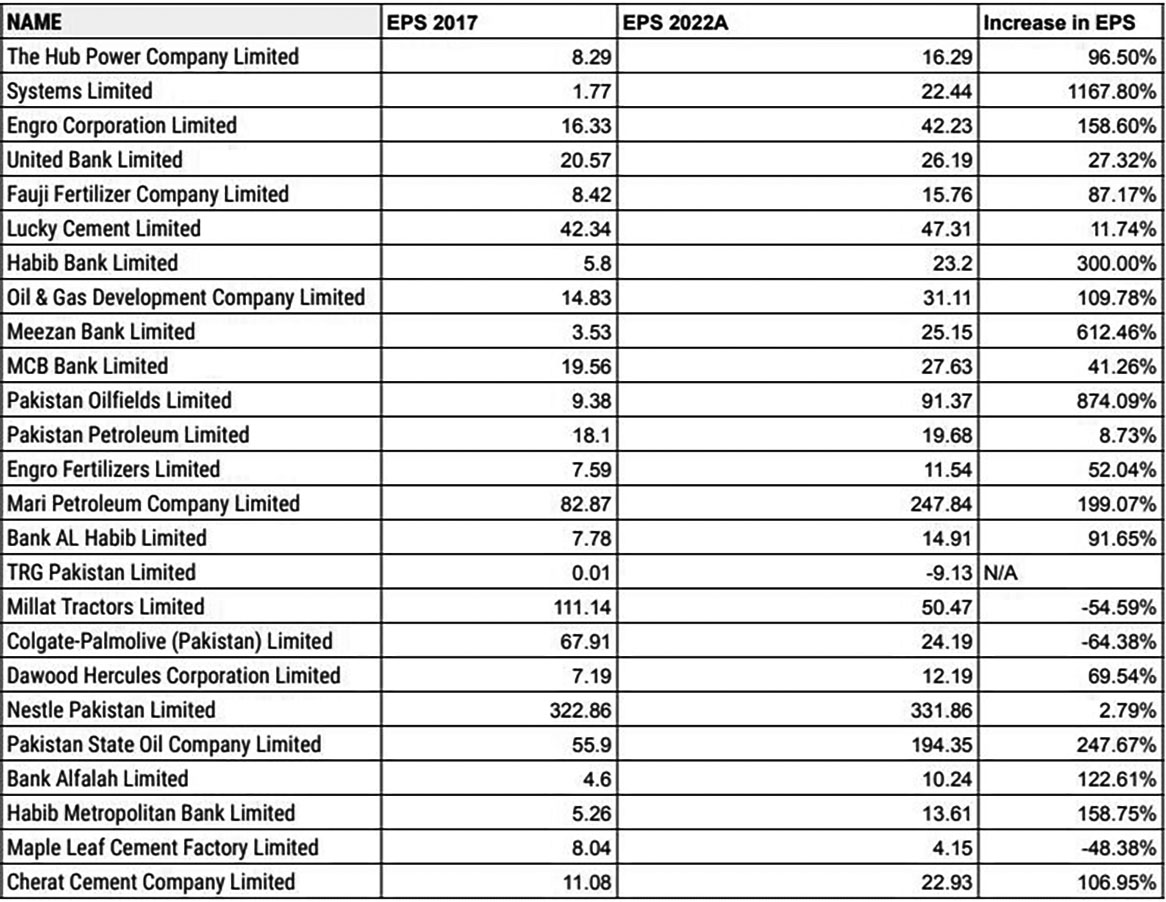

Regardless of these two factors, the earnings of the companies are back to the levels they were in 2017 and in many cases, the earnings have jumped many folds. The earnings of many of the index constituents fell from 2020 to 2022 due to COVID-19 leading to a fall in earnings. Many of these companies have now bounced back.

A cursory look at the table below shows that the earnings of companies have increased dramatically in the last five years and many of the companies are making profits much higher than they were doing in 2017.

Saeed feels that the market of 2023 has not responded to an increase in profits as it used to do in 2017 when the market sentiment was much different. The recent rally has been driven by the oil and gas sector primarily while cyclical sectors have not seen the same rise owing to higher policy rate, lower interest from foreigners and economic conditions hampered due to economic and political challenges.

In terms of the interest rates, it can be seen that even though finance costs for many of these companies have jumped, per share earnings (EPS) have absorbed this cost and still increased. In addition to that, experts point towards the fact that it is inflation that has led to an increase in EPS. This can be explained away by saying that price per share is also a nominal value and as one nominal value has increased, it has not been reflected in the price of the share.

Farooqui says that the rally was induced when fears of a default subsided after the SBA was reached. As the market was trading at low valuations, the rally was due in the market; a correction of sorts after the possibility of a default was eliminated.

He adds “Banks garnered strong flows because the risk of debt structuring subsided which was an overhanging risk associated with the sector. The insistence of the IMF to solve problems related to power and gas circular debt led to rejuvenation of the energy chain. The cyclical sectors reacted well to the assumption of easing import restrictions and opening up of the economy.”

A contrarian view

A balancing view to the above stated thesis can be that, even though the market looks undervalued, the reality is hidden behind a complex veil. As inflation is touching sky high levels of 20 to 30 percent, the SBP has taken necessary steps in order to address this with monetary tightening. Interest rates in 2017 were hovering around 5 percent while they now stand at 22 percent.

In basic terms, in 2017, investors were looking at a return of 5 percent if they deposited the money in the bank. If they were willing to deposit Rs. 100 in their bank account, they were getting Rs. 5 at the end of the year and they were happy. In the stock market, they were also willing to buy a stock of Rs. 100 which was earning Rs. 5 in terms of their profits. This would have equated to a PE of 20. Looking at the data, the multiple was hovering around that level.

When the same analysis is carried out for the present day, depositors are earning 20 percent at the bank. If they are willing to deposit Rs. 100 in the bank, they would expect to get Rs. 20 on that deposit. If they are being asked to buy a stock in this environment, they would want a return or EPS for the company to be at least Rs. 20 in order to be willing to invest. For a company earning Rs. 20 when the share price is hovering around Rs. 100, the PE ratio comes out to be around 5.

This is exactly where the market stands right now and based on the high interest rates, it can be expected that the multiple will stay around this level. This is due to the fact that investors can get risk free returns greater than the stock market with their bank. Why would they want to invest in a risky market giving you lesser returns when the bank can give you higher returns.

The contrarian view also holds some ground as inflation adjusted returns have totally been ignored till now. Even if the stock market is consistently giving a return of 15 percent, once this is adjusted for inflation, the investment has actually lost value as the inflation rate is much higher than the return.

There can be an expectation that as long as inflation remains high, the interest rates will persist or even rise. With further belt tightening on the cards, it can be expected that things will get worse before they get better. With the recent increase in petroleum prices, the next MPC is expecting interest rates to increase or stay stable. This means that unless interest rates are lowered, the stock market will stay depressed until a positive signal is provided by the SBP in some way, shape and form.

Looking forward

The basic understanding of the situation as it stands points towards that the best is yet to come. The sentiment in the market might have been subdued recently due to political uncertainty relating to elections being delayed, but the core takeaway is that the fundamentals are strong.

As stability and certainty comes back to the economy, the market may respond positively to these changes. With inflation being tapered off in the recent few months, the SBP can look to cut interest rates which are at record high and are not sustainable for a long period of time. As mentioned earlier however, they may very well not change even if inflation recedes, due to the IMF insistence on keeping interest rates high.

Mohammed Sohail, CEO at Topline Securities adds to the positive sentiment by saying “Valuations are at an unbelievably low level and we have seen serious investors including foreign funds returning to the market after the IMF deal. If the caretaker government maintains financial and economic discipline in line with IMF guidelines then we may see the stock market improving further.”

Saifullah Kazmi, head of investment banking at intermarket securities states that “valuations are attractive across all sectors that are thematically strong and hedged against exogenous factors, such as USD parity, commodity prices and such. Prudent and patient investment into high performing sectors, such as Banks, E&P, Export oriented companies and some high Beta plays would be a surefire way to outperform the index, which should attain a new all time high in CY23.”

In addition to that, the results of many of the companies have already started to trickle in and will be carried out from now till October end. These results are already showing a great earning season which will seep into the investor sentiment of the market itself. As earnings look to move the needle, the index can expect some bullish behavior to return to the market and even break the all time high of 53,000.

The next few months are key and based on economic and political stability, it can be expected that the index will reap benefits of a good corporate season in conjunction with the political environment of the country. When asked if he sees a policy revision from SBP, Sohail stated that it primarily depends on inflation numbers in the next few months before a policy reduction will be considered. A sustainable rally is dependent on a smooth transition to a caretaker setup and elections being held in a timely manner.

That’s great! They’re exactly what I’m looking for! Thank you for sharing these wonderful and rewarding things with me and all of you!

Very valuable analysis. great work

Its an excellent anylysis. Very much helpful for the long term invester. Keep posting.

Amazing content plz keep posting about Pakistan Stock Market 📈🇵🇰

Excellent work

awesome doing great analysis, definately deserved much hight appereciation, well done keep it up.

Good research based article. keep it up. 👍

Great content. you are doing well.

But when will prices of all stocks in 2017 will come now price

“ The multiple has more than halved and for most market experts this means that the market is currently highly undervalued.”

The growth rate was 5% then and 0.25% now. Keeping that in mind the market is NOT undervalued.