Pakistan is witnessing a historic surge in its exports of furnace oil — or fuel oil, as it is also known. The first half of the fiscal year 2024 has already eclipsed the total volume exported in the entirety of the previous fiscal year. What is behind this phenomenon? The answer lies within the evolving preferences of power plants, which have pivoted towards more cost-effective and efficient alternatives, leaving the once-dominant furnace oil plants languishing in their wake.

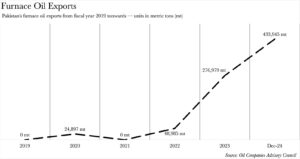

In the six-month period spanning from July to December 2023, Pakistan has dispatched a mind-boggling 433,945 metric tons of furnace oil to foreign shores. This figure utterly overshadows the 276,979 metric tons it exported throughout the entire fiscal year of 2023 — from July 2022 to June 2023. This staggering quantity also signifies the zenith of furnace oil exports in the annals of Pakistan’s history.

So, one might ask — what precisely is going on?

The first thing at play is Pakistan’s plummeting electricity generation is in freefall. The most recent example being December’s generation output being the nadir since December 2017. The most recent manifestation of this decline was in December, when generation output hit its lowest point since the same month in 2017. This downturn has led to a multitude of power plants lying idle, particularly those at the lower end of the National Transmission & Despatch Company’s merit order. The plants operating on furnace oil — colloquially known as residual fuel oil (RFO) plants — languish at the very bottom of the merit order.

“The low priority and merit order list stipulates that the low or no furnace oil consumption trend in Pakistan will persist in the future,” clarifies Aftab Hussain, Director and former Managing Director & CEO at Pakistan Refinery.

The reason for their relegation to the bottom? Their cost of electricity generation dwarfs that of other alternatives.

“RFO plants generate electricity at a rate of Rs 38/kWh, in stark contrast to the reliquified natural gas plants which operate at Rs 26/kWh, and the coal plants that generate electricity at Rs 17/kWh and Rs 12/kWh, contingent on whether they utilise imported or local coal,” expounds Mohammad Aitazaz Farooqui, the Head of Research at Providus Capital.

“The RFO plants had a paltry share of 2.4% across the calendar year 2023 due to their exorbitant costs. Their current Rs 38/kWh is a staggering increase from the 26/kWh from December 2022,” adds Faizan Kamran Khan, the Chief Executive Officer at FRIM Ventures.

Pakistan also harbours long-term plans to phase out furnace oil altogether, with initiatives such as the Indicative Generation Capacity Expansion Plan 2022-31. This is further bolstered by the burgeoning interest in Thar-based power plants that Pakistan has witnessed of late.

“The influx of new nuclear plants, and coal plants such as Thal Nova, Shanghai Powergen, and Thar Energy have further diminished the appeal of RFO plants,” asserts Kamran.

Currently, there is a dearth of data regarding the final destinations for Pakistan’s furnace oil, and the foreign exchange it’s accruing. However, the numbers are likely to be trifling — that is, if they exist at all. Furnace oil is a low to negative margin product for local refineries. Its survival is solely due to it being an unavoidable byproduct of refining crude oil at a refinery. Modern refineries across the globe produce minimal to no furnace oil, however, refineries in Pakistan are yet to attain such technological prowess.

At best, it is a nuisance. At worst, it obstructs storage facilities and compels refineries to find a means to discard it before they can resume refining crude oil. The cost of transporting the furnace oil also contributes to the loss in some instances.

“The export of furnace oil is the last resort for the refineries to operate and safeguard their refinery margins from motor spirit and high speed diesel production until their upgrade projects materialise in the coming six years period as per the Refinery Policy (2023/4),” adds Hussain.

The only deviations to the continuous increases in export are likely to be the sporadic resurgence of local demand, particularly when other sources of fuel are incapable of meeting demand or on the rare occasion that Pakistan’s electricity demand spikes to levels closer to its total installed capacity.

Read more: Refineries halt fuel oil exports amid rising local demand, energy shortages

“Ephemeral surges in local demand may materialise under the influence of seasonal variations or extraordinary events, yet its persistence and sustainability remain dubious. It’s akin to the annual canal cleaning ritual that occurs in January and February,” Hussain muses.

Dear author is a naive to generate technical report on furnace oil export. He has mentioned that Pakistan has exported “433,945 million tonnes” of RFO during July to December 2023. In my opinion that Pakistan do not possess capacity of refinery so figure may corrected as 433,945 metric tonnes instead of million tonnes. It needs to be clarified, please.

You are right but you could have avoided ridiculing the writer. Sounds very rude on your part.

Yes, but correcting this data/ information is more important than moral consideration. But 👍😁 for the young writer.

one question if exports are high rocketed then, what are the worries, is this good for Pakistani economy

Pakistan should export everything and everyone until there’s nothing left.

Pakistan has capacity of this Khuro saheb

12 hours loadshedding every day. No gas. Keep exporting furnace oil, onions, wheat and all that stuff till the population feels compelled to leave the country.

Those supporting such harsh and anti-people measures of the government are doing no service to the people.

If the common man does not survive, all your measures will be of no use.

so exports booking while nearly 18+ hours of load shedding, extremely high cost of Electricity bills, extreme amounts of hidden taxes and further taxes that when asked are not disclosed. this means all the export money is going in the pockets of the Curroupt individuals, groups, Military Generals, police, politicians etc..

Salam walikum Daniyal, something about this article doesn’t add up. Please verify your source and also would appreciate an investigative article on the same topic.

THE ONLY LEGITIMATE CRYPTO RECOVERY EXPERT….!!!

Good day Audience, I want to use this great medium to announce this information to the public about Mr MORRIS GRAY. few months back, I was seeking an online BTC investment plan when I got scammed for about $172,000. I was so down and didn’t know what to do until I came across a timeline about Mr MORRIS GRAY. so I reached out to him and to my greatest surprise, they were able to recover all the funds which I had previously lost to the Devils. I am so glad to share this wonderful news with you all because it cost me nothing to announce a good and reliable Hacker as Mr MORRIS GRAY, His direct email is Morris Gray 830 at gmail dot com, WhatsApp: +1 (607) 698-0239….