A lot has happened at Careem recently. Uber, which had acquired Careem Rides for $3.1 billion in 2019, recently exited the Pakistani market. Even though this does not change a lot for Careem Pakistan and its operations, it did garner attention in the news.

Another recent event at Careem was their new, and perhaps belated, flexible fare offering. It has been a few months since the new offering was launched and Profit was interested in finding out how the bidding model is working out for Careem.

And lastly, we wanted to verify whether the claim that Careem is too expensive, compared to other apps, holds any truth to it.

Profit explores.

Driven by FOMO or necessity?

Surprisingly, it was the pioneer of ride hailing in Pakistan that was the last one to introduce a bidding model for its customers. Previously, Careem only offered a marketplace variable fare model for pricing, whereby neither Careem’s captains, nor its customers had any control over the fares they paid.

But was it the fear of missing out or something else that made Careem introduce its new Flexi Ride offering?

According to Careem Pakistan’s Country General Manager (GM) Muhammad Imran Saleem, the decision had to do with the very premise of why the company operates in Pakistan. “The decision to introduce Flexi Rides had to do with Careem’s heavy sell on being localised and addressing the needs of the market. We’ve spent almost a decade setting this industry up, experimenting with a lot of different things along the way. It’s a very different Careem than what it was two to four years ago,” Salem stated.

He believes that the company’s evolution has been an ongoing process and over the course of the last few years, one thing that became very apparent was that the purchasing patterns and the economic situation have changed drastically. “The changing costs of owning and maintaining a car, fuel prices, and the overall condition of the transport infrastructure in the country had a big role to play in the decision, along with the purchasing power of course,” he explained.

Continuing the same point, Saleem relayed, “The positioning of Careem historically has been that we place ourselves at a premium. We want to provide an exceptional experience, which we couple with safety and support. However, we came to the realisation that there is a big segment of the market that requires a little bit more in terms of value for money, which wasn’t something that we indulged in, in the beginning.”

Eventually, Careem realised that there is a demand for a product that offers better value for money, allowing all stakeholders to be a little bit more flexible than their previous offering. And as with any type of organisation, evolution becomes very important. “The decision to include this feature wasn’t made just a few weeks before launch. It involved extensive software development over a period of about a year and a half. Even after launching it, we’re constantly refining the product based on ongoing learning. We initially rolled it out in smaller cities before expanding, recognizing that each city has its unique dynamics,” Saleem concluded.

Since this was not a new feature in the market, Profit was curious how Careem’s stakeholder responded to Flexi’s phased launch.

Saleem informed, “So there are several facets of the offerings that we have. Of course, there is the hailables offering, the motorbikes and the rickshaws, and then we have small cars with AC, small cars without AC and then premium cars, as well. So we launched Flexi in a couple of, what we refer to, tier two cities, which are smaller cities– Multan and Faisalabad. However, these are still huge markets.”

Saleem said that they observed a good response with the initial launch and the premise of introducing it in smaller cities was to give the company a chance to figure out the user interface and user experience. They conducted A-B testing in Faisalabad and Multan to determine optimal button placement, text, and pricing methods. Based on the findings, Flexi was launched in two variants, Flexi Air Condition and Flexi Mini, in Islamabad and Rawalpindi, catering to different consumer preferences and budgets to test what worked best.

He divulged an interesting finding here, “The combination of both Flexi AC and non-AC rides revealed a preference among customers for the non-AC option, highlighting an important insight. To cater to those seeking greater value with reduced prices, particularly those uninterested in air-conditioned rides, we initially introduced a non-AC mini product exclusively in Lahore.”

When inquired about the adoption rate of the new bidding model, Saleem shared, “So in Lahore, when you want a Flexi ride, you’ll be able to get one without air conditioning and the results of this feature were immediate. I’d say 80% of the people or more, who were actually using the mini product at a marketplace level, were now actually diverting and using the Flexi model.”

In the initial weeks, adoption of the product increased gradually over time through marketing and incentives, particularly for the low-value non-AC option. Customers experimented with it alongside the previous product, indicating a fluid usage pattern where they alternated between the two offerings.

Saleem also told us that even customers who typically used cars with AC shifted to the non-AC option during certain times, such as mornings and evenings in the colder months, appreciating its affordability. However, they still had the flexibility to opt for air-conditioned rides during hotter afternoons,justifying why the company kept both models operational. “The core principle remains empowering both captains and customers to make their own choices, leveraging their extensive experience with ride-hailing services,” he said.

Well, this reflects that the reception of the new offering was positive among Careem’s customers, but what about the other most important stakeholder?

What do the Captains say?

We asked Saleem about some major concerns raised by Captains, pertaining to both pricing models.

He answered, saying that, “Captains prefer the flexibility to switch between models based on different cycles within the month. The traditional marketplace model offers higher commissions along with bonuses for ride volume, like receiving additional earnings for completing a set number of rides, albeit with a higher commission rate of around 15% plus tax. This contrasts with the Flexi model, which offers lower commission levels and lacks similar bonuses. This preference for flexibility reflects a shift in the mindset of captains, who appreciate the ability to choose between models based on their earning goals and circumstances.”

He informed that In the alternative model, captains are charged a 5% commission with no bonuses attached, presenting distinct nuances. Full-time drivers meeting their targets can switch to this model for lower commission rates. Part-time drivers, like office commuters, find it advantageous due to lower commissions and absence of trip targets. Captains appreciate the flexibility of alternating between models, which is why we have this mechanism in place.

The commissions, 5% for Flexi model and 15% for the regular model, are exclusive of taxes. Saleem shared that taxes vary by province, ranging from 4% to 5%. Islamabad, as a central territory, has no tax, while Sindh has 4% and Punjab has 5%.

Profit learnt that Careem conducted rigorous educational efforts for captains through various communication channels and training sessions for its Captains, familiarising them with the new tool.

One issue that captains had with Flexi was the constant vigilance required to combat competition dynamics, prompting the need for a flexible model allowing captains to opt out of actively selecting rides. Concerns regarding potential earnings impact due to customer-set pricing were addressed by introducing a lower commission rate for the Flexi model, ensuring profitability as well.

In contrast, the traditional marketplace model faced criticism for its lack of flexibility in ride assignments, which the Flexi model aimed to alleviate by offering more freedom in choosing destinations. While some technological features allowed captains to set preferences for ride locations, these were restricted to certain times to maintain overall service availability. Despite initial challenges and earning concerns, the introduction of the Flexi model aimed to provide captains with greater autonomy and address customer demands for flexibility, ultimately contributing to a more dynamic and responsive ride-hailing ecosystem, according to Saleem.

The million dollar question

Pricing is perhaps the most important aspect for users of ride hailing apps. A slight fluctuation can make customers switch to a competitor app.

Profit asked Saleem how exactly Careem positions itself in the market, especially with rising competition, especially with recent entrants like Yango that offer extremely low fares?

He said, “Pricing dynamically adjusts based on trip variables.The system learns market demand and supply, employing basic economic principles to maintain equilibrium. It determines pricing to address imbalances, attracting more captains to areas of high demand by raising prices and adjusting prices downwards where supply exceeds demand. This adaptive strategy, developed over many years in Pakistan, reflects our deep understanding of pricing dynamics.”

He also insisted that Careem is in fact not as expensive as the general perception goes, adding that the fares are determined in a way that neither party is exploited.

We also asked Saleem how the captains feel about Careem’s pricing strategy, since competitors such as Yango do not display the fares before a ride starts, taking all control away from their drivers.

Saleem said, “Of course, our captains have a basic understanding, but we take it further by educating them on fare calculations. Captains are aware of the base minimum fare and earn a set amount per kilometre travelled and per hour or minute spent in the ride. Each trip’s variability is acknowledged; while we provide an initial fare estimate, the actual fare may differ due to factors like traffic or route changes, a feature captains appreciate. For example, if a trip is agreed upon at 300 rupees and encounters extensive traffic, the fare remains 300 for the customer, but the captain’s costs increase significantly. This transparency distinguishes our pricing model from competitors, as we provide not just estimates but also a comprehensive breakdown before the trip, empowering captains to anticipate potential earnings based on trip parameters. Captains understand that a trip’s distance and traffic conditions directly impact their earnings, allowing them to make informed decisions about accepting rides.”

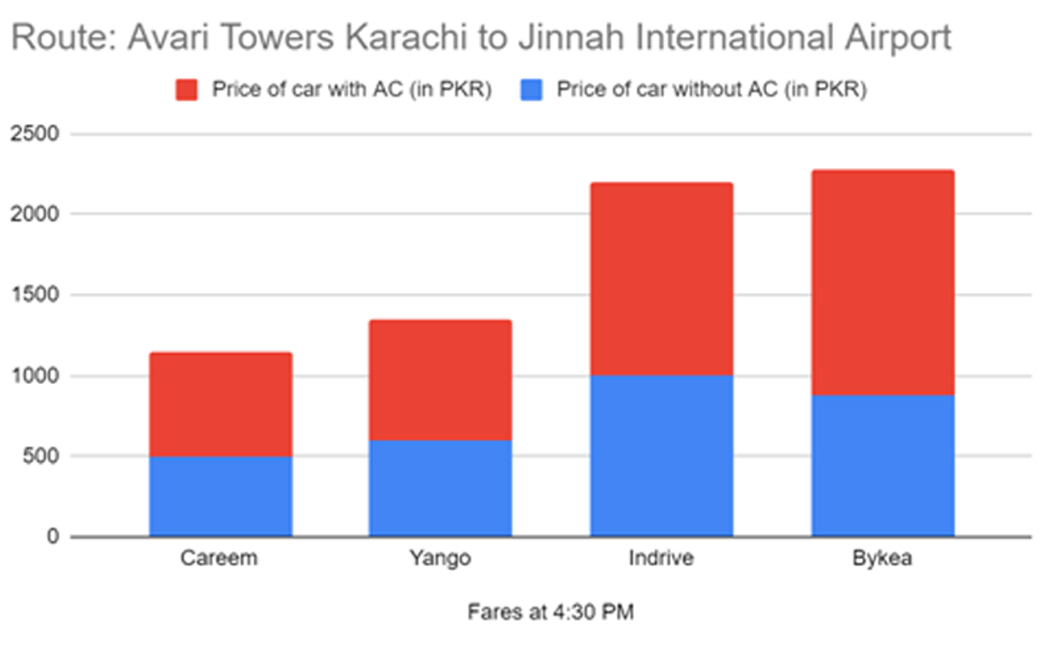

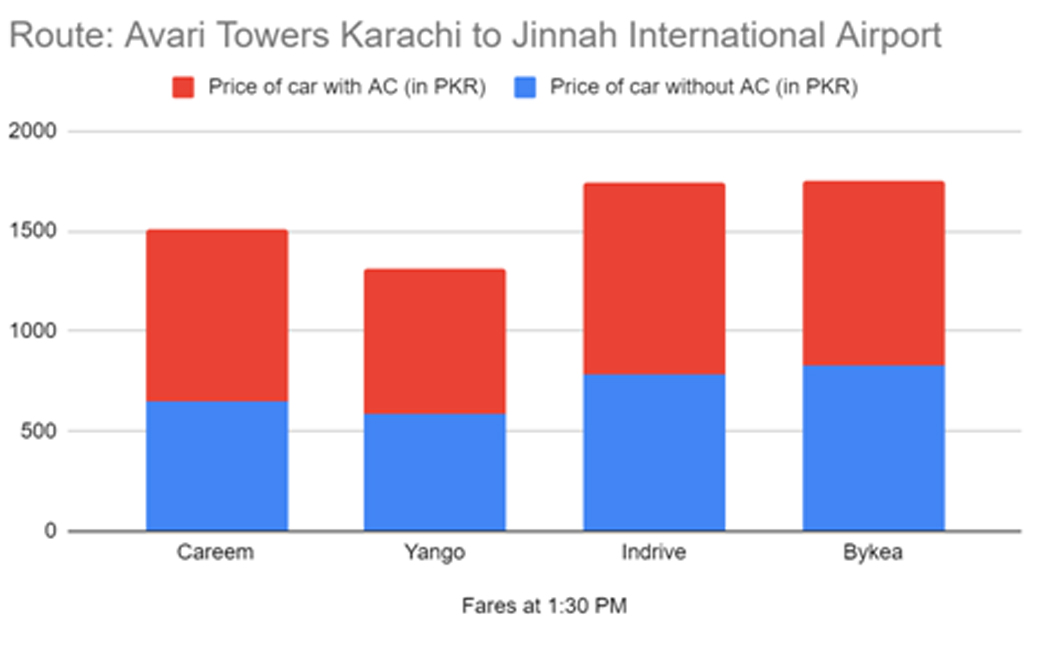

Profit engaged in a comparative exercise to determine whether Careem is the most expensive ride hailing app in Pakistan or is this belief in fact a false one. We selected a 16.5 kilometre route in Karachi from Avari Towers to the Jinnah International Airport at two different times of the day. We included two types of rides, AC and non-AC.

The results revealed that during peak hours (4:30 PM), Bykea and InDrive offered the most expensive rides in both car categories.

The same two companies were also the most expensive during non-peak hours.

Yango offered the cheapest rides, however, based on the review of 20 frequent users of ride hailing applications, the low price was not worth “the horrendous travel experience”. All 20 users agreed that they valued their safety and time significantly more than the few hundred rupees they would save with Yango.

The numbers show that Careem has actually managed to strike a balance between too high and too low fares, offering an acceptable rate to customers, while making sure that drivers are not taking cuts in their earnings.

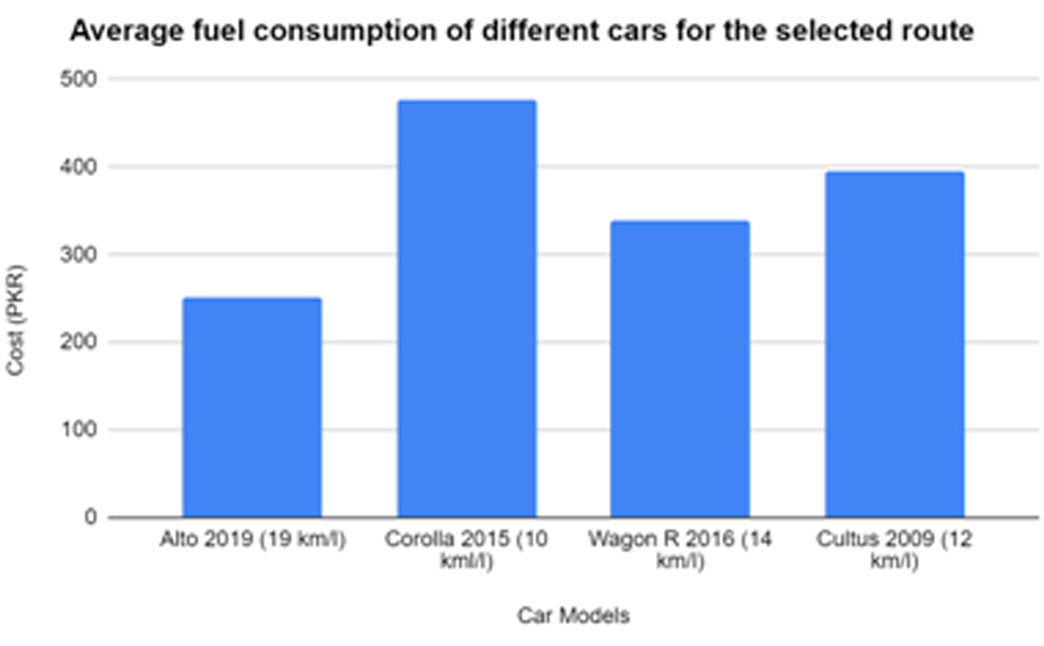

Profit also calculated the estimated fuel cost of going from Avari Towers to the airport in different cars that are most commonly driven by ride-hailing drivers. The average fuel cost ranges from Rs 250 to Rs 476, depending on the car and model.

Even with bigger cars like a Toyota Corolla, the fuel cost does not exceed Rs 500. You will not get this rate even on the cheapest non-AC car if you opt to use a ride hailing service. However, it is understandable that the fares will be higher than the minimum fuel cost of travelling, considering that along with driver’s cuts, the companies also need to make profits.

Careem’s response to growing competition

When ride hailing first became a thing in Pakistan, commuters did not have many options. They could only choose between Careem and Uber’s very similar offerings. However, as the sector developed, several other players entered the market. Both local and international ones. With Bykea’s strong delivery presence and InDrive’s global experience, one would imagine that things got a little difficult for Careem.

We asked Saleem to share how Careem deals with the market getting saturated by the minute.

He said he wanted to address this question from an industry standpoint rather than as someone associated with Careem. “In my view, having multiple options available in the market is beneficial for several reasons. Firstly, it fosters healthy competition, keeping all players vigilant. Additionally, with diverse market segments, specialisation can be advantageous without causing harm. As internet penetration in Pakistan improves, a significant portion of the population now possesses smartphones or internet access. However, the adoption of online financial transactions, whether for e-commerce or ride-hailing, remains low due to trust issues. Offering three to four alternatives can help overcome this barrier by gradually building consumer confidence in the available products and services.”

Secondly, he added that more players in the market allow better lobbying power to influence regulations that impact the sector. “Having multiple options available also enables a stronger industry representation in dealings with regulators and the government. Contrary to common perception, collaboration among ride-hailing companies allows for unified advocacy and lobbying efforts when engaging with government entities, ensuring that industry perspectives are adequately considered in policy-making and legislative processes.”

Well, maybe healthy competition keeps Careem on its toes, but we wonder what it is doing to stay on top of its game.

According to Saleem, there are two main reasons why he believes customers would choose Careem over its competitors.

“We differentiate ourselves particularly through our deep understanding of the Pakistani market and our ability to swiftly localise our services to meet customer preferences. As pioneers of ride-hailing in Pakistan, our extensive institutional knowledge and strong ties to the country allow us to tailor our product offerings and marketing strategies uniquely. Unlike competitors, we prioritise authenticity and cultural resonance. Even our marketing campaigns and slogans reflect a cheeky and fun yet distinctly Pakistani approach, unlike others who a lot of times just translate taglines from their campaigns abroad to Urdu. This deep connection resonates with both customers and captains, providing us with a competitive advantage in the industry.”

Secondly, Saleem said that a great focus on security is an aspect that sets Careem apart from others. “Our commitment to safety encompasses processes including rigorous vetting of captains, involving collaboration with law enforcement agencies and thorough physical verification. We prioritise customer security with dedicated safety teams ready to respond to any incidents promptly. This dedication to safety resonates strongly with our customer base, particularly women, who comprise a significant portion of our loyal clientele.”

He said that Careem’s regular outreach to top customers, predominantly women, underscores their trust in Careem’s safety measures, reinforcing their continued use of the app. “Beyond safety, our commitment extends to in-ride support, addressing various concerns such as navigating through traffic or handling unforeseen issues like fuel shortages or punctures. This comprehensive approach ensures a superior customer experience, exemplifying a concierge service that guarantees customers reach their destinations seamlessly. These initiatives not only differentiate us from competitors but also reflect our unwavering commitment to prioritise safety and enhance the overall journey experience for our valued customers.”

Even though safety concerns trump most other concerns for Pakistani commuters, sometimes security features can be, well, really annoying! For instance, InDrive’s new in app calling feature that lets you connect to your driver through an encrypted call through the InDrive application, so the driver does not get access to your personal contact details.

The issue, you ask? Well, the quality of these calls is so bad that you end up taking the driver’s number and calling them directly. It also takes ages to connect the call, only to hang up in frustration and hope that the driver is competent enough to follow the directions on the map correctly.

We asked Saleem how Careem ensures safety, without compromising on the overall experience of users?

He explained, “Balancing safety and convenience is paramount, and our approach emphasises customer choice. For instance, our in-app calling feature offers three options: calling through the app, direct captain calling, or contacting our support centre. This flexibility caters to diverse preferences, acknowledging that what constitutes an excellent experience varies for each customer. Over our nearly decade-long presence in Pakistan, we’ve learned that prioritising flexibility ensures customer satisfaction, recognizing that individual preferences may differ. Ultimately, our goal is to empower customers with options that align with their safety and convenience preferences, ensuring a seamless and personalised experience for all.”

Over the years of operation, Careem claims to have enhanced efficiencies and reduced costs in advertising and digital marketing due to business scale. However, safety remains a significant investment, therefore no monetary compromises are made when it comes to spending on security features and services.

It is not for us, or within the scope of this article, to decide who is the ride hailing king, however, most recent reviews reflect that Careem has made a comeback in Pakistan, with fairer prices and overall a better experience than any other competitor.