The additional tax levied on banks based on their Advance-to-Deposit Ratio (ADR) has become a pain point for Pakistan’s banking sector.

The ADR is a value that banks use to measure the percentage of funds they have loaned out compared to their total deposits. Over the past couple of years, with interest rates high, banks have been getting more deposits and have not been loaning as much money. To discourage this, the government imposed a tax based on ADR value of less than 50%.

This has been a tricky situation for the banks to manage. How do you avoid this advanced tax? Well, one way is to discourage very large deposits that are just parked in banks. As a result, a number of banks have introduced monthly fees on high value deposits to decrease the volume of money they are holding.

The first bank to do this was Bank Alfalah, which announced a monthly fee on the 15th of November. They were not alone. Other banks quickly followed, the Habib Bank Limited (HBL) and Bank of Punjab (BoP) announcing similar fees on the 18th of November. So how do they work?

Monthly fee on deposits

What we have is these banks announcing a fee on very high value deposits. The first to announce it was Bank Alfalah, which will charge 5% on accounts that have a month-end balance of Rs 5 billion (500 crores). So if you have that much money in a Bank Alfalah account, you will have to pay Rs 25 crores as a fee at the end of the month.

“Accounts maintaining a balance of Rs 5 billion or above on the last day of the month shall be charged a 5% fee on their month-end balance,” reads the addendum to the schedule of charges of July to December 2024.

“It is common practice for banks to regularly update and amend the Schedule of Charges (SoC) in line with market conditions and dynamics. The SoC is reviewed periodically and updated accordingly,” said the bank, indicating that the fee could evolve in the future.

Bank Alfalah isn’t alone in targeting high-value deposits. HBL has implemented a 6% monthly fee on balances of Rs 5 billion or more, resulting in a charge of Rs 30 crore for such accounts. For foreign currency deposits of equivalent value, HBL applies a reduced fee of 3%.

Meanwhile, BOP has adopted a more targeted approach. The bank’s fee is restricted to conventional savings deposit accounts exceeding Rs 3 billion. These customers will be charged a 5% fee on month-end balances, including foreign currency accounts holding an equivalent amount. This move allows BOP to strategically reduce its reliance on costly deposits while working to streamline its current account-to-savings account (CASA) ratio.

How will it actually work?

“This appears like a scheme to manage ADR tax”, remarked a senior banker in a conversation with Profit.

At its core, the Advance-to-Deposit Ratio (ADR) measures a bank’s lending activity relative to its deposits. The advances refer to lending to the private sector (businesses or individuals) and deposits is the money customers park in the bank through current accounts, savings accounts, or term/fixed deposits. Banks pay interest on some deposits (like savings or fixed deposits) and use this money to either lend to the private sector or invest in government securities. Ideally, a healthy ADR reflects a bank actively lending to fuel economic activity.

Now, banks have options to manage this. They can either increase their lending or decrease deposits. It seems Pakistani banks are going for the latter. But in either case, it was important for banks to manage their ADR. Take Bank Alfalah for example. At the end of September 2024, its gross ADR stood at 42%. In the corporate briefing session of the third quarter of 2024, the bank’s management was confident about reaching the 50% mark by year-end. They also indicated that deposit growth would remain subdued in the final quarter of 2024, with a focus on improving the deposit mix. However, as per Topline Securities, missing the 50% mark could push the bank’s full-year effective tax rate to a steep 56%. The situation is not much better at the other banks. The gross ADR of HBL and BOP stood at 38% and 40% respectively, which is below the 50% mark.

Who will it impact?

| Classification of Scheduled Banks’ Deposits by Category of Deposit Holder and Size of Account | ||||||||||||||||

| As on 30th June, 2024 | ||||||||||||||||

| Foreign Constituents | Domestic Constituents | |||||||||||||||

| Government | Non financial public sector | NBFCs | Private Sector Business | Trust Funds | Personal | Total | ||||||||||

| Size of Accounts (Rs in billions) | No. of Accounts | Amount | No. of Accounts | Amount | No. of Accounts | Amount | No. of Accounts | Amount | No. of Accounts | Amount | No. of Accounts | Amount | No. of Accounts | Amount | No. of Accounts | Amount |

| 5 – 10 | 1 | 8.08 | 49 | 326.7 | 49 | 350.2 | 34 | 238.3 | 49 | 327.7 | 5 | 35.5 | 1 | 8.17 | 188 | 1,294.6 |

| Above 10 | 43 | 872.2 | 28 | 472.7 | 29 | 525.1 | 38 | 833.0 | 1 | 17.0 | 139 | 2,720.0 | ||||

| Total | 1 | 8.08 | 92 | 1,198.9 | 77 | 822.9 | 63 | 763.4 | 87 | 1,160.7 | 6 | 52.5 | 1 | 8.17 | 327 | 4,014.6 |

| Source: State Bank of Pakistan | ||||||||||||||||

As of June 2024, the latest data published by the State Bank of Pakistan reveals that there were 326 domestic accounts holding deposits exceeding Rs 5 billion. Among these, only one account belonged to an individual, with a balance of Rs 8.17 billion.

“If the number of such individual accounts has increased since then, that would be a different matter. However, it’s unlikely, as people generally do not hold such large sums in bank accounts,” explained Mir Nejib Rahman, a financial services consultant. “Typically, this kind of money is invested in mutual funds, properties, or other avenues of investment,” he added.

“At a personal level, this won’t make much of a difference,” remarked Mir Nejib Rahman. “The individual account holder can easily split their funds between multiple banks to avoid the fee. For instance, if someone has Rs 8 billion in one account, they could simply divide it into Rs 4 billion across two banks, bypassing the charges altogether. However, private sector business and government might face financial costs if they have deposits in the banks that have levied monthly fees “.

Of the remaining accounts, 92 are held by the government, collectively containing deposits worth Rs 1.2 trillion (or Rs 1,199 billion). Another 77 accounts belong to non-financial public sector institutions which are primarily state-owned enterprises (SOEs) with total deposits amounting to Rs 823 billion.

This means that the government might have to pay more than Rs 10 crore in fees if these large deposits are in banks that have levied a monthly fee on high value deposits.

Non-Banking Financial Companies (NBFCs) hold 63 accounts with deposits totalling Rs 763 billion. Private sector businesses hold a notable share with 87 accounts collectively worth Rs 1.16 trillion (Rs 1,161 billion). Additionally, six accounts belong to trust funds, containing deposits of Rs 52.5 billion.

So what will these depositors do to avoid paying hefty fees?

As per Rahman, currently banks are flushed with liquidity, therefore, moving out of deposits will not impact them. “Some movement of funds will happen, but it won’t make much of a difference to the banks,” explained Rahman. “If this money remains in deposit accounts, the ADR tax charged would be higher than the cost of retaining these deposits.The banks are better off letting these funds go rather than keeping them and incurring a higher tax burden.”

As per Rahman, NBFCs, private sector businesses, trust funds etc. are likely to split their deposits across multiple banks to keep balances below Rs 5 billion or transfer them to banks that haven’t imposed the fee. “Currently, only a few banks have implemented this charge, but it’s possible that 3-4 more may follow suit”, remarked Rahman.

As of September 2024, except for two banks excluding United Bank Limited (UBL), all banks had ADR below 50%.

(Note: UBL announced that its ADR has surged to 50% in its corporate briefing session after the release of nine months financial statements)

| Bank | ADR | |

| Samba Bank | 58% | |

| JS Bank | 51% | |

| UBL | 50% | |

| Habib Metro Bank | 48% | |

| Allied Bank | 44% | |

| Faysal Bank | 44% | |

| Meezan Bank | 42% | |

| Bank Alfalah | 40% | |

| Bank of Punjab | 40% | |

| Habib Bank Limited | 38% | |

| Bank AlHabib | 35% | |

| Soneri Bank | 34% | |

| MCB Bank | 33% | |

| Askari Bank | 33% | |

| Bank Islami | 31% | |

| National Bank of Pakistan | 30% | |

| Standard Chartered Bank | 23% | |

| Bank of Khyber | 21% | |

| Bank Makramah | 10% | |

|

However, Rahman opined that moving deposits from one bank to another might not be a problem for private sector businesses provided that all banks do not start charging fees on high deposits.

“It’s unlikely that the National Bank of Pakistan (NBP), a state-owned bank, will impose such a fee. In that case, the government might shift its deposits to NBP,” Rahman added.

A senior banker shed light on another strategy banks might adopt to manage high-value deposits. “Banks would not be comfortable with depositors simply withdrawing their money and taking their business elsewhere to other banks,” he explained.

So what can the banks do instead?

“Instead, they might transfer these deposits to their own Asset Management Companies (AMCs). This is a regular practice in the case of fixed deposits: to avoid losing customers seeking higher yields, banks often suggest investing in AMC products”, said a senior banker.

High-cost fixed deposits often pose a challenge for banks, as they can turn into a liability when the funds cannot be lent out profitably. Conventional banks in Pakistan are required to pay depositors a minimum rate, typically 1.5% below the prevailing policy rate.

With the current policy rate at 15%, conventional banks must pay 13.5% interest on savings accounts. However, the six-month KIBOR (Karachi Interbank Offered Rate)—the benchmark for interbank lending and borrowing—stood at 13.6% as of November 18, 2024. This leaves banks with a razor-thin spread of 0.1%, making it difficult for them to profit from lending activity.

As per the senior banker, since AMCs are partially or wholly owned by banks, this is a mutually beneficial arrangement as the banks benefit from commissions. Moreover, transferring funds to AMCs offers tax benefits for banks as tax on AMCs is lower than that of banks.

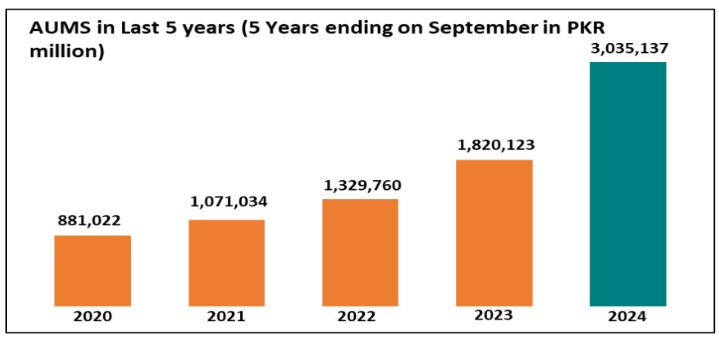

“Consequntly, the assets under management (AUMs) have increased to the highest level in history,” exclaimed the senior banker. As per Mutual Fund Association Pakistan (MUFAP), AUMs at the end of September 2024 amounted to Rs 3.04 trillion.

However Rahman believes that transferring funds all of a sudden towards wealth management products can be risky however it is an option nevertheless.

Another way to go about could be using pay orders. “When a pay order is issued, the funds are transferred from the customer’s deposit account to the bank’s central payables account, which is not categorised as a deposit,” explained a senior banker. “Since the ADR tax is calculated based on deposits, this manoeuvre allows banks to artificially lower their deposit base, effectively reducing their tax liability.”

The ADR dilemma

The ADR has been a contentious issue for the past couple of years. Very basically explained, a bank’s business is to accept deposits from customers and lend funds to other customers. But over the past few years, the interest rate in Pakistan has been so high that banks have found it easier to accept deposits compared to lending money.

So what do the banks do? They lend to the one entity that does constantly need money no matter what: the government. This proved a pretty good system for the banks which have been making huge profits. But the government felt this was bad business. In a bid to force banks to lend more rather than just buy government-backed securities, the government placed an additional tax on any bank with an ADR lower than 50% in 2022. ADR is basically advances (lending) divided by deposits. Banks had to pay a 10% additional tax if the ADR is between 40% and 50%, a 16% additional tax if the ADR falls below 40%, and no additional tax if the ADR is above 50%. This additional tax was applicable on income from federal government securities.

This was seemingly a way to encourage banks to lend more and encourage business at a time when the economy has been in the doldrums. But a lot went down behind the scenes, and the banks were able to window dress their accounts to avoid these taxes despite successive finance ministers doubling down on it. That is why the policy did not last too long. In 2023, banks were exempted from this tax as announced in the fiscal year 2024 budget, so that banks had enough liquidity to lend to the cash-strapped government.

The banking sector had high hopes that this tax would be eliminated for fiscal year 2025 as well. However, contrary to the hopes of the sector, in the budget, the government stayed mum on the ADR-based tax and did not eliminate the tax for the fiscal year 2025.

But that does not mean that the sector did not retaliate. In weeks prior to the announcement of the budget for the fiscal year 2025, As per the report by Dawn, the Pakistan Banks Association (PBA) had remained engaged with the finance ministry and the FBR on the ADR-linked taxation and other levies on the banks.

Other tactics to avoid ADR tax

More recently, Askari Bank took its grievances to court. On November 11, ProPakistani reported that Islamabad High Court has barred the Federal Board of Revenue (FBR) from recovering income tax from Askari Bank based on the calculation made by the tax department for prescribing the tax rate based on the gross advances-to-deposit ratio.

Askari Bank’s counsel argued that the FBR’s approach—taxing income derived from investments in federal government securities based on the gross ADR—exceeded its constitutional authority. By doing so, the FBR is effectively attempting to regulate banking practices through taxation, a move the petitioner claims violates Article 73 of the Constitution. Moreover, the counsel further contended that the imposition of the tax is retroactive in nature, as it targets investments in federal government securities that have not yet matured during the financial year and the tax chargeable in relation to such investments could not have been enhanced and made applicable retrospectively.

“The FBR’s approach makes no sense—they can’t regulate banks this way,” opined Rahman. “This is a balance sheet item. Tax should be imposed on income, not on balance sheet figures. Taxing balance sheet unprecedented—not just in Pakistan, but globally. Taxes are always levied on income, not on balance sheets”, added Rahman. It is worth noting that the banking sector is already one of the highest tax-paying sectors in the country.

On the other hand, some banks have turned to lending to State-Owned Enterprises (SOEs) and orgainsations where loans are directly or indirectly guaranteed as a strategy to meet regulatory requirements without risking their capital.

For instance, UBL provided over Rs 200 billion in loans to the Pakistan Agricultural Storage and Services Corporation (PASSCO). This move helped UBL successfully meet the 50% ADR requirement, allowing the bank to avoid additional taxes while supporting a key government entity.

Similarly, as per a report by Dawn, Trading Corporation of Pakistan (TCP) got Rs 360 billion financing from banks at KIBOR minus 11.9 % which means that TCP raised financing of Rs 360 billion at four per cent.

“Banks are supposed to function as intermediaries, but instead of lending to corporates and small businesses, they are increasingly lending to the government and state-owned enterprises (SOEs). These are all tactics designed to counter the ADR tax,” remarked an industry source. “I believe government-guaranteed loans or loans to SOEs should not be counted as part of advances in the ADR tax calculation. This would give a clearer picture of how much lending is actually going to true corporations and SMEs.”

This issue is not new. Back in 2022, when the ADR tax was to be implemented for the first time, instead of increasing lending to the private sector, the banks lent money to development finance institutions because they are less risky.

Profit has extensively covered this issue. Read: Pretty outside, ugly inside: How Pakistani banks window dressed their books to avoid new taxes

“The banks are doing everything except for lending to the private sector because they are comfortable with making easy money”, lamented a senior banker.