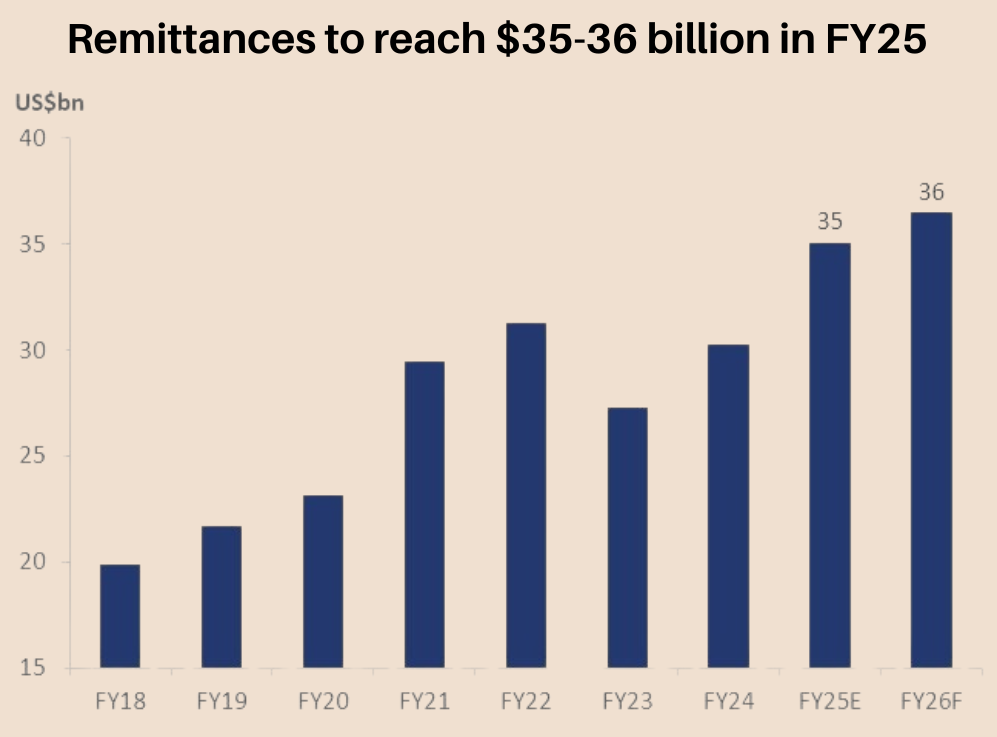

Remittances sent by Pakistanis working overseas are expected to reach $35-$36 billion by the end of the ongoing fiscal year 2024-25, according to the data compiled by Topline Securities.

This will be a boost of 16% YoY from the remittances received during the previous fiscal year 2023-24. According to data from the State Bank of Pakistan (SBP), workers’ remittances clocked in at $30.3 billion by the end of the last fiscal year.

Worker remittances surged 24% year-on-year (YoY) to reach $3.052 billion in October 2024, from $2.463 billion in the same month last year.

Remittances continue to play a pivotal role in bolstering Pakistan’s external account and stimulating economic activity, while also supplementing the incomes of households dependent on these funds. The World Bank in its recent report, “Migration and Development Brief 40”, projected Pakistan’s worker inflows to reach approximately $30 billion in 2025.

However, Topline Securities said remittances are expected to reach $35-$36 billion. This strong momentum is on the back of stability in the Pakistani rupee and higher export of manpower in the last 2-3 years.

Official data from the Bureau of Emigration and Overseas Employment reveals that nearly 10 million Pakistanis have emigrated over the past 17 years. Since 2022, the emigration rate of highly skilled professionals has increased to 5%, up from the previous rate of 2%, while the proportion of highly educated emigrants has remained consistent at 3%.

Over the past two years (2022-2023), the majority of emigrants have been blue-collar workers and laborers, with 37% categorized as skilled workers and 46% as unskilled laborers.

Foreign worker remittances have grown by 35% year-on-year (YoY) to $11.8bn in the first four months (July-October) of FY2024-25, led by strong growth from UAE, Saudi and UK markets by 56%, 37% and 39%, respectively.

From the United Arab Emirates, inflows increased by 10% month-on-month, reaching $620.9 million, with a 31% jump compared to October 2023.

Inflows from the United Kingdom were $429.5 million, showing a slight 1% increase from September and a 30% year-on-year improvement.

Remittances from the European Union saw a minor month-on-month dip, standing at $359.1 million, while inflows from the United States reached $299.3 million, reflecting an 8% increase.

This growth in worker inflows is attributed to a stable exchange rate, a narrowing gap between open market and inter-bank rates, the expansion of digital payment options, and an increase in workers relocating abroad, particularly to Gulf Cooperation Council (GCC) countries.