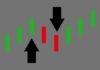

When Ittehad Chemicals Ltd (ICL) released its calendar-year 2024 results this week, the headline numbers looked deceptively flat: revenue was broadly unchanged at Rs24.3 billion. Yet behind the still-water line lurked a decidedly choppier earnings story. Net profit slid 24% to Rs1.39 billion and earnings per share dropped from Rs18.26 to Rs13.86 as gross margin narrowed from 21% to 20%.

Management placed the blame squarely on energy costs. A presidential ordinance issued on 30 January 2025 and subsequently converted into law imposed a five-per-cent “off-the-grid” levy on the already-inflated price of natural gas and RLNG consumed by captive power plants (CPPs). At the same time, the Ministry of Energy raised the gas tariff for industrial CPPs by a further 23% in March under International Monetary Fund pressure. For ICL, which has historically relied on its own 35 MW gas-fired plant at Sheikhupura, the new regime inverted the cost equation: it is now cheaper to buy power from the Lahore Electric Supply Company (LESCO) than to self-generate.

ICL has therefore shifted the bulk of its demand to the grid, operating its captive plant only during peak hours when grid outages threaten production continuity – a move the company confirmed during its post-results briefing. While the switch mitigates the immediate gas levy, it drags profitability because grid electricity incorporates capacity-payment surcharges designed to underwrite Pakistan’s oversized generation fleet. The twin forces explain why Ittehad’s gross margin deteriorated even further to 17% in the March 2025 quarter despite a 26% year-on-year rise in quarterly sales. The content in this publication is expensive to produce. But unlike other journalistic outfits, business publications have to cover the very organizations that directly give them advertisements. Hence, this large source of revenue, which is the lifeblood of other media houses, is severely compromised on account of Profit’s no-compromise policy when it comes to our reporting. No wonder, Profit has lost multiple ad deals, worth tens of millions of rupees, due to stories that held big businesses to account. Hence, for our work to continue unfettered, it must be supported by discerning readers who know the value of quality business journalism, not just for the economy but for the society as a whole.To read the full article, subscribe and support independent business journalism in Pakistan