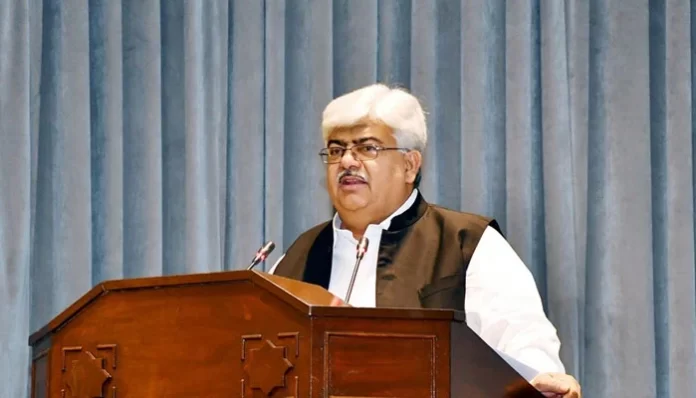

Chairman of the Federal Board of Revenue (FBR), Rashid Mahmood Langrial, affirmed that the government will not reverse the new legislation disallowing 50% of expenditure for cash sales exceeding Rs200,000 per transaction.

The law, passed through the Finance Act 2025, was implemented from July 1, 2025, and applies to “Income from Business,” as defined under Section 18 of the Income Tax Ordinance, 2001.

According to media reports, Chairman FBR clarified that while the National Assembly and Senate Standing Committee on Finance approved the law, it could only be revised in the next Finance Bill for 2026-27.

Senate Standing Committee members, including Senator Mohsin Aziz, expressed concerns about the law’s impact on businesses, with Aziz describing it as “anti-business.” He suggested that many in the business community would feel the negative effects of this legislation.

In response, Langrial stated that the government is pushing toward a cashless economy, emphasizing that sales beyond a certain cash threshold should be discouraged.

Senator Sherry Rehman criticised the new provision, calling it a “draconian law,” and noted that the Pakistan Peoples Party opposes it. Despite these objections, the FBR chief defended the law, stressing its alignment with the government’s long-term goals.

In the same meeting, Langrial assured the committee that the FBR had not been used for political victimisation, refuting claims of pressure from high-ranking officials to target political figures. He explained that the FBR has firmly separated itself from political influence and warned tax officials that any attempt to exert such pressure would result in immediate suspension.

The committee also addressed a case raised by Senator Afnanullah Khan regarding harassment by FBR officials over tax demands for an incomplete project. Langrial pledged a swift resolution and emphasised that any official found guilty would face appropriate consequences.

Senator Mohsin Aziz raised concerns about the frequent reopening of taxpayer cases, to which Langrial responded that tax officials were instructed to collect only the correct amount of taxes, not additional taxes.

The meeting also touched on the status of barter trade between Pakistan and Iran, with officials noting that the Commerce Ministry had initiated discussions based on mutual understanding. The final arrangements will depend on approvals from both FBR and the State Bank of Pakistan (SBP).