When Government of Pakistan opened its telecoms market to private sector 13 years ago, the country saw a massive inflow of foreign investment. The new players spent heavily ($4 billion in fiscal year 2006-2007 alone) for buying licenses, building infrastructure, and acquiring customers and became the largest media advertisers – even forcing the big budget consumer goods companies to compete for a slot in the prime time transmission.

Fast forward to April 2014, the country embraced next-generation mobile broadband technologies 3G and 4G. A broadband explosion hit the country, and so did disruptive technologies, throwing the incumbent out of its comfort zone and stagnating its revenue growth – that, too, when all companies were well and truly engaged in a tooth and nail fight in a hypercompetitive market where taxes are high, tariffs low, and even pennies matter.

Telecom revenues down

In fiscal year 2017, the telecom sector’s revenues grew by a meager 1.5% to Rs464 billion compared to the preceding year’s Rs457 billion, but data revenue hit an all-time high – to Rs140 billion (approximately), up 40% from Rs99 billion of the corresponding year.

To look at it from a different angle, data now accounts for 30% of industry’s total revenues, up from 21% of the previous year. However, this growing usage of data is not translating to growth in overall revenues. Worse still, operators are forced to invest in infrastructure to cater to the growing demand for data – the industry has spent $1.3 billion in acquiring additional spectrum and upgrading of network in fiscal years 2016 and 2017.

Much like their counterparts in other countries, Pakistani telcos have been looking for new revenue streams for quite some time to deal with stagnation in revenues and dwindling profitability. But never before has the need to reinvent been greater than now when the juggernaut of over-the-top (OTT) services, the likes of WhatsApp, Viber, Facebook Messenger and Skype, have squeezed the margins of traditional players even further becoming an existential threat to them.

Hence, in a rather radical move, Jazz has become the first operator in the country’s $4 billion plus industry to take the bull by the horns.

Jazz’s plan is in line with the global strategy of its Dutch parent Veon (formerly VimpelCom), one of the world’s top 10 telecom operators, which has decided to expand beyond telephony and data to compete with disruptive technologies eating into its market.

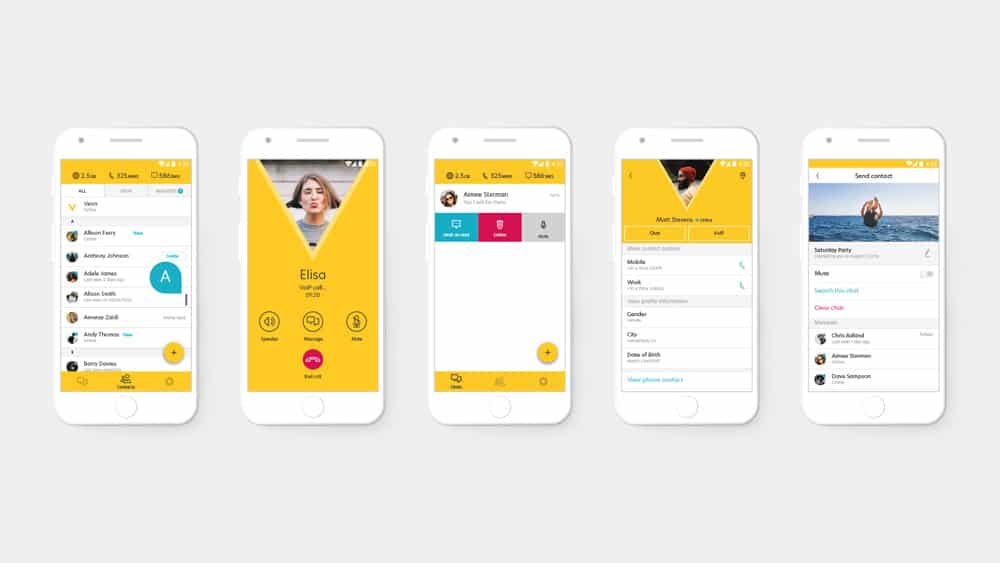

In an attempt to reinvent itself as an internet platform, Pakistan’s largest telecom company just launched its OTT app, called Veon – fifth in the 12-market universe of Veon.

The company says it is not a single app like WhatsApp but a personal internet platform to do almost everything using one’s mobile phone like news feeds and self-serving mobile topups and cellular bill payments. Going forward, it will also include peer-to-peer and business payments as a mobile wallet will be integrated into it, which will allow 3 million active JazzCash users to shop, pay utility bills and make various other payments from within the app. To be precise, the company aspires to be what WeChat is to China and it has already played the first ace up its sleeve by offering Veon ‘for free’.

“All a customer needs to do is be in the coverage area [close to a mobile tower] and he can use Veon, even if he has zero credit on his SIM,” Jazz’s CEO Aamir Ibrahim told Profit during his recent visit to Karachi while unveiling the strategy.

Whether ‘free’ or paid for and on the path to its success what obstacles lie in ambush, we will come to that later. First, some background on why Jazz is venturing into the OTT space and its implications for the industry.

Kill the attacker or get killed

Sporting a white shirt under his navy blue jacket, Veon’ logo placed on its lapel, Ibrahim, the Jazz supremo, told Profit “we are not going to be in the do-nothing category”, as he refers to the threat of OTTs.

“Traditional telcos have made money mainly from voice but didn’t do any innovation except the SMS, but OTTs did that and surpassed us in that space,” the CEO said. “It’s not about being bigger, it’s about being better,” he said referring to the need for introducing the personal internet platform play.

However, Jazz’s entry into the OTT space not only raised eyebrows but also resulted in fears in some quarters that it might have serious implications for the entire industry.

In a recent article, Profit has already reported how jazz, which has become a significant market player, accounting for nearly 40% of the telcos’ revenue, is using its economic muscle combined with an aggressive sales strategy to shake up the market.

Veon has turned out to be its most aggressive move since Jazz customers don’t have to pay anything to use Veon, but those of Telenor, Zong and Ufone will have to pay for data packages to their respective service providers to avail free instant messaging, group chat, voice calls and other features the app is offering.

The company already boasts 52.6 million customers, which is 13 percent higher than the entire customer base of Zong and Ufone put together, and if Veon clicks, it may lure users from other networks to buy Jazz SIMs, resulting in a further squeeze on the margins of its competitors who still rely on voice and text as the bread and butter of their business. On the flip side, it may also dent Jazz’s own revenue because its users’ telephony needs are met with by Veon without spending a penny – voice and text still account for 75% of Jazz’s sales.

Though Jazz has taken the lead in OTT space, the industry seems to be divided over the threat this particular monster poses and on how it should be fought. Some argue Jazz’s latest move to offer free voice and instant messaging can be self-destructive for the entire industry.

For example, Zong, the Chinese telecom giant that sits atop huge cash reserves, has responded with an equally aggressive move. In an obvious answer to Veon, it has just announced to give its data subscribers free and unlimited access to all WhatsApp services on all networks anywhere in the world.

A rather spoilsport move which might be enough to ensure Veon’s doom but at the same time will accentuate the threat that OTT’s like Whatsapp pose to all telcos including Zong. In other words, the ‘race to the bottom’ price wars that brought telcos to their current situation are entering yet again a new, and potentially highly dangerous era.

“Telcos in Pakistan still have a breathing space because voice and text presently account for up to 70% of the sector’s revenues,” said a senior telco official from outside Jazz’s orbit requesting anonymity. The market is still far from ready for such an aggressive move, especially because there is a dearth of content to engage users, let alone monetize traffic, he said, adding, “The industry should collaborate on this subject rather than one company going it alone.”

“This is certainly a big threat for competition and they must be planning their moves at the moment,” says Parvez Iftikhar, member of an Islamabad-based ICT think tank. He, also forecast that other telcos will also venture into the OTT space – though presently there aren’t any signs of that happening.

For example, Telenor, the second largest operator in the country, has floated many apps from payments, to lifestyle to create a digital ecosystem, but it hasn’t yet shown any signs of venturing into the OTT space. Ditto for Zong and Ufone.

“We are fully aware of the growing needs of our customers and constantly innovating to cater to those,” said Telenor Pakistan’s statement. The company says it is working closely with the government and other stakeholders towards digitalization, stressing it wants to not only serve the high-end users but also empower a large chunk of the population through basic telecom and digital services and platforms.

Based on feedback we got from other stakeholders, it is evident the industry is not on the same page on whether OTTs are an immediate threat or one to watch out for. However, one thing is clear: Jazz is not willing to wait. Ibrahim admits they might become less relevant as a telco but believes that for their customers, they will be more relevant as digital lifestyle partners of their customers. “If we didn’t become an OTT, WhatsApp would kill us. The risk of not taking this risk is much higher.”

To put Ibrahim’s statement in perspective, mobile virtual network operators also called OTTs – a mobile operator that doesn’t own spectrum or have its own network infrastructure – are disruptive technologies, which serve consumers of traditional networks bypassing controls. They are unlicensed providers of services similar to those provided by the incumbent (text and voice) but pay no taxes, nor share revenues with the network operators. What rubs it the wrong way even further, traditional operators have to make significant investments in upgrading their networks to cater to the increasing volume of data (big data), consumers of these services end up generating through their network.

The OTT threat has become so evident that leading research firms, the likes of McKinsey and Citi have published reports calling for executional efficiencies to avoid being displaced by OTTs entering the core telco market with innovative business models and technologies. According to a research by McKinsey & Company, the OTTs share could be as high as 60% of messaging and 25% of voice revenues by just next year.

The global research giant says Telcos have to choose between investing to become digital players or merely serve as “dumb pipes” for these digital players.

These disruptive technologies are not going to stop at mere instant messaging and voice calls. As one pounds the keyboard to finish this report and meet the deadline, WhatsApp is in the process of a possible move into online payments in India, its biggest market with over 200 million monthly users or a fifth of its total user base.

What exactly is WeChat?

On the other hand, WeChat, the Chinese home-grown OTT app, has become the largest app of its kind in the world valued at $40 billion. In addition to instant messaging, group chats, video calls and sharing of large files, its users can do almost anything — play games, pay bills, transfer money, read news, order food online, pay bills at grocery stores, and buy movie tickets and foreign trips without leaving the app. The app, which also has a business-oriented chat service, is touted as Chinese version of Facebook, for it has become the hub of all internet activities in China and may eventually steer the country towards a cashless economy – presently, half of the internet sales in China are made through mobile phones.

Veon is aspiring to become Pakistan’s WeChat but that is easier said than done. Assuming they are able to defy the odds that are stacked against them and achieve a WeChat like status and market penetration, industries other than Telco should be worried.

It can be argued that WeChat owes its success to the barriers to entry present in mainland China vis-a-vis ‘The Great Firewall’ that block most major western social media apps.

But Tencent, the holding company of WeChat has done much more than simply taking advantage of China’s strict internet firewall, it has created a mobile phone universe within one app for its users. Messaging and social media may be the core element of WeChat but its usability in terms of ecommerce and gaming is what really takes the cake.

Simply put WeChat is at every point of your daily contact with the world, from morning until night. Shopping, transferring money, playing games, interacting with other users is all done through a singular app and and increasing number of WeChat users have dropped the conventional way of handling their money – it is all done through the app.

Veon has similar ambitions to emulate WeChat and if it is able to do so it can disrupt industries such and banking and retail in one stroke. Not only that, conventional advertising platforms like print and electronic media should be worried as well.

The targeted delivery of their marketing campaigns on cellular devices means a reach that cannot be duplicated by current advertisement outlets. Forget bulky billboards, flashy TV ads and print ads (already dwindling).

Imagine getting an ad on your Veon app news feed about the latest line of Nishat Linen, share it immediately with your friends, discuss the designs, choose an item, pay for it, get it delivered, wear it and post a picture of yourself on your timeline – full circle all through one app. That’s multiple huge industries whose work will be done on a mobile phone in a matter of minutes without the user having to leave the comfort of their home or even on the go.

Most radical overhaul to date

It was little surprise then when Veon announced last year it was weaning itself from shrinking revenues from traditional business (basic telephony and data) to focus on becoming a personal internet platform – this is the most radical overhaul to date in telecom history, according to a report by Reuters.

Being one of its top five markets, it was only natural for Jazz to follow footsteps of its parent company – about a fifth of Veon’s revenue comes from Pakistan operations. But, the question remains, can it become the WeChat of Pakistan and help Veon achieve its ambitious target of becoming an internet giant?

According to Ibrahim, Jazz initially aims to build a critical mass of customers and leverage its large user base for contextual marketing – that is marketing the right product to the right customer in the right context and in the right location.

For example, if a customer who previously searched for or visited McDonald’s is close to one of its outlets, he may get an alert from that outlet saying how about 20% discount on a meal. This is what analytics can do by tracing customer’s location and tracking his search history etc, similar to what Amazon does.

“We have a bigger chance of success because of a large customer base and that’s where Veon also comes into play,” the CEO said.

According to Ibrahim, it doesn’t make sense to spend Rs50 million for a billboard on Shahrea Faisal when one can reach the target audience with a more clinical approach. When advertisers will see a large number of customers online on Veon, they will advertise with the company – this is precisely what they are targeting.

“I think it’s a good bet because data is the next oil,” said Iftikhar, the ICT expert. “Big data analytics facilitate marketing ease of finding the right audience for your product, the likes of social media giant Facebook are doing it already.”

Iftikhar believes big data has a valuable proposition for Jazz. “Even if they use it for their own research, they will benefit a great deal from it while using it for advertising has immense business potential,” he said. Business to business (B2B) is another untapped market, which they can cash in on using their app, he said.

They are focused on building an engagement platform, but the main idea is to build bigger community of Veon customers in Pakistan – the benchmark to measure success.

The internet hub of Pakistan?

While there is big data at play, Veon is not restricting it to contextual advertising alone. The company has not publicly disclosed its plans other than use of big data analytics, but our sources say it is gearing up to become the hub of all internet activities in the country, just like what WeChat is to China. And In Ibrahim’s own words, the company is not worried about how much money goes into achieving that target. Doesn’t make sense to just get a share of the advertising market. Does it?

According to people familiar with the matter, the company has spent in excess of $100 million as part of the launch evident enough from a lucrative launch ceremony in Lahore, a nationwide ad campaign, and promotions like free nuggets pack from McDonald’s and Rs3000 worth of credit for shopping at ChenOne, a highend chain of fashion and home accessories, available to all those downloading the Veon app.

It has just partnered with Daraz.pk, the largest e-commerce store in the country, for title sponsorship of the week-long Black Friday event, starting today (Monday, November 20). Though investment figures are not known, there will be special promotions available for Veon – another attempt by the company to lure more users to its app.

Unlike WhatsApp taking eight years to plan entry into payments, Veon Pakistan is already working on its mobile financial services arm JazzCash to integrate its 3 million mobile wallet users for peer-to-peer and business payments – a $150 billion untapped market where 99% transactions are processed in cash.

Besides mobile payments, the company is also reported to be working on developing gaming and music studios for Veon. It is also working on developing a media property that will generate news content for Veon users. Simply put, Jazz is trying to make Veon a personal internet platform for users who can do everything with a few taps without ever having to leave the app.

“I think Jazz is in a good position to invest because of recent divestment of their mobile towers which brings them a lot of spare money,” Information and Communications Technology expert Parvez Iftikhar said of the recent Edotco deal that would fetch Jazz $940 million in proceeds.

One of the emerging markets on Morgan Stanley Capital International’s investment index, Pakistan is home to 135 million millennials, which means two-thirds of its 207.8 million population being under the age of 30. According to the latest Pakistan Telecommunication Authority report, there are 55 million smartphone users in the country where telcos cover 85% of the population.

These numbers indicate Veon’s bet is certainly not without a reason, for it could not afford to ignore the market, which contributes 20% to its global revenue. However, achieving the end goal may turn out to be an uphill task, for it is not the only player eying a slice of the OTT pie.

“As the overall digital market grows – an additional billion middle-tier customers for telcos, mainly in emerging markets, is expected by 2025 – the door for new OTT entrants is opening,” McKinsey & Company said in a report earlier this year.

We’ve got company

To put this report in local perspective, WhatsApp may not be the only threat Veon has to deal with as Tello Talk, Pakistan’s first home-grown OTT app that aspires to become the country’s national messenger, is another promising contender for the OTT segment.

Four months into the launch, the app is close to 100,000 installs already that going by the management’s claims have come without a single ad dollar spent. Tello has a four plus (4.3) rating on Play Store, but has over 70% retention rate and its users log in to the app four to five times a day and have one-minute sessions on average – the app hasn’t even added the voice calling feature yet.

“These retention and engagement rates are quite impressive, especially because it is all organic,” said Shahbaz Jamote, CEO Tello Talk and Country Manager for Tilism Technologies, which has previously been running M3 Technologies, the pioneers of mobile value-added services in the country. Though it still remains an unknown entity in the industry, Jamote expresses his satisfaction since they have achieved these stats without any advertising dollars.

Though WhatsApp is the most popular OTT app in Pakistan with an estimated 12 million users in the country, the market is very much open for new players. Both Veon and Tello are still very new and it will be too early to comment which one will fare better. However, what Profit has learned from studying business models of both is that the two have different approaches towards the market.

If one studies the business model of Tello, it can’t be ruled out. The app is following a broader regional trend whereby locally-grown OTTs have done exceptionally well even against WhatsApp. For example, LINE, Kakao Talk, WeChat, and Hike are the national messengers of Japan, Korea, China and India respectively. All of them are home-grown and placed an early bet on OTT, that is even before WhatsApp established itself as a global giant.

Other than the early entry into the OTT market, in some cases, like China, they have benefited from the regressive regulatory regime that restricted WhatsApp. But all said one can’t deny these local OTTs have made it big because of their familiarity with their respective local markets.

Take, for example, Hike, which is best known for its 15,000 stickers across a wide range of local dialect that allow users to share images including those of Indian festival greetings to Bollywood celebrities, cricketers and even Game of Thrones characters. Its users send each other over 300 million stickers a day, in addition to the 40 billion text messages shared on the platform.

If numbers from Hike are any indication, its consumers use the app mainly for instant messaging, often through sharing these stickers rather than typing tedious messages. That also explains why Tello is more focused on messaging rather than introducing the voice calls. Some of the stickers on Tello include classics like Mustafa Qureshi’s famous dialogue ‘Nawaan Aya Ain Soneyaa…’ while others are inspired by famous social media memes like ‘Kaisa Diyaa? Hain?’, which is attributed to controversial show host Amir Liaquat Hussain.

“I think Tello or any other OTT app has a definite chance of eating into telcos market share,” Iftikhar, the expert, said adding, “It is happening all over the world as a lot of small players, especially mobile virtual network operators (MVNO) are doing well in their respective markets.”

By contrast, Veon is not a localized app and has much work to do if it has to strike a chord with public. Given Veon’s bet is on creating an engagement platform, it is also where it has its biggest risk. For example, Japan’s LINE also came to Pakistan, spent huge money and acquired 7 million users, but then they faded away because they tried to replicate a Japanese app in the Pakistani market. China’s WeChat, on the other hand, didn’t take any chances so they bought stakes in Hike instead of entering Indian market directly.

Veon was trending at number one on top charts at Play Store in the third week of its launch and already had 1 million installs, which the company sees as an overwhelming response. Though it has since doubled users to 2 million, the app slipped to number 3 on November 16 with 26% of the total (12,023) customer reviews giving it a rating of 3 or below – the company refused to share details of engagement and retention rates.

The app also has some bugs and glitches, as evident from reviews on its Facebook page and users we spoke to. However, the company is aware of it and working to improve it. In the CEO’s words, “if you have launched a perfect app, you are too late”.

The company is heavily marketing Veon as a free app, but it may cost them on other services. That is the app will consume data if a user is on a package and may not be able to use internet for services other than Veon once he has consumed his data limit.

That said, it also has an edge over competition. For example, Jazz is the local partner of Veon, which means the network quality for Veon to Veon call on Jazz network could be made better than that of WhatsApp to WhatsApp call. However, to ensure better network quality for Veon, specially as the country’s overall internet quality improves, the company may have to take a rather unethical approach by violating the concept of Net Neutrality – Net Neutrality is a basic principle that prohibits a significant market player like Jazz from speeding up or slowing down or blocking content, applications or websites their users may want to use.

Though a possibility, they may not exercise this option because Ibrahim doesn’t seem to be bothered about the dominance of WhatsApp in the market.

“When Blackberry messenger service was popular, who would have thought WhatsApp could click, but it did,” Ibrahim said. He, however, added Veon could become an alternate engagement platform as people might not necessarily link to a single app.

Responding to a question about a possible competition from Tello, the Jazz chief said there are many WhatsApp equivalent things in the market, but what’s important is whether they offer any value proposition to the customers.

“The market is still in a nascent stage, with room for growth for everyone,” Jamote of Tello said referring to the 2015 U.S. Mobile App Report, which says smartphone owners use up to three OTT apps on their devices. “We believe many more OTT players will come, some will close, others will thrive; only experience building will differentiate path because user will dictate what it wants,” Jamote said.

Besides competition, Veon may also face regulatory challenges, if recent developments are any indication of that.

Currently, India’s Bharti Airtel is lobbying for ‘same service same rules’ to press their regulator to introduce same rules for OTTs and telcos. There are reports of China restricting WhatsApp – and PTA is also considering its options.

“PTA aims to continuously undertake initiatives such as revision of the licensing framework, spectrum refarming, regulating the OTT Services under the Telecommunication Policy 2015,” the regulator said in its latest annual report. “PTA is in the process of hiring an international consultant to assist PTA in devising the best possible licensing framework. The revised licensing framework will also consider the regulation of OTT and VoIP services that are increasingly replacing the traditional voice communication,” it said.

Earlier this month, the government also warned official circles to avoid using WhatsApp and other OTT services, which sends customers data to remote servers listed abroad – something Veon should watch out for because its customers’ data may also be sent abroad as per their consent form.

“Currently, there is no clarity on how to regulate OTTs and whether they should be regulated or not,” an official said referring to PTA’s stance on the subject. He, however, added the regulator would like to encourage local developers since there aren’t many in the country.

——Additional input from Mohammad Farooq

Sorry, Mobilink seems to have spent millions on an app that crashes when you add channels and is in English in an Urdu speaking country. Seems like a bad start.

Brilliant 360 view in a concise article!

Excellent article. Insightful. Just a bit repetitive. But felt like reading something from an international level magazine. Proud to see such Pakistani writers who do thorough research.

[…] per a report by Profit in a recent article, data now accounts for 30% of industry’s total revenues, up from 21% of the previous year, but […]

Comments are closed.