KARACHI: The Board of Directors of Bank AL Habib Limited (the Bank) announced the financial results of the Bank for the half year ended 30 June 2018.

As per the results, the Bank declared a pre-tax profit of Rs7.08 billion for the half year ended 30 June 2018 as compared to Rs7.52 billion for the corresponding period. Profit after tax for the half year ended 30 June 2018 was recorded at Rs4.20 billion against Rs4.41 billion for the corresponding period last year. Bank’s profit (excluding capital gains) grew by 35.36 per cent compared to the corresponding period last year. Earnings per Share (EPS) of the Bank were recorded at Rs3.78 per share.

The Bank’s total assets increased by 9 per cent reaching Rs1 trillion as on June 30, 2018, mainly due to the expansion of Bank’s loan book by Rs105.34 billion, standing at Rs445.17 billion as on June 30, 2018, showing growth of 31 per cent in net advances, compared to the last year end.

Advances to Deposits Ratio (ADR) of the Bank stands at 59.45 per cent. The Bank has improved its market share in terms of the loan book.

Prudent financing strategies and sound risk management policies of the Bank resulted in a decrease in non-performing to gross advances ratio to 1.13 per cent as at June 30, 2018, as against 1.52 per cent as on December 31, 2017. The coverage ratio of Non-Performing Loans is also increased to 145.54 per cent as at June 30, 2018, from 144.32 per cent on December 31, 2017.

The Bank maintained long term and short term rating at AA+ (double A plus) and A1+ (A one plus). The ratings reflect the bank’s sustained performance, high quality assets, satisfactory financial profile and healthy liquidity.

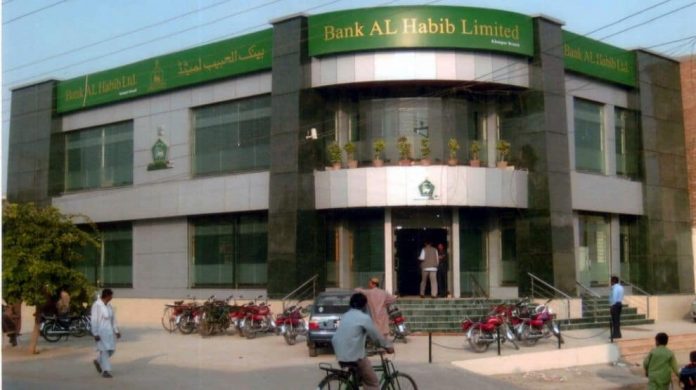

The deposits of the Bank increased by 8.12 per cent as compared to December 31, 2017 reaching Rs748.80 billion as on June 30, 2018. The Bank continued with its strategy for outreach expansion – adding significant branches every year. The Bank’s branch network has now reached 685 branches/ sub-branches having coverage in 259 cities of Pakistan and 3 branches and 4 representative offices outside Pakistan. In line with the Bank’s vision to provide convenience to customers, the Bank is operating with the network of 787 ATMs across Pakistan.