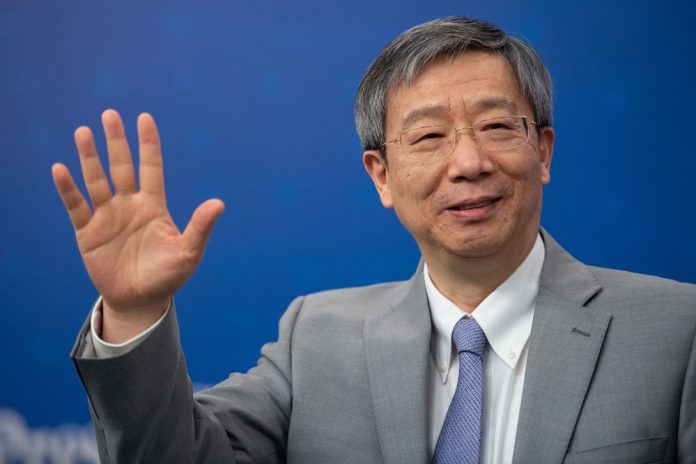

BEIJING: China and the U.S. have reached consensus on many “crucial” issues and and have discussed the need to observe the “autonomy” of each other’s monetary policy, People’s Bank of China (BoC) Governor Yi Gang said.

“The two sides discussed issues surrounding the yuan including the need to abide by previous commitments made by Group of 20 nations not to engage in competitive depreciation and to communicate closely on currency issues,” Yi said during a press conference in Beijing Sunday during the annual National People’s Congress. He didn’t say on which issues they had reached consensus.

The negotiators also discussed the importance of a market-orientated foreign exchange mechanism and the need to disclose information to International Monetary Fund standards, Yi said. He has been part of the Chinese team at the trade talks.

The issue of currency manipulation has become part of the ongoing talks to solve their trade confrontation, with the U.S. pushing for a pledge by China to not devalue its currency as a way to gain competitiveness or offset the effect of tariffs. China has said that any deal to end the trade spat should be “two way, fair and equal.”

The PBOC has “basically exited” daily intervention in the foreign exchange market, Yi said, reiterating the existing intention to keep the yuan “basically stable” at “reasonable equilibrium.” China will “never” use the exchange rate for competitive purposes, to increase exports or to solve trade disputes, he said.

The talks on foreign exchange have been “very meaningful,” and the yuan exchange rate formation mechanism is in line with G-20 standards and is decided by the market, Yi said, adding that he expects to reach more consensus in discussions with the U.S. on this. He didn’t say what he meant by that.

Looking at the comments as a whole, including Yi’s reference to continuing to use counter-cyclical measures, “it seems to me that there will not be obvious change on the yuan mechanism,” said Iris Pang, a Hong Kong-based economist with ING Bank NV.

The yuan has surged 2.3 percent against a basket of trading partners’ currencies this year amid optimism China and the U.S. are edging toward a resolution of their trade dispute. While a stronger currency helps rein in capital outflows, a sustained advance risks hurting a flagging economy that benefits from export growth.

Premier Li Keqiang reaffirmed on Tuesday the government will push to “improve the formation mechanism of the exchange rate” in his work report. That phrase reappeared after being omitted for two years in equivalent reports, a signal that currency reform may be back on the policy agenda soon.

China’s “prudent” monetary policy stance hasn’t fundamentally changed even as the central bank focuses more on providing support to the economy during a period of slowing growth, Yi said.

Prudent policy still means focusing on domestic conditions and giving more support to small and medium-sized companies, while balancing that with external factors, Yi said. The central bank will work to lower real interest rates to drive down the cost of borrowing for smaller and private firms, he said.

The PBOC has led a campaign since last year to support the struggling private sector by pushing banks to lend more. It has come up with multiple innovative monetary tools to add incentives to lenders, and economic data so far this year imply the work has showed some progress. The central bank has also cut the amount of cash that banks must keep in reserve multiple times, in order to inject cash into the economy.

“China still has some room to cut the required-reserve ratio, but this is much smaller than in previous years,” Yi said Sunday. “In China’s current stage of development, a certain level of RRR is necessary and appropriate,” said Yi, without specifying what that level is.

China “will gradually transition the reserve requirement ratio to three levels that differentiate between large banks, medium-sized banks and small banks, including rural credit cooperatives and rural commercial banks,” he said. “We are currently in the process of simplifying so that the RRR framework can be more clear and transparent.”

China’s overall debt ratio declined by 1.5 percentage points over the previous year in 2018, and the macro leverage ratio was 249.4 percent at the end of 2018, Yi said.