“Gold’s rallying because this monetary largesse will eventually have to be repaid and that payment may come as sudden higher inflation somewhere down the road.”

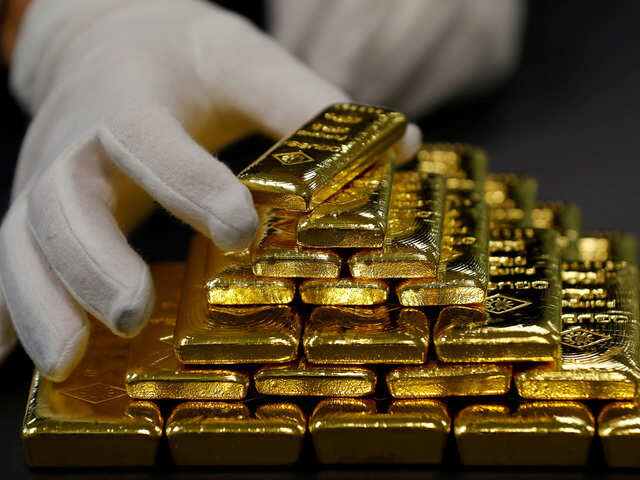

Gold prices surged over 2.5% to their highest in a month on Thursday after the U.S. Federal Reserve announced a massive stimulus to combat the economic toll of the coronavirus pandemic.

Spot gold jumped 2.5% to $1,686.85 per ounce by 1:31 p.m. EDT (1731 GMT), having earlier hit its highest since March 9 at $1,690.03. It has risen about 4.2% so far this week.

US gold futures settled 4.1% higher at $1,752.80. “The Fed unveiled yet another howitzer from its arsenal offering substantial relief to small and medium sized businesses as well as municipalities,” said Tai Wong, head of base and precious metals derivatives trading at BMO.

“Gold’s rallying because this monetary largesse will eventually have to be repaid and that payment may come as sudden higher inflation somewhere down the road.”

The Fed rolled out a broad, $2.3 trillion effort to bolster local governments and small and mid-sized businesses to keep the U.S. economy intact as the country battles the coronavirus pandemic.

Fed Chair Jerome Powell said the central bank will continue to use all the tools at its disposal until the U.S. economy begins to fully rebound from the harm caused by the outbreak.

Data showed the number of Americans seeking unemployment benefits in the last three weeks has blown past 15 million, with weekly new claims topping 6 million for the second straight time last week as the pandemic has abruptly grounded the country to halt.

More than 1.47 million people have been reported infected by the new coronavirus globally and 87,760 have died. “The economic impact of the pandemic is likely in any case to preoccupy markets for a very long time to come, even once the pandemic has eased,” Commerzbank analysts said in a note. “Gold is likely to profit from the unprecedented glut of central bank money and new debt.”

Also helping gold, the dollar fell 0.6%, en route to a weekly dip. Holdings of gold by ETFs rose in March to a record high of 3,185 tonnes, worth $165 billion, the World Gold Council said on Wednesday.

Major physical bullion hubs saw activity dwindle this week due to coronavirus-led restrictions, with strained supply chains cut off from soaring safe-haven demand in some regions. Elsewhere, palladium rose 0.2% to $2,179.13 per ounce, platinum rose 2.5% to $748.10 and silver rose 2.6% to $15.44 and were up over 6% so far this week.

Most markets will be closed for Good Friday on April 10.