ISLAMABAD: Business optimism in Pakistan witnessed a decline during the first three months of 2020, when compared with the fourth quarter of 2019.

The findings of the Dun & Bradstreet’s Business Optimism Index (BOI) for the first quarter of 2020 released on Monday shows that enforcement of Covid-19 lockdown in the third week of March had only intensified the deterioration in the business sentiments and sped up the shift from optimism to pessimism.

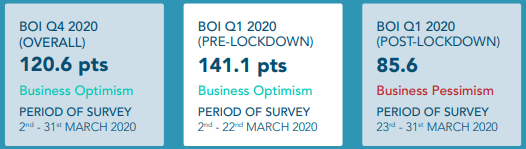

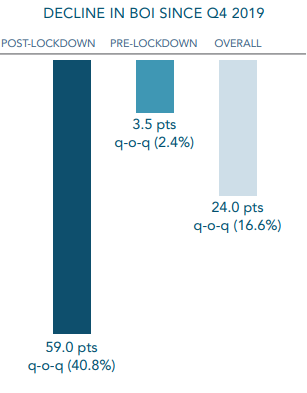

Before the implementation of the lockdown, the report says, the businesses were optimistic and hopeful that the pandemic would not affect Pakistan very acutely. Thus, only a marginal drop of 2.4 per cent was witnessed in the BOI during the pre-lockdown Q12020 when compared with the Q42019 BOI. However, after enforcement of the lockdown, Q12020 BOI dropped from a high of 141.1 points — the index level prior to the lockdown — to 85.6 points (below the benchmark neutral value of 100 points), indicating a significant shift in the business sentiments from optimism to pessimism.

Overall, the composite BOI stood at 120.6 points in Q12020 was down by 16.6pc from144.6 points in Q4 2019.

The BOI survey was conducted during Q12020 with companies spanning all sectors across Pakistan.

These included a mix of SMEs and large enterprises; representation from manufacturing, trading, and services sectors in proportion to their respective value-added contribution to the GDP.

Dun & Bradstreet launched its world-renowned BOI for Pakistan in Q42019 and has issued the second edition for the last quarter. The report aims to measure the pulse of the business community and provide an outlook of business sentiments in Pakistan.

The BOI for Q12020 represents mixed sentiments, collected both before and after the announcement of the lockdown in Pakistan. Since the majority of responses were captured before the lockdown restrictions, the Q12020 BOI issue primarily – at an aggregate level – reflects a pre-Covid-19 sentiment analysis.

The report discusses five key parameters for businesses, i.e. sales revenue, selling price, volumes sold, number of employees, and profits. At an overall level, businesses were optimistic for all the parameters for the upcoming quarter (Q22020). However, post-lockdown, there is a significant shift in business sentiments. Prior to the lockdown, 68 per cent respondents anticipated an increase in sales revenue and 62pc respondents anticipated increase in profits; however, post-lockdown, only 19 per cent respondents anticipated increase in sales revenue and net profits.

Additionally, prior to the lockdown, only three per cent respondents anticipated a decline in the number of employees; however, post-lockdown, this number increased sharply to 16pc.

As per the report, Exporters’ Optimism Index, at an aggregate level, stood at 116 points in Q12020 compared to 144.8 points in Q42019. Breakdown of results into pre-lockdown and post-lockdown revealed that the index stood at 134.8 points pre-lockdown and deteriorated sharply to 84.3 points post-lockdown. USA, UAE and Saudi Arabia were identified as top export destination for businesses.

In addition, 27 per cent of the businesses indicated that they are planning to export to new markets in future. Macro-economic concerns of inflation (44pc) and exchange rate fluctuation (34pc) were key factors hindering business growth in Q12020. Also, nine per cent of respondents reported COVID-19 related uncertainty as an emerging challenge among the businesses.

Nauman Lakhani, Country Head of Dun & Bradstreet in Pakistan, said, “The second issue of D&B Business Optimism Index comes at a time when businesses world over are facing unprecedented challenges in sustaining their operations due to prolonged closure, decreased demand and disrupted supply chains. This is the reason why a contrast can be seen in responses of business owners before and after the lockdown was implemented during the last week of March 2020.”

He continued, “We at D&B, through our global expertise in providing critical business insights, are helping Pakistani businesses in identifying and evaluating alternate business partners, vendors and customers so they can minimize the impact of current situation by establishing new relationships where their existing suppliers and customers are no more able to do business with them. We look forward to get in touch with more Pakistani businesses and help them explore new avenues for business amid the lockdown and its impacts.”