LAHORE: Despite the news about the anti-dumping duty on imported steel bars, the Pakistan Stock Exchange (PSX) failed to carry the forward momentum of the last week where the index posted a 5 per cent gain. Cement came to spoil the show and the sectors market capitalisation dropped approximately 4.15 per cent during the session.

While talking to Profit Capital Stake’s Research Director Maha Jafer Butt shared her thoughts saying, “The day remained divided between steels doing well after the National Tariff Commission determined anti-dumping duty on imported steel bars. The sector reacted bullishly with ASTL, MUGHUL and ITTEFAQ touching their upper circuit breakers.”

She added, “The cement sector, on the other hand, had got hammered and pulled the index lower, finishing flat”.

None of the 17 scripts traded could post any sort of appreciation. Lucky Cement Limited (LUCK) was down 4.88 per cent, Attock Cement (Pakistan) Limited (ACPL) lost 2.66 per cent, Bestway Cement Limited (BWCL) was lower by 4.61 per cent, D. G. Khan Cement Company Limited (DGKC -4.99 per cent), Cherat Cement Company Limited (CHCC -4.99 per cent) and Pioneer Cement Limited (PIOC -5.00 per cent) were floored. Fauji Cement Company Limited (FCCL -3.07 per cent) depreciated with its peers despite informing stakeholders through a notice to the exchange about the completion of rehabilitation works on Line 2 of 7200 TPD.

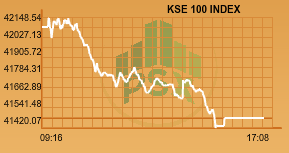

The benchmark KSE 100 lost 1.63 per cent during the day to touch its intraday low of 41,414.12. The index settled 604.35 points less than its previous close at 41,483.54. The KMI 30 index hit by the cement sector declined 2.44 per cent to 70,193.39 while the KSE All Share Index lost 349.40 points. The advancers to decliners ratio stood at 93 to 239.

The market volumes crashed down from 261.18 million of the last session to 153.47 million. Engineering sector was the top pick of investors and 31.61 million shares were exchanged in it. Amreli Steels Limited (ASTL +4.99 per cent), Mughal Iron and Steel Industries Limited (MUGHAL +4.99 per cent), and Ittefaq Iron Industries Limited (ITTEFAQ +4.90 per cent) all surged to days maximum possible price intraday.

Shifa International Hospitals Limited (SHFA 0.00 per cent) announced the execution of a memorandum of understanding with Fatma Properties Limited of Tanzania for the establishment of a hospital in Dar-es-Salam, Tanzania.

Highnoon Laboratories Limited (HINOON +4.63 per cent) conveyed to stakeholders that its wholly owned subsidiary has received regulatory approvals to manufacture 27 pharmaceutical products and has commenced commercial operations.

The company also declared financials for the quarter ended September 23, 2017. Sales contracted 2.44 per cent to Rs 1.45 billion compared to the last quarter. This resulted in a 3.42 per cent decline in net profits to Rs 1.52 million. Earnings per share stood at Rs 5.93 inch higher than Rs 5.04 of 3QFY16.