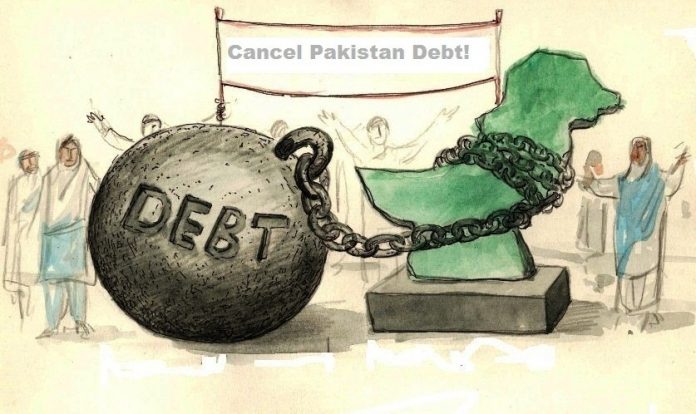

LAHORE: Pakistan joined the fray of six other nations susceptible to possible risk of defaulting on its debts as its credit-default swaps increased in October and are near its highest levels since June.

Interestingly, Pakistan hasn’t defaulted even once on its debts since independence in August 1947. Last week, Bloomberg reported about risk-premium on emerging market sovereign bonds decreased seven basis points to 295 basis points over US treasures, according to JP Morgan Chase & Co. Index.

Pakistan which is South Asia’s second largest economy has approached the IMF twelve times for loans since 1988. S&P Global Ratings in 2nd week of November categorized Pakistan among “fragile five” countries that remain endangered to a normalization in global monetary conditions.

Besides Pakistan, Lebanon, Egypt, Bahrain, Ukraine, Ecuador and Turkey stand at risk of defaulting on its debts, as all these nations are afflicted with external debt obligation issues.

The risk of default has been amplified by Venezuela defaulting on its debts last week, as money market managers hounded to find countries that could be prone to risk of default in future.

And Pakistan was among a host of other countries mentioned above were earmarked as potential candidates to defaulting on its debts.

Economic pundits and several media/print outlets have warned of Pakistan seeking another bailout package from the International Monetary Fund (IMF) since July due to deteriorating macroeconomic indicators.

World Bank in October forecast Pakistan’s external financing requirement at $17 billion for the current financial year, which is equivalent to 5pc or 6pc of gross domestic product.

Also adding pressure to the country’s economy are rising imports under China-Pakistan Economic Corridor (CPEC), which pushed current account deficit to more than double to touch $14.4 billion by end of September.