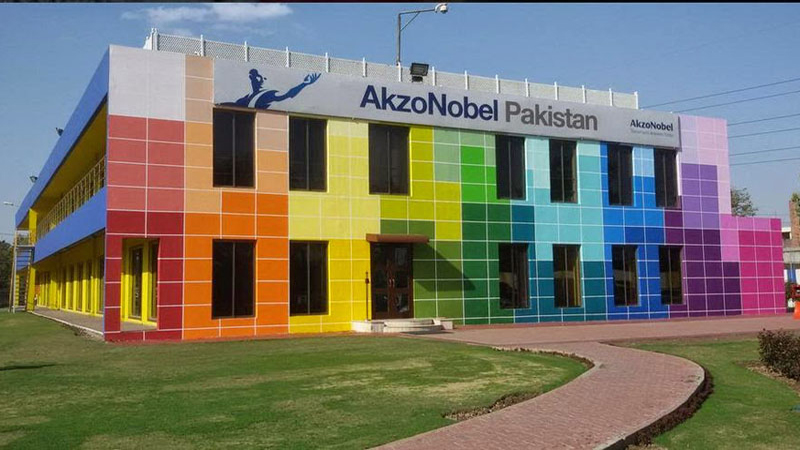

With a board meeting, a product launch and the company’s business review all crammed together, Jeremy Rowe, AkzoNobel’s managing director for decorative paints in South East, South Asia and the Middle East, was in Pakistan for a busy little spell this past week.

A management consultant, specialising in strategy and business transformation, of quite considerable repute, Rowe has worked across many companies and continents. He was appointed to the AkzoNobel Pakistan’s board on Oct. 27 2016 – in addition to many country boards (including Indonesia, Thailand, Oman, in the vast region, making him, in a manner of speaking, the king of all he surveys in one of the leading paint brands.

Not unfamiliar to Pakistan, Rowe has been visiting this country since around 2005 – more often in the recent past. And in his latest sojourn, he sat down with Profit for a tete-a-tete about the whole gamut of paint business in this country and also the regions that he oversees. The following are the excerpts.

Profit: Jeremy, what brings you to Pakistan?

Jeremy Rowe: Whenever I come to Pakistan I try to do more than one thing. We have a board meeting and a product launch, and I will be spending some time to review how the business was doing and how things were going according to our future plans.

Profit: Since when has Pakistan been under your purview?

JR: About three years, since 2014. Though I have been with the business here before, but it wasn’t in the same capacity as I am now. I first visited back in 2004 or 2005, and I have been familiar with the place as it’s been part of the region that I haved looked after for the last few years.In South-East Asia and South Asia we consider Pakistan sort of a medium size country along with Thailand, Malaysia and Sri Lanka, the big ones being India, Indonesia and Vietnam.

Profit: Looking at India, Sri Lanka, Vietnam, what are the similarities and differences between them and the paint industry in Pakistan?

JR: There are both similarities and differences between different countries. We can maybe split up also the paints and coatings market into different parts. So generally we would think about two parts, one being what we call the decorative paints market that goes to homes basically, plus some wood, metal and concrete type products. And then there is coatings or performance coatings which go on everything else – cars, ships, trains, cans, mobile phones. We call it performance coatings, because generally there is a higher level of performance needed for such products compared to a house or a building. Every market has those two types.

The decorative paints market is generally driven by only two things; how often you paint your house and the development of infrastructure, say new cities and towns. The performance coating market is driven by the different sub-segments, so automotive would be driven by the number of cars [manufactured] and the number of accidents as well, but also big things like oil and gas developments, marine is driven by ship building. So there tend to be different factors for different categories involved. What we generally find is that the paints market is driven by GDP plus 1 time or 1.5 times GDP is generally the way paint market grows over the medium term. In terms of habits and behaviours, South-East Asia and South Asia are not so different. Unlike Europe, we will not find many DIY guys across Asia where a lot of people use painters to repaint their houses. Also there are a lot of consumers who tell the painters to even buy paint for them. So the structure of the market is a lot of small shops. We don’t get these big format retailers in Asia. Typically its small, and traditional paint shops who are the main channel of distribution to the market. And the performance coating segment is a bit more similar across countries, because if you make cars, you make cars, if you paint ships you paint ships, so those are a bit similar across countries. And then there are habits like, the walls are a bit different in one country then the other, different painter habits, how much do they dilute the paint, also what colours people use as well. So colours tend to be most vibrant, in South Asia, in India, Pakistan and Sri Lanka, a bit mixed in South-East Asia, and if you go as far as North Asia, people tend to use whites and pastels.

One reason it is nice to be in Pakistan is that people like using colours, and since colours is our business it is nice for us. There are plenty of similarities and that is good for a company like us, because we are in lots of countries, so we can try leverage what works in one country and not the other, best practices, and also learn what works here and take it to other countries, and that way we tend to work as a multinational. In the performance coatings you might as well have global customers anyway and we make sure we serve them properly in many different locations.

Profit: So which country do you think would be most similar to Pakistan amongst the big countries?

JR: You would certainly say in South-Asia, Sri Lanka, Bangladesh, India, Pakistan, the habits are somewhat similar of painters and consumers and also that is true in South-East Asia as well. We don’t see them being much different.

Profit: How is AkzoNobel doing in India?

JR: We have been in all these countries for a long time. I was actually trying to get data, when the business was established here. I know in Sri Lanka it was round about in 1965 and in India its in the 1970’s. I think its similar here in Pakistan. And generally what we are talking about, is the family of the ICI business because AkzoNobeitas grown through acquisitions and mergers over many years. Back in 2008, AkzoNobel acquired ICI globally. It is principally the ICI paints and coatings business, which has been in Pakistan for a long time. So what’s great about the Dulux brand is that it is really well-known. It’s a premium, high-quality, high-performance brand. We are doing well here, and India and Sri Lanka as well. We are also in Nepal and Bhutan and a little bit in Bangladesh. So we are all over South Asia. When we look at Pakistan, this has been as a country a long- standing and successful business.

Profit: Can you brief us the about your upcoming brand, Promise ?

JR: When most people think about Dulux, they recognize it as a premium, high-quality and a very reliable kind of brand. While it’s great, we decided to make that brand experience available to people at a more affordable price. That’s what Dulux Promise is all about, bringing the brand price of Dulux to a more affordable point. It’s a quality product. We have had an internal launch today, and we will be doing external press announcements and activations in the media soon.

Profit: How is this different from your Paintex brand?

JR: It’s a higher quality brand than Paintex – you may call it in-between the two. Paintex to my knowledge is only in Pakistan. It remains an important part of our portfolio, we are working also to improve and activate the Paintex brand as well. One of our philosophies as a company is, we want to try and address all the different segments, be it the different paint segments or the different levels of affordability of the market. Promise is an important part of fulfilling that mission.

Profit: So you are going to stick with Paintex as well?

JR: Yes, that will continue to exist. It’s a relatively large, volume brand for us.

Profit: According to data from Pakistan Economic Survey 2016 the Pakisani paint industry grew a steady 3.99% YoY for three consecutive years. Moreover according to Berger Paints Pakistan, the industry was worth approximately Rs38 billion. In that backdrop, what is your current market share?

JR: I can’t comment on the Berger numbers. I think we will point you to some external views of the size of the Pakistani paint market, there’s a wide range when you look at it. It is fair to say that the market pattern is a bit difficult to estimate in terms of the size of the market compared to some others. I think the growth numbers you have used are similar to what we would think as well. We are a bit forward looking than that. We see Pakistan entering a phase where we think there would be a strong GDP and development of the infrastructure. And that tends to be good for the paint market. Both rising prosperity of the consumers and industrialization would hopefully be a good period for the paint market.

Profit: Are you expecting the growth rates to be above 5-6 per cent?

JR: I think, around 8 percent. If that happens, and that will rely on many things coming in, like investments. If it does, it should certainly get to that level.

Profit: While doing a story on the paint industry last year, what we found out then was post 2010 AkzoNobel started losing market share despite people associating quality with the brand since the ICI days. Instead of AkzoNobel, the research indicated Brighto as the market leader while there are others that claim to be at No 2 and 3. What do you think is the reason?

JR: You got to be a bit careful if you are talking about volume or value because you will get different thoughts of market. As for ourselves as a premium brand obviously our value market share will always be higher than our volume market share simply because of where we play. We have Paintex, but obviously our strongest position is in the premium segment where we have Dulux. However, if you look at the market you will find a number of players of roughly equal size. The reality is the market is quite competitive, with lots of players who are not very different from each other in terms of size. Being number 1,2 or 3 is probably not very important actually. In some markets you get someone who’s much bigger than everyone else, that’s not Pakistan. Here it’s a number of players, of relatively equal size. In a market with huge potential, who’s going to emerge as the leader in the next 5 to 10 years? We hope we will.

Profit: Your profile says you are basically a person from the consulting industry, a strategy guy, advising different companies. In case of Akzonobel Pakistan what would your strategy be? We also noticed the share price in the last one year has fallen. Post 2010, the sales did go down, probably it was because of the token. What do you plan on doing?

JR: That is something I’d love to tell you but I can’t. Unfortunately I will have to reveal that as we execute things. What you have seen today is one component in the launch of Dulux Promise. We have a couple of other things lined up for the next few years, which I can’t tell you about as it is competitively sensitive.

Profit: Some brands in the market are using token extensively. Even though AkzoNobel also uses it in the Paintex, it is complying with the government regulation of how to advertise it but others are not. There is also some other foul play going on in the market.

With AkzoNobel’s international policy, how are you going to compete with something like that?

JR: We are who we are. So, if we compete in Pakistan we will maintain our standards and the integrity of what we do, we wouldn’t think about doing anything different but we still need to be competitive. That is why our real focus is on things like long-term brand building, which has nothing to do with the financial activity derived by tokens. We have always had the belief that if we do something in the market long enough than it can help to change and professionalise the market. And we think that will happen here in Pakistan as well. So, we will continue to do the things we think are right. So far, I would say that it is necessarily the right thing to do but it has worked for us really well for the last few years. So we are happy taking the right course and professionalising the market.

Profit: How are things in India and Sri Lanka. Do you face the same issues there as well?

JR: No. Token is rather a Pakistani feature – and not really prevalent in other markets. There are similar things but not to the level of prevalence as here in Pakistan. Every market has its own uniqueness, ditto for Pakistan. In every market painters have a certain level of influence – higher in some economic or mid-ranged price points, less so when you have an established brand in the mind of the consumers, who then say, I want Dulux instead. The real way of dealing with it is building the value of the brand. Obviously a brand has heritage but we also need to be innovative. So we introduced Easycare last year and Velvet Touch before that. To build the brand properly is the best way to distinguish yourself in the market, where such promotional mechanisms help.

Profit: In other South Asian markets, things aren’t as directed towards the painters?

JR: Yes, our data would suggest that the painters are more influential here than in other markets. However, painters are influential in all markets. It’s just a matter of degree and also we think it’s also a phase of the market. As consumers are becoming more discerning in Pakistan, and starting to ask what’s the quality of the brand, what’s the quality of the paint, where does it come from and that draws them to the better brands.

Profit: So you have never decided to go after tokens, like one of the big paint companies in Pakistan did with their advertising campaign pegged on it?

JR: Yes, they chose to communicate and that was there choice. We think it’s better to talk about one’s own product, the brand and what it can do for you.

Profit: Do you feel you have benefitted from their campaign against tokens, without having to take the painters head-on?

JR: I don’t know it it worked for us or for that matter if it worked for them either. We think it’s really proper to focus on the brand, the quality and the experience. We built the Dulux Visualizer to help consumers with colour selection. This is the way to develop the industry, to bring new experiences for the consumers. That is really something you will see that in all our activities over the last two to three years.

Profit: And how do you think CPEC will play out for the paint industry?

JR: Any investment in a country is positive for an industry like ours, as there is new infrastructure, industrialization, and the wealth is created.

Do you think there will be a direct impact in Gwadar and Balochistan. Are your dealers reporting better numbers?

JR: I think not so obviously yet but we expect that to happen. Where you get centres of development in a country you get demand as well.

Profit: The news is that one of your biggest British investors Tweedy Browne decided to divest its shares. Will it impact on the goodwill of AkzoNobel, both locally and internationally?

JR: I think all investors everyday make their choices about where they wish to invest and it is absolutely their business and I wouldn’t even seek to think of commenting about it because those are the choices they make. I think AkzoNobel has been fortunate enough to have had a lot of long-standing shareholders who have stood by us during various changes in the business and we genuinely think that is what shareholders want. They want us to be stable and maintain long-term focus on performance and that’s what we try to aim for. We have made our future expectations globally quite clear to our shareholder in the 2020 targets laid down. We have laid out to our investors what we aim to achieve in the next three to four years for AkzoNobel as a whole. I think most of them will support us on that. It is up to us to deliver on that. That is our job as the management of the business.

Profit: Recently, AkzoNobel launched a Virtual Visualizer App (Augmented Reality). How effective was it in Pakistan?

JR: It was an international launch for the app but being a multinational, whenever we introduce new technology, we quickly bring that to consumers internationally. The app was launched in over 40 countries including Pakistan and it is an innovation because there is no other app with augmented reality as part of it. Like with any new app, you hope on producing something that the people will download and use. That’s the two things we focus on right now. Globally we are in the 13-14 million download area, which is pretty good for a decorating app. In Pakistan, we have about 75,000 downloads, which is again pretty good. We can also measure how many people have used it, when people update and how long they use it for. I would say the app has been pretty encouraging and we think that is because people do need help in colour selection and that is what it is for, to help make confident colour choices. So you can see the colours before you buy the paint. You can use the app in live augmented reality or shoot a video, so it is more than a photo. It is designed to be easy to use, so you can just pick it up and use it. Mostly for colouring the main walls. You can also do sectioning and other things but they take a bit effort. You can also send it to your friends and share.

Profit: It would be really good for interior designers to show their clients the end-product?

JR: As a consumer your main question is what’s the colour, how is it going to go with the surroundings. For the interior designer, obviously they will give you the selection but their consumer might think how is it going to look. So the app gives a bit more confidence in selection of colours. I think you are right, it is good for both consumers and professional customers.

Although it is an app on the app store which was basically for consumers at this stage. It is one of our big digital innovations in the decorative paint field. We also have done digital innovations in the performance coating side, like the virtual spray booth technology for training a car sprayer. When you can train them in virtual reality before they actually get to work, using the app saves a lot of paint. For marine business, we have very sophisticated parts and tracking shipping, how much fuel they save when going around the world using our coatings which can then be turned into things like carbon credits. A lot of digital innovation going on in the paints industry at the moment is quite exciting.

Profit: According to research the informal sector is bigger than the formal sector. What do you think about the numbers, the phenomenon overall and what can be done about it?

JR: I am not sure about the numbers but it is very true that all paint markets start with a fairly large informal sector. It was also true about South-East Asia, but you go there now and it doesn’t really exist anymore. In South Asia, there is a large informal sector in distemper products because it is not difficult for someone to make a cheap whitewash. What we have found out is that market just develops. As better products come into the market, first at premium level, then mass market and economy level, such products stop being used since they are neither cost-effective, nor high-functioning. They may be cheap but then the customers have to redo it all the time. So, over time that informal market tends to disappear by itself. And the consumer eventually notices the difference in quality and it develops people’s awareness about what properties real paint has. Honestly, we don’t think about it that much.