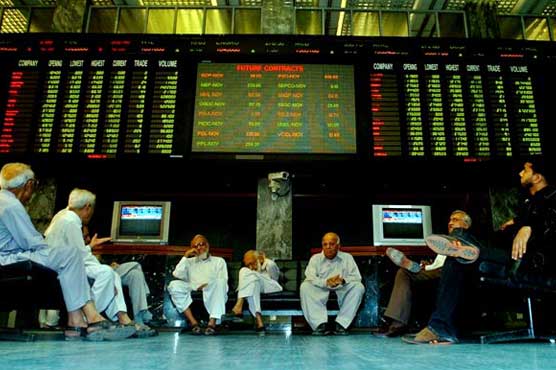

LAHORE: The 100 Index started the day on a buoyant note, pushing the 100 Index higher in a bid to recoup losses from the previous sessions driven by positive contribution from Energy, Materials and Financials. However, recent episodes of investor exuberance led to bouts of profit taking throughout the day. Just like a boomerang is shaped to rotate and spin back to the point of its origin the day ended on a similar note with the 100 Index closing up 9.77 points (+0.02 per cent) at 46,486.50 after touching an intraday high of 46,759.47 (+283 points or +0.60 per cent). Market Volume and Turnover expanded (up 42 per cent and 53 per cent respectively) on d/d basis amid profit taking in the second session. Selected names stood out among the rest with FFC (6.6 per cent of total turnover – up 162 per cent on d/d basis), ENGRO (5.8 per cent of total turnover – up 395 per cent on d/d basis) and EFERT (4.0 per cent of total turnover – up 436 per cent on d/d basis) standing tall among Materials (34.1 per cent of total turnover – up 53 per cent on d/d basis), rallying on the back of increasing demand and possible jump in fertilizer prices. Utilities (11.8 per cent of total turnover – up 192 per cent on d/d basis) and Consumer Discretionary (11.1 per cent of total turnover – up 141 per cent on d/d basis) also stood out on the back of rising investor excitement in these sectors.

Mixed contribution led to a flattish close with Telecommunication (+1.86 per cent), Utilities (+0.63 per cent) and Energy (0.34 per cent) contributing towards a positive close as PTC (+1.86 per cent), SNGP (+1.73 per cent), HUBC (+0.52 per cent), SSGC (+3.06 per cent), PSO (+2.58 per cent), PPL (+0.61 per cent) and OGDC (+0.45 per cent) closed in green. On the flip side, Health care (-0.51 per cent), Consumer Staples (-0.49 per cent) and Financials (-0.24 per cent) ratified a reactive close as SHFA (-3.84 per cent), SEARL (-0.41 per cent), PAKT (-1.32 per cent), NESTLE (-1 per cent), COLG (-1.56 per cent), UBL (-1.91 per cent), HBL (-0.19 per cent) and BAFL (-0.89 per cent) closed in red. On the political front, PM Abbasi has said that the caretaker set-up will be in place for 60 days from June 1. He also held discussions with the opposition leader pertaining to the setup of the caretaker government, which will take over once the ruling PML-N government completes its tenure in end May.

Market participation for the 100 Index increased to 106.35mn shares (+42.1 per cent on d/d basis). Major contribution to total market volume came from AGL (+12.75 per cent), LOTCHEM (+1.89 per cent) and ANL (+4.35 per cent) churning 50.24mn shares out of the All Share volume of 284.38mn shares. Daily traded value for the 100 Index increased to USD 63.22mn from USD 41.48mn in the previous session (+52.42 per cent on d/d basis); FFC (USD 4.16mn), PPL (USD 4.02mn) and ENGRO (USD 3.68mn) were among top contributors from traded value perspective. Major contribution to the 100 Index upside came from PSO (+2.58 per cent), FFC (+1.25 per cent), PPL (+0.61 per cent), SNGP (+1.73 per cent) and FFBL (+4.06 per cent) adding 81 points. On the flip side, UBL (-1.91 per cent), POL (-1.07 per cent) and EFERT (-1.62 per cent) took away 73 points. The 100 index is 23 per cent above its 52-week low of 37,736.73 reached on December 12, 2017 and 12 per cent below its 52-week high of 53,127.24 touched on May 25, 2017.

Technically speaking, the 100 Index closed on an indecisive note eking out marginal gains amid expanding turnover. Having reached our immediate target (47,100) we expect market to stall and stage a retreat for now. Next support is Thursday’s low (46,085).