The Board of Directors of Bank AL Habib Limited announced the financial results of the Bank for the nine months period ended September 30, 2018.

As per the results, the Bank declared the pre-tax profit of Rs9.92 billion for the nine months period ended September 30, 2018 as compared to Rs10.38 billion for the corresponding period.

Profit after tax for the nine months period ended September 30, 2018 was recorded at Rs5.90 billion against Rs6.25 billion for the corresponding period last year.

The bank’s profit (excluding capital gains) grew by 27 per cent compared to the corresponding period last year.

Earnings per Share (EPS) of the Bank were recorded at Rs5.31 per share.

The bank’s loan book increased by Rs110.10 billion, standing at Rs449.93 billion as on September 30, 2018, showing growth of 32.40 per cent in net advances, compared to the last year end. Advances to Deposits Ratio (ADR) of the Bank now stand at 58.52 per cent. The Bank has improved its market share in terms of the loan book.

Prudent financing strategies and sound risk management policies of the Bank resulted in a decrease in non-performing to gross advances ratio to 1.12 per cent as at September 30, 2018, as against 1.52 per cent as on December 31, 2017.

The coverage ratio of Non-Performing Loans is also increased to 146.94 per cent as at September 30, 2018, from 144.32 per cent in December 31, 2017.

The Bank maintained long-term and short-term rating at AA+ (double A plus) and A1+ (A one plus). The ratings reflect the Bank’s sustained performance, exceptional asset quality, satisfactory financial profile and healthy liquidity.

The deposits of the Bank increased by 11.01 per cent as compared to December 31, 2017 reaching Rs768.81 billion as on September 30, 2018.

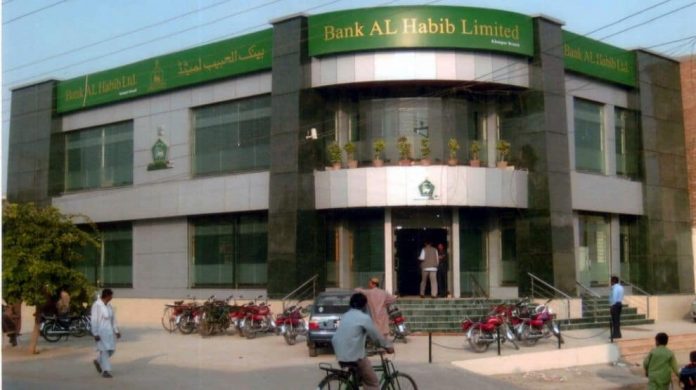

The Bank continued with its strategy for outreach expansion by adding significant branches every year. The Bank’s branch network has now reached 700 branches / sub-branches having coverage in 263 cities of Pakistan and 3 branches & 4 representative offices outside Pakistan. In line with the Bank’s vision to provide convenience to customers, the Bank is operating with the network of 809 ATMs across Pakistan including 119 offsite ATMs.