–Third finance bill aims at encouraging investment, exports, promoting ease of doing business

–Super tax on non-banking companies abolished, interest on agri loans reduced from 49pc to 29pc

–Govt abolishes withholding tax on banking transactions for filers, non-filers allowed to purchase 1300CC vehicles

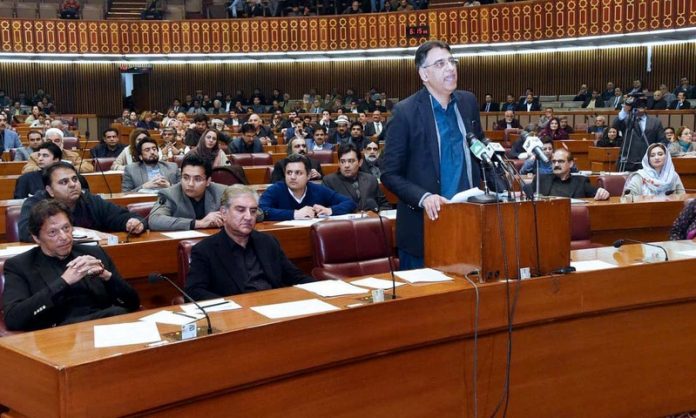

ISLAMABAD: Amid ruckus in the National Assembly on Wednesday, Finance Minister Asad Umar announced the Finance Supplementary (Second Amendment) Bill of 2019, a package of measures to shore up strained public finances also dubbed as “mini-budget” that comes only months after the government presented its last finance plan in September.

The finance minister began his address by calling it an economic reforms package and “not a mini-budget”.

“Two years ago an economic situation began to develop when all economic experts started to say that danger bells are ringing. But instead, those in power did not pay heed, they thought the people were ignorant, and instead they conspired to buy an election,” he said.

Umar added that the deficit grew to Rs900 billion, asking how this gap would be filled.

According to the finance minister, there were record losses in Pakistan Steel Mills, Pakistan Railways and the opposition had left the country in a debt of up to Rs2,500 to Rs3,000bn.

“The people sitting on my right [the opposition had left nothing when they were leaving the government. Instead of reforming themselves, the previous regime tried to buy an election. The budget deficit, as presented by them [in their budget], should have been 4.1 but the actual deficit at the end of the year clocked in [much higher],” he said, speaking above opposition shouts of “Liar, liar!”

“They destroyed the electricity [generation and distribution] system and left us a Rs450bn deficit. The gas [distribution] system which had never witnessed a deficit has now recorded Rs150bn deficit,” he complained. “Similarly, the deficit was around Rs30bn in railways.”

“I wish those shouting ‘Liar, Liar!’ right now had called out their own ministers when they were in power,” Umar said after recounting the challenges he said he had inherited. “We took several difficult decisions, and I appreciate that the people realised that these difficult decisions were necessary.”

“I want to give them the good news that these difficult decisions are yielding dividends: the deficit is reducing, exports are increasing and imports are declining. We need to bring a balance in revenue and expenditure as it is vital for growth. Our imports are touching a dangerous point. We have to increase exports and bring reforms in the agriculture and other sectors,” he said.

“The camera is recording [when I say this]: At the time of the next election, the PTI govt will not have to purchase an election [like our opponents attempted to]. The years 2022 and ’23 will witness the highest growth as compared to the period from 2008 to 2023,” he claimed.

FINANCE BILL IN BRIEF:

- No WHT on banking transaction for filers

- Ban on purchase of vehicles for non-filers lifted, can purchase vehicle up to 1300CC

- Reduction in import duty on raw material for certain items

- Increase in sales tax on mobiles

- Reduction on small marriage hall fix tax from Rs. 20,000 to Rs. 5,000

- Increase in tax on vehicles above 1800CC. FED is now 25pc

- No WHT on shares purchases and sales

- 49 per cent tax on SMEs reduced to 20pc

- Interest on agri loans reduced from 49pc to 29pc

- Introduction of interest-free revolving credit of Rs5 billion (qarz-i-husna)

- Pilot scheme to be introduced in Islamabad to facilitate traders in filing and paying taxes

- Duty on news print abolished completely

- Investment in solar panels and wind turbines to be exempt from duties and taxation for five years

- Super tax on non-banking companies to be abolished

- Capital loss carry-over to be allowed for 3 years (stock trading)

- Continuation of 1pc per annum reduction in corporate income tax

- Taxes on cars with engine capacity of 1800CC and above to be increased

- Tax refunds to be worked out; promissory notes to be issued by mid-February

- Duty on diesel engines for agricultural applications to 5pc from current 17pc

ANNOUNCEMENTS:

Umar announced to abolish withholding tax (WHT) on banking transactions for tax filers. He said the government will be launching a Rs5 billion ‘qarz-e-husna’ [loan scheme].

The finance minister said non-resident Pakistanis can now buy properties and vehicles.

Ban on purchase of vehicles for non-filers has been lifted as they can now purchase cars up till 1300CC capacity, but higher taxes will apply.

Umar said tax on income to small and medium-sized enterprises (SMEs) will be 20 per cent while agricultural tax will be dropped to 20 per cent.

The government has decreased tax from Rs20,000 to Rs5,000 on small wedding halls up to 500 square feet while import duty on news print has been eliminated.

Umar announced to form special economic zones with regard to China-Pakistan Economic Corridor (CPEC).

In the next 5 years, those working to produce products for renewable energy will be exempt from sales tax and customs duty, he apprised.

He said there will be no taxes on bids for sports franchises until they become profitable.

From July 1, “super tax” will be eliminated for non-banking companies, he said and added that continuation of 1pc per annum tax reduction in corporate income tax.

The government has increased taxes on vehicles over 1800cc. Tax for low-priced phones will be decreased while it will remain same on expensive phones.

A scheme will be introduced of promissory notes for exporters. Any exporter will be able to take loans from banks on these notes, the finance minister said.

Umar also announced to reduce income tax on housing schemes for low-income people from 39 per cent to 20 per cent to encourage housing sector under prime minister’s project for construction of five million houses.

To promote ease of doing business, the PTI minister declared that the business community will now be required to file their statements about withholding tax only twice in a year from the previous practice of filling 12 statements in a year.

THIRD FINANCE BILL:

The ‘mini-budget’ would constitute the third finance bill for fiscal 2018-2019.

In May 2018, the National Assembly had passed the Finance Bill 2018-19 during the tenure of the PML-N government, the basic structure of which remained the same as announced by then Finance Minister Miftah Ismail on Apr 27, 2018.

In September 2018, the PTI government Umar had presented amendments to the budget announced by the PML-N.

The amendments included a cut in the centre’s development programmes and measures to bring the budget deficit down to 5.1 per cent.

Tax rates were lower than the previous year and the tax relief that had been granted by the PML-N was revoked from salaried persons earning more than Rs200,000 per month. The tax rate in the highest income tax slab was raised from 15 to 30 %. The rate of withholding tax on banking transactions for non-tax filers was increased to 0.6%.

Other developments included an increase in federal excise duty on imports of luxury vehicles and duties on ‘expensive’ cell phones. Customs duty was also increased on more than 5,000 ‘luxury’ items. Regulatory duty was increased on the import of more than 900 items.

The Insaf Sehat Card facility was expanded to erstwhile FATA and Islamabad Capital Territory.

OPPOSITION OPPOSES:

The government had last week sought the opposition’s support for the mini-budget. National Assembly Speaker Asad Qaiser had facilitated two meetings between the government and opposition in which the issues of the mini-budget and formation of committees of the NA were discussed.

However, leaders of various political parties had refused to obey government’s plans, saying the mini-budget “will add to the miseries of public” and “badly affect the commerce and industrial sectors in the country”.

PPP’s Sherry Rehman had, in a statement, expressed her reservations over ever-increasing prices of various commodities.

Similarly, several PML-N leaders, including former premier Shahid Khaqan Abbasi, had also lamented the government’s move to present another finance bill.

The PML-N leaders had earlier lashed out at the PTI government for what they termed “directionless and failed” economic policies, which they claimed had drastically brought down the country’s growth rate and economy in just five months.

A step towards friendly business tradition & economic growth environment……. I really appreciate the PTI government for this achievement and they have gained back my trust in them otherwise I was totally disappointed from their working style…..