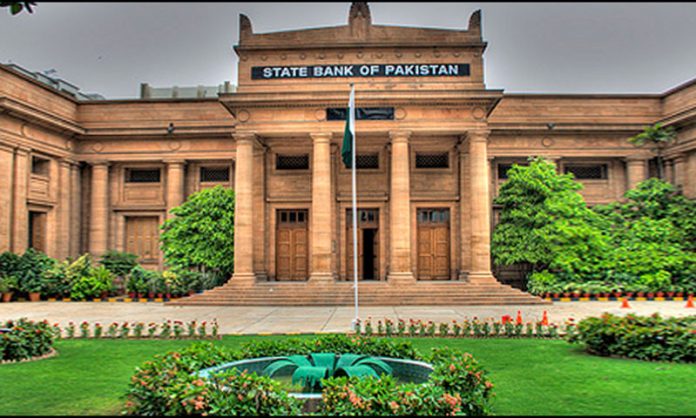

KARACHI: The State Bank of Pakistan (SBP) has said that the projected slowdown in global economic activity, particularly in the US and Euro may affect exports and the demand for bank advances.

In its Mid-Year Performance Review (MPR) of the banking sector for the Calendar Year 2019 (H1CY19), the central bank has extensively analyzed the performance of the banking sector.

The SBP said a projected slowdown in global economic activity — particularly in the US and Euro area — is likely to influence exports and the demand for advances. “In addition, owing to perceived weakening in re-payment capacity of firms and recent pick-up in the non-performing loans (NPLs), banks may remain risk averse in their lending behaviour.”

The report said that despite challenging macroeconomic environment, banking sector maintained its growth trajectory during the first half of CY19 (H1CY19) largely, backed by decent growth in deposits. “The banking sector remained sound and stable during HICY19. Although some dimensions witnessed moderation, the overall risk profile of the banking sector remained satisfactory H1CY19”, the report said.

The State Bank said the rise in minimum savings rate is likely to induce depositors to opt for more savings and fixed deposits, while banks may face challenges in mobilising low cost deposits.

The SBP said banks are addressing margin pressure by making their investments in the risk-free government papers.

The report said that the overall risk profile of the banking sector remained satisfactory. The earnings of the banking sector improved owing to increase in Net Interest Income (NII), which improved all the profitability indicators.