KARACHI: The State Bank of Pakistan (SBP) on Tuesday announced it would cut the policy rate by 75 basis points, from 13.25 per cent to 12.50pc.

The decision was taken based on a lower predicted inflation forecast, but also a concern about the coronavirus pandemic and its potential impact on the external and domestic demand.

According to the State Bank, the average headline inflation is expected to remain within the 11-12 per cent forecast in FY20, before falling to the medium-term target range of 5-7 per cent. This is earlier than previous State Bank expectations.

National CPI inflation surged to 14.6 per cent in January 2020, before a deceleration in February 2020 to 12.4 per cent. Currently, average national CPI stands at 11.7 per cent during the first eight months of FY20.

This was in line with the last monetary policy review in January 2020, where SBP had again projected average inflation for FY20 to remain broadly unchanged at 11-12pc.

The SBP believes that the 75 bps reduction in policy rate is “appropriate on a forward-looking basis to achieve the 5-7 per cent medium-term inflation target.” This was decided in order to make the interest rate corridor symmetric around the policy rate, as per best practices around the world.

HOSPITAL SCHEME

To that end, for the first time, the State Bank has announced a Refinance Facility for combating COVID-19, RFC which is a Rs5 billion scheme, provided to banks at zero per cent, who can then lend to hospitals at 3 per cent for five years for equipment.

Banks will provide — this facility, at zero per cent, which will then provide financing at maximum end-user of 3 per cent for 5 years.

“This is not the first step. We are ready to take action if more things happen. This is not the final scheme,” said Reza.

Commenting on the scheme, the SBP governor said they were still waiting to see how the virus in fields, and that there is no limit to helping hospitals.

The State Bank also reached out to 29 hospitals, to get a price range for ventilators. Ventilators cost between Rs1.5 million and Rs2.5 million, and that the Rs200 million schemes with maximum financing limit does not cover it.

TERF SCHEME

Simultaneously, the SBP announced a “Temporary Economic Refinance Facility (TERF)” and its shariah-compliant version to stimulate new investment in manufacturing. Under this scheme, the SBP will refinance banks to provide financing at a maximum end-user rate of 7 per cent for 10 years for setting up of new industrial units. The total size of the scheme is Rs100 billion, with a maximum loan size per project of Rs5 billion.

On the subject of TERF, the SBP said the TERF was similar to the highly popular LTFF, which was a credit scheme for exporters.

“It can be accessed by all manufacturing industries, with the exception of the power sector, where an SBP refinance facility for renewable energy projects already exists. In line with the SBP’s other refinancing schemes, the credit risk will be borne by banks and the selection of projects to finance will also be determined by them.”

TERF has been initiated during the coronavirus outbreak, as the economic activity may be affected as people are scared.

“This scheme will help counter any possible delays in the setting up of new projects that investors were planning prior to the Coronavirus outbreak.”

Through TERF, the SBP wants to make investment attractive and decrease the cost of investment.

The LTFF is offered at 6pc, while TERF is at 7pc. This is because the SBP still wants to incentivize exporters, while giving non-export sectors some benefits. The TERF also has a one-year limit, to act as pressure for instant investment.

“It will be available for one year only, requiring a letter of credit (LC) to be opened by end-March 2021.”

MARKET ANALYSIS

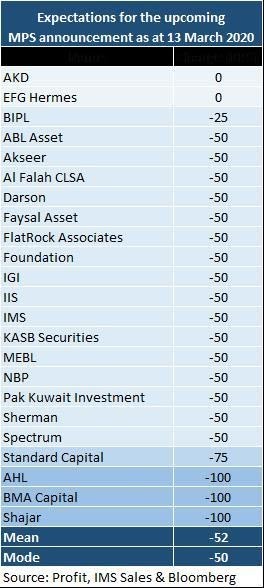

The policy rate is not in line with market expectations. Almost all major investment banks had predicted that the policy rate would be cut, according to a survey conducted by Profit, Bloomberg, and IMS.

However, 16 out 23 research houses had predicted a policy rate cut of 50 basis points. Three had predicted a policy rate cut of 100 basis points, and two had predicted no policy rate cut.

Only one research house, Standard Capital, had anticipated a 75 bps cut.

Naushad Chamdia, CEO of Standard Capital Securities, said: “SBP cut interest rates by 75bps to 12.5pc keeping in line with their average inflation outlook of 11pc-12pc at the start of the year. Though SBP also feels that inflation is getting moderate in the coming months hence we feel it can further be lowered down in the coming months. Though market participants were expecting a better cut in line with the international trend.”

Previously, market analysts had believed that a cut in the policy rate will happen much later in the year, in July or even September. However, the pandemic forced the State Bank’s hand.

According to Adnan Sheikh AVP Research at Pak Kuwait Investment Company: “Although the SBP move was in line with street consensus, looking at the attrition at share prices of banks and other cash-rich companies along with the resilience of cyclical and levered companies hints that the market was looking for way more, and the SBP has disappointed”

OUTFLOWS

Commenting on outflows, Baqir said that the foreign outflows were not related to the Pakistan interest rate. Instead, as the whole world is panicked because of coronavirus, there has been a general ‘flight to safety’. Pakistan is not the only one affected; this has affected all emerging markets.

The SBP also said that they had enough reserves of $10.6 billion to cover the magnitude of risks.

“Notwithstanding recent volatility in foreign exchange markets, the SBP’s FX reserves have maintained strong growth, driven by the narrowing current account deficit. Reserves increased from US$ 7.28 billion at end-June 2019 to US$ 12.76 billion as of end-February 2020 – an increase of US$ 5.48 billion”

Analysts expect that the currency is likely to be under pressure considering the outflow of dollars due to the liquidity concerns of foreign investors. Considering how gold, a safe haven, has not managed to save itself from this liquidity selling spree, the rupee is likely to lose unless an intervention takes place.

According to sources, the State Bank of Pakistan (SBP) intervened at 4 pm on Friday to ensure the stabilization of the rupee to bring the dollar down to Rs157.25 by pumping liquidity.

The IMF has allowed the SBP to intervene in the exchange rate during disorderly market conditions

Commenting on disorderly market conditions, the state bank governor said the bank looked at three things when intervening. One, the movement of the trade; the bid/ask spread and the distance, with the greater distance the more the uncertainty; and the market supply and demand.

As reported yesterday, total gross divestment during March 2020 has surpassed $772.3 million, according to data released by the SBP, as ‘hot money’ leaves the country amid ongoing concerns about the impact of the COVID-19 outbreak.

IS PAKISTAN FOLLOWING INT’L RATE CUTS?

“When we consider the interest rate, we look at two reasons: one the inflation projection, and two the expectation of GDP,” said Baqir.

Baqir was also quick to say that the interest rate cut was not due to other central banks cites.

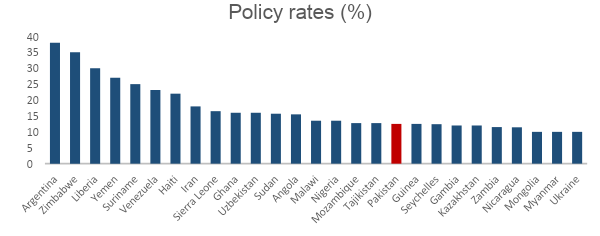

“We are not competing with other central banks”, he said. When looking at central banks they should be divided into advanced economies and emerging markets.

“Emerging markets do not have the same advantages. The US prints dollars. We, print rupees.”

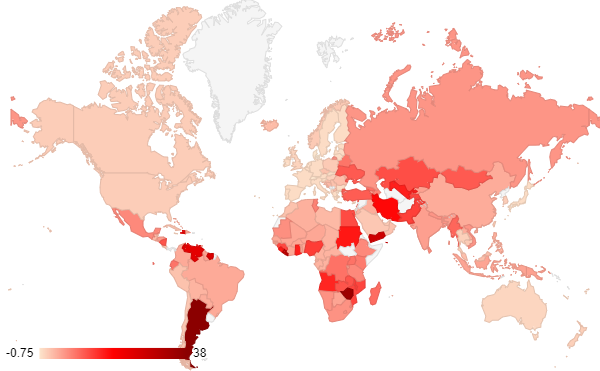

Global interest rates are averaging at approximately 5.5 per cent, following a wave of interest rate cuts. Out of 166 countries, 27 countries or 16 per cent of the world have double-digit policy rates.

According to Chamdia: “We feel that interest rate cut is far less than the market required where even new investors have lost horrendously due to the global Coronavirus crisis. SBP rate cut is less than 10% compared to places like Egypt which cut rates by 300bps for stimulus. US & Canada cut rates by 80pc & 60pc respectively to boost markets wherein we have made a symbolic cut that will not go down well with businesses in the country which need stimulus packages from the government to make things running. In our opinion interest rate cut is not as per market expectation”.

IMPACT OF CORONAVIRUS

As per the SBP, the cut was not primarily due to the coronavirus. “The MPC emphasized that the current market volatility is externally driven and the strengthening in the fundamentals of Pakistan’s economy that drove the improvement in Pakistan markets before the Coronavirus outbreak remains intact.”

However, in the statement, the SBP mentions that the cut “should provide important additional support to investment in response to the anticipated slowdown in activity due to the coronavirus pandemic.”

“Recent high-frequency indicators re-affirmed that the decline in most economic sectors was bottoming out before the Coronavirus outbreak.”

Having infected more than 130,000 individuals, and with a death toll surpassing 5,000 people, coronavirus (COVID-19) – now labelled global pandemic – has managed to bring life to a halt around the world. As a result of the deadly virus, global economies are feeling the heat due to the disruptions in supply and dampened demand sentiments.

Global GDP estimates have been slashed by 5 bps to 2.4pc as opposed to previous estimates of 2.9pc.

The impact on Pakistan is likely to be subdued considering how the slump in oil prices has cushioned the costs to the economy.

According to Baqir, the biggest single impact is the oil drop, which is a positive supply-side shock and a positive supply-side shock for the economy as well.

As per BMA, “During FY19, Pakistan imported $16 billion worth of oil, 31pc of the country’s total import bill. We estimate that for every $10 per bbl decline in Arab Light’s spot price, Pakistan’s import bill can fall by $ 1.6 billion.”

As per a report by BMA Research, the impact is likely to hit Pakistan due to the impact on trading with infected countries. The report reads, “A large portion of Pakistan’s economy is driven by imported materials including most key sectors such as textiles, automobile, energy, steels, pharmaceuticals, and consumers.”

Considering how a number of these countries are in quarantine, analysts expect that Pakistan’s trade with these countries will be impacted thereby disrupting supply chains.

Speaking on the potential of exporters orders cancelled, the SBP said they were not too concerned about the impact on exports, saying that since Pakistan’s exports to GDP ratio was less than 10 per cent, we would not be as affected as a more export-reliant country, like Vietnam. “In a way, it’s good we are not outward-oriented”.

With global export leaders impacted by the spread of the virus, this could lead to Pakistan emerging as an exporting nation.

“SBP now projects real GDP growth for FY20 of around 3.0 per cent, while expecting a modest recovery next year provided that the spillover impact of the Coronavirus outbreak on global trade and financial markets is moderate and short-lived.”

“Fundamentally we are dealing with a disease,” said Baqir, adding that there are a lot of factors that are out of the control of the State Bank. Even if interest rates are cuts, people will not take the risk of leaving their houses, and start spending.

STOCK MARKET

As per Al Habib Capital Market expectations, the banking sector and E&P will see a slash in earnings across the board. Steel and IPPs, however, will likely see a rise in earnings.

The PSX, however, owing to uncertainty, hit four market halts in the past seven days. Today, the market was held back in terms of volume with the expectation of the MPS.

“I think the cut is below market expectations. However, as the market has fallen significantly in the past two sessions, therefore, it shouldn’t decline further. Stability in the external account and increment in foreign exchange reserves is essential for investor confidence.”

Commenting on the stock market, the SBP said that the stock market covers market uncertainty, whereas the bank covers the real economy, such as factories, experts, and people.