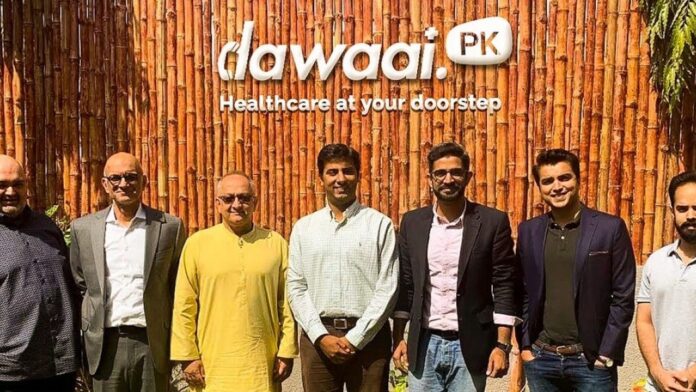

LAHORE: Online healthcare start-up Dawaai has raised investment from Pakistan-based Sarmayacar and London-based Kingsway Capital, a statement from Sarmayacar said.

Though the exact amount of the investment raised remains undisclosed, Profit confirmed that it is a seven-figure investment raised in a pre-series B round, with Sarmayacar being the lead investor.

Dawaai primarily operates as an online pharmacy targeting both the B2B (retail pharmacies, medical stores and businesses) and the B2C segments across the country.

Pakistan’s pharmaceutical market is estimated to be at least $3 billion in size and growing at a double-digit rate (excluding the rampant counterfeit market of $1+ billion). Despite its size and growth, the sector remains extremely fragmented with incumbents including a handful of regional chains and a large number of single-location retail players reliant on an inefficient and expensive supply chain riddled with counterfeit products. Dawaai instead sources products directly from manufacturers and established distributors to ensure authenticity and subsequently fulfils demand aggregated across the country through its managed end-to-end logistics function.

Furquan Kidwai, a former investment banker from London, started Dawaai in 2013 with a mission to digitize pharmaceutical logistics in Pakistan. After a prolonged period of establishing a foothold in the highly regulated and complex pharmaceutical space in the country, Furquan’s business appears to be thriving – growing more than six times in scale in less than a year. The increased scale has also appealed to manufacturers who previously struggled to have their products reach far-flung areas of the country, which in turn has helped Dawaai win more attractive terms from manufacturers. The challenge for Dawaai, it appears, is not the addition of customers rather ensuring efficient logistics and sufficient inventory supply to fulfil orders from across the country.

Furquan believes, “Healthcare should be accessible and affordable for everyone, and to make that happen we are setting up the infrastructure, supply chain and logistics. The way consumers access essential items is changing fast and we expect the same trend with their healthcare needs. Dawaai is positioning itself to lead the charge on fulfilling that customer demand. With the capital we have raised and support of partners like Sarmayacar and Kingsway, we are focused on driving scale in the most capital efficient manner and ushering Pakistan’s healthcare system into the new era.”

The investment round brings together Sarmayacar, Pakistan’s leading venture capital firm, together with London-based investment firm Kingsway Capital (also investors in Zameen.com’s parent entity EMPG) and San Francisco-based Mentors Fund.

Rabeel Warraich, Sarmayacar’s Founder and Managing Director, said, “Moving pharmaceutical products across Pakistan comes with logistical challenges, impacting margins in a price-controlled market. This creates the opportunity for a parallel counterfeit market to thrive as consumers cannot access affordable and authentic medicines.

Dawaai, in our view, is tackling these very real pain points – by aggregating demand across the country and managing logistics end to end, customers now have a company that will bring authentic drugs direct from manufacturers and distributors to their doorstep. We believe Pakistan is quickly moving through its digital revolution and an increasing proportion of its population, much like other developed countries, will buy its drugs online in the years to come. We have absolute conviction in Furquan being the leader that will make Dawaai the protagonist in that transformation across Pakistan and beyond.”