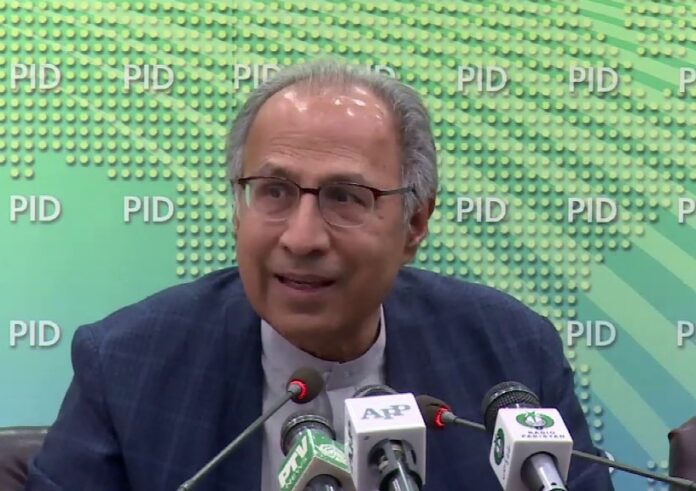

ISLAMABAD: A delegation of Nishat Group has met Adviser to the Prime Minister on Finance and Revenue Dr Abdul Hafeez Shaikh to apprise him of the damages done by the COVID-19 related economic downturn to large scale manufacturers (LSM).

Advisor to Prime Minister on Commerce Razak Dawood, Minister Industries Hammad Azhar, Dr Ishrat Hussain, Finance Secretary and Chairperson Federal Board of Revenue (FBR) were also present in the meeting, according to a press statement issued by the Finance Ministry here the other day.

The delegation shared that the COVID-19 induced demand compression while the size of balance sheets of large manufacturers was not maintainable, adding the major contributory factor was massive labour cost specially in labour intensive industries like garments sector.

Any arrangements of avoiding permanent laying off or furloughs are putting excessive strains on the liquidity position of businesses, which are anticipating slow economic recovery, hence hedging against potential solvency issues.

The delegation head stressed on an enhanced role by the government to ease liquidity position of large businesses, highlighting the need for crafting scheme for cost-sharing between public and private sectors. On the occasion, the finance adviser empathised with the participants and updated them about the current status of implementation of the prime minister stimulus package worth Rs1,240 billion.

The delegation was asked to put up a precise case for financial facilitation and its parameters as the State Bank of Pakistan (SBP) had already been running a scheme for payroll protection.

The advisor to the prime minister on commerce desired for working out the impact of reversion of orders by the United States, from China to other countries, and its potential impact for manufacturers in Pakistan.

The industries minister requested the delegation to provide details of the proposal in terms of cost sharing arrangements along with details about requirements of different sectors so that the government could ensure balanced treatment to all key contributors to gross domestic product (GDP). The finance advisor concluded the meeting with the understanding that specific proposal be crafted regarding up-scaling of existing scheme of the SBP as too many interventions carry the risk of diluting the impact. He further emphasised that upper bounds of additional liability be calculated through defined parameters so that evidence-based decision may be shaped before next budget.