ISLAMABAD: While rejecting and expressing disappointment on some proposals made in the Finance Bill 2020, the Senate Standing Committee on Finance on Wednesday, asked the maritime affairs secretary to disclose names of contractors and sub-contractors working at Gwadar, who are being considered for duty exemptions for a period of 40 years.

The senate committee further asked top officials of the Federal Board of Revenue (FBR) and the Ministry of Maritime Affairs to identify real beneficiaries of the proposed amendments.

Additionally, amendments related to the authorised economic operator programme and concessions on raw material for operating companies in Gwadar was also rejected. The committee has decided investigate the matter further since original documents stated a 20 year period for exemptions while the time span was changed to 40 years in the Finance Bill 2020.

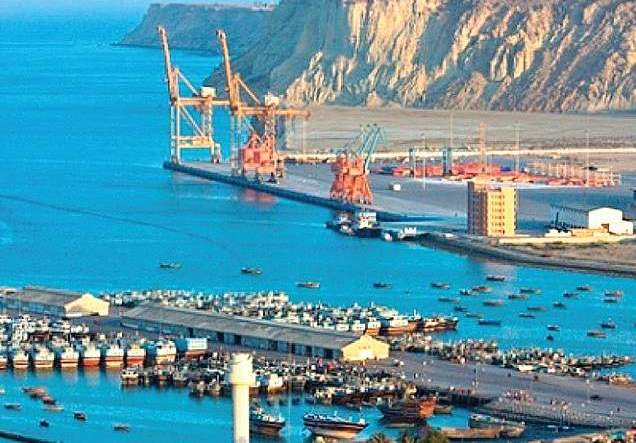

The committee further pointed out that amendments relevant to tax exemptions for Gwadar port are in violation of the law and directed the maritime affairs secretary to present details of agreements with contractors and subcontractors on Thursday.

The secretary was also asked to present before the committee a copy of the agreement between the Pakistani government and a Singaporean company, signed in 2007, related to the handling of the Gwadar port. The agreement was later sold to a Chinese company in 2013.

While the secretary maritime affairs assured that he will try his best to present the needed documents, committee members insisted that it will be binding on him to disclose everything to the legislators in order to get the amendments approved.

Senator Dr Musadik Malik, on the other hand, said that the government should ensure transparency and that it should not further amend agreements to give benefits to certain people. Senator Ayesha Raza also seconded Musadik Malik’s concerns and said that the committee was misguided on the issue of duty exemptions for Gwadar port.

Earlier the committee on Wednesday took up the Finance Bill 2020, containing the annual budget statement presented in the parliament June 12, 2020. Amendments made to the Customs Act, 1969, and the Sales Tax Provisions of Finance Bill, 2020, were reviewed.

During the meeting the FBR team also failed to convince the committee over the two major reforms related to Pakistan Customs in the budget for cross-border movement of goods under the Trade Facilitation Agreement (TFA).

One of the amendment relates to the Authorised Economic Operator (AEO) programme. The AEO programme aims to facilitate secure trade supply chains through simplified procedures.

The committee also unanimously rejected FBR’s amendment stating that the burden of proof lies with the accused.

The amendments that were approved related to extending the scope of smuggling, introducing higher penalties, repayment of regulatory duty to exporters, the inclusion of under-invoicing in the ambit of fiscal fraud and adjudication of cases within 30 days.

Additionally all amendments to the sales tax pertaining to the documentation of the economy were approved.