LAHORE: A report released by International Institute of Finance (IIF) on Thursday said Pakistan’s economy could grow by 1.8 per cent in the ongoing fiscal year 2020-21 fueled by some recovery in private consumption.

According to IIF, the coronavirus pandemic led to a contraction of 0.7 per cent in output during the last fiscal year 2019-20.

It shared domestic demand fell by 2 per cent, whilst exports of goods and services rose 1.6 per cent as opposed to a decline of 7.3 per cent in imports of goods and services.

“However, risks to the economic outlook are tilted to the downside, amid uncertainty regarding the magnitude and duration of the pandemic.

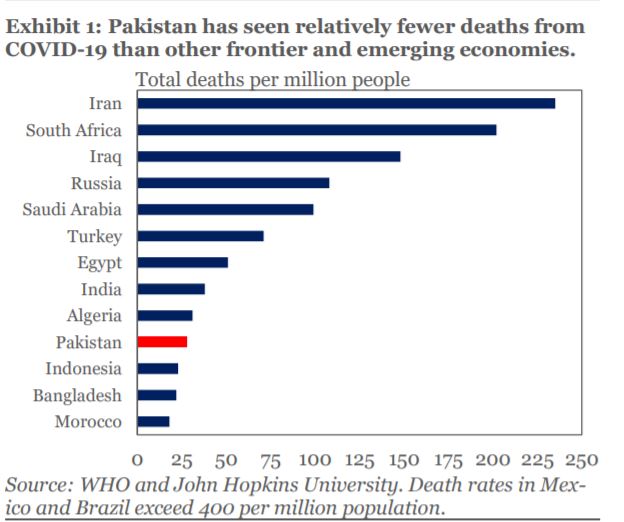

Adjusted for population, fewer cases and deaths of COVID-19 have been recorded in Pakistan than in other developing and emerging economies,” said IIF.

“These results are subject to a large degree of uncertainty, as data quality, testing capacity, and transparency vary.

While the rate of new cases has recently declined, the pandemic still puts considerable stress on Pakistan’s public health system. As of mid-August, lockdown restrictions had been lifted across the country,” it explained.

The report highlighted that the response measures taken by the government have been adequate backed up by the IMF’s emergency financing in the amount of $1.4 billion, provided in April 2020.

“Expansion of social programs has rightly focused on tackling the health emergency and supporting the most vulnerable while stimulating economic activity.

The Central Bank of Pakistan’s (SBP) proactive liquidity initiatives and lower policy rates are propping up economic activity and safeguarding financial stability,” it observed.

“The policy rate has been lowered 5 times since February, a cumulative reduction of 625 bps. The authorities have also introduced a fiscal stimulus package in the amount of $5.1 billion (1.9 per cent of GDP), which included direct transfers to wage workers and poor families, financial support to SMEs and the agricultural sector, higher subsidies for basic goods, and various tax incentives.

One-third of this amount has been implemented already, and the remaining $3.4 billion will be used in the current FY 2020/21 budget,” it added.

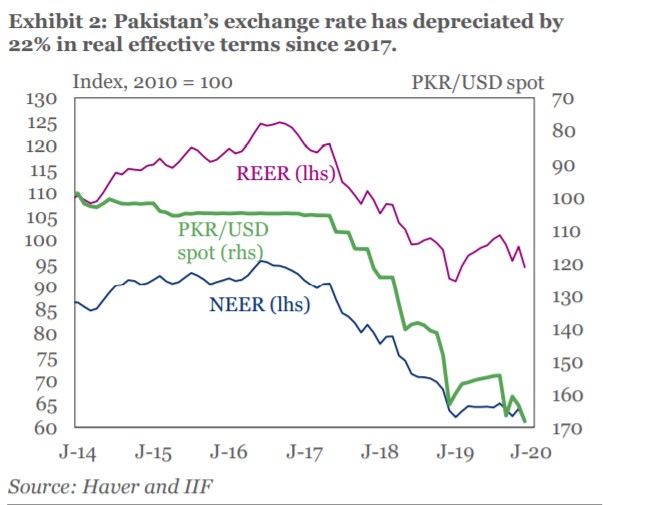

Meanwhile, the IIF noted that the sharp depreciation of the rupee has decreased external vulnerability and the exchange rate is now market-determined and depreciated by 22 per cent in real terms since 2017.

It underlined that the external position is strengthening due to impact of currency depreciation and weaker domestic demand since imports fell 18 per cent in nominal dollar terms, more than offsetting the slide in exports of 7 per cent in FY20.

“Workers’ remittances, which slightly exceeded exports of goods, continued their increase, supported by a more depreciated exchange rate and appropriate policy steps implemented by the authorities, including reducing the threshold for eligible transactions from $200 to $100 under the Reimbursement of Telegraphic Transfer (TT) Charges Scheme, increased use of digital channels, and targeted marketing campaigns to promote usage of formal channels,” it said.

Likewise, the fall in the trade deficit coupled with higher remittances shrunk the current account deficit from 4.8 per cent of GDP in FY19 to 1.1 per cent in FY20.

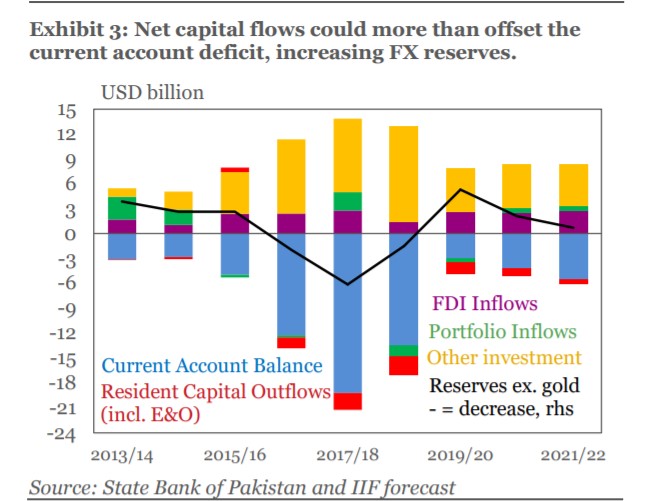

And net capital inflows have more than counterbalanced the current account deficit, contributing to a major increase in official reserves (excluding gold) to the equivalent of 2.8 months of import coverage.

Also, the IIF projected current account deficit may widen slightly to 1.6 per cent of GDP because of some recovery in imports and slightly lower remittances in ongoing FY21, the increase in net capital inflows would lead to a further rise in official reserves.

“Resistance to tax reforms and cost-recovery in the energy sector from entrenched elites could undermine the fiscal consolidation strategy and put public debt sustainability at risk.

The completion of the second Extended Fund Facility (EFF) review has been delayed pending implementation of key reforms.

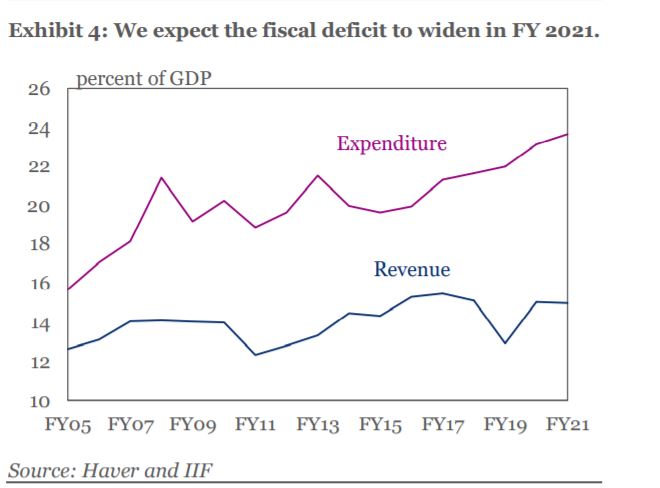

The narrowing of the deficit in FY20 (ending June 2020) to 8.1 per cent of GDP was largely due to one-off factors, including the jump in profit transfers from SBP to the budget, which bolstered non-tax revenue. Spending increased by 15.6 per cent due to sharp increases in interest payments on debt and social transfers,” said IIF.

The budget envisions reductions in subsidies, freezing salaries and pensions and increases in petroleum levies.

Although due to increasing defense spending coupled with higher interest payments (6.3 per cent of GDP) and rollover of fiscal stimulus from FY20 could widen the deficit to 8.7 percent of GDP against a budgeted deficit of 7 per cent, which is based on the growth of 2.1 per cent.

And public debt could rise to 86 per cent of GDP by June 2021, compared with 70 percent in 2018.

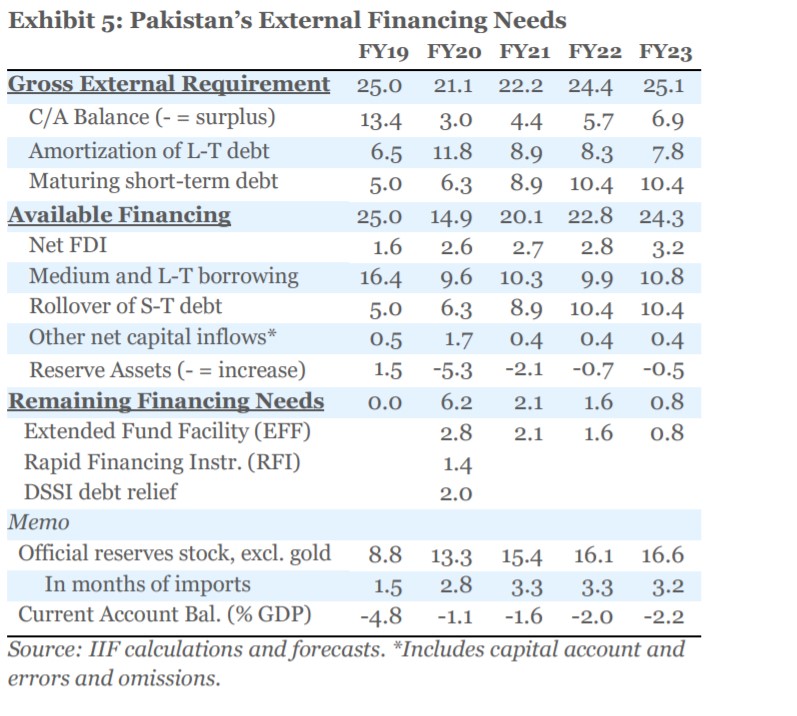

Nonetheless, the IIF warned that the external funding picture warrants caution as debt amortization will remain high in the coming years to come.

“However, improvement in the current account, rollover of short-term debt, and Debt Service Suspension Initiative (DSSI) have eased Pakistan’s external financing needs and shored up its official reserves, which could increase further to $15.4 billion (excluding gold) by June 2021 (3.3 months of imports of goods and services).

The DSSI provided debt-service suspension to help Pakistan and other low-income countries to concentrate adequate resources on fighting the COVID-19 pandemic,” it concluded.