“2020 was a reminder that sometimes we’re tested not to show our weaknesses but to discover our strengths, as EFERT continued to grow. When the Food Security of the Nation rests upon our shoulders, our teams rise to the occasion, go above and beyond for the farmers and, for Pakistan.”

That bit of corporate speak you just read comes from Engro Fertilizer’s brand new annual report for the year ending December 31, 2020, (the report itself was released on March 9, while the financial results were released a little earlier, on February 15).

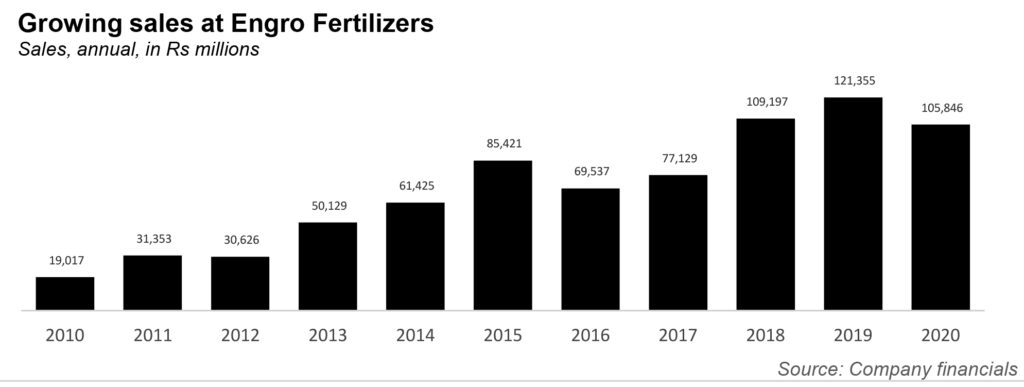

The hyperbole aside, the company actually did quite alright. The company’s revenues in 2020 stood at Rs105.8 billion, or a decline of 13%, compared to sales revenue of Rs121.4 billion in 2019. According to Engro, this decrease can mainly be attributed to decrease in Diammonium Phosphate (DAP) Fertilizer offtakes and reduction in Urea prices announced during the year. “The fall was partly mitigated by the stellar performance of our sales team that achieved the highest ever volumetric Urea sales during the year,” the report noted.

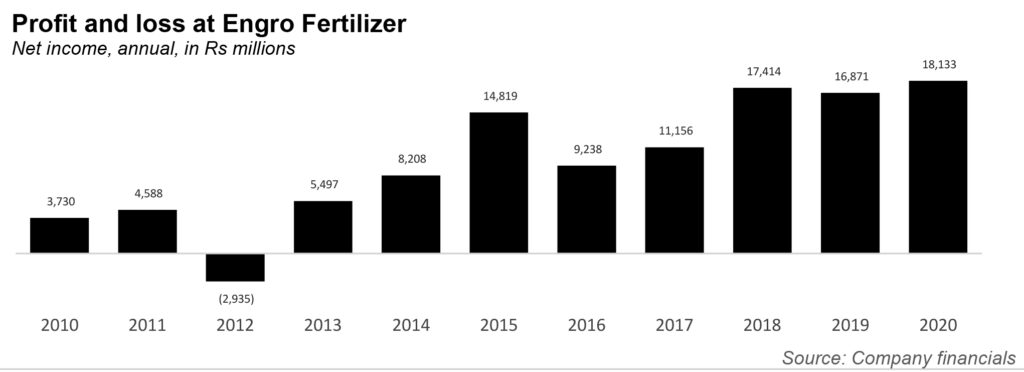

Meanwhile, the finance cost of the company decreased by 17% to reach Rs3.2 billion from Rs3.9 billion in 2019, mainly due to declining interest rates and decrease in outstanding long-term loans of the company. The company’s tax expense for 2020 stood at Rs3.2 billion, a decrease of 70% compared to the 2019 tax expense of Rs10.5 billion. One of the major reasons for this decline is the reversals of nearly Rs3.4 billion in tax provisions. For the year 2020, on a standalone basis the Company’s profit after tax stood at Rs16.8 billion, compared to Rs18.6 billion in 2019, registering a decline of 10%. On a consolidated basis the company posted a profit after tax of Rs18.1 billion showing a growth of 7% compared to profit after tax of Rs16.9 billion in 2019. As a result, consolidated earnings per share increased to Rs13.57 per share compared to Rs12.64 per share in 2019.

So all round, not a bad year at all. It is at this point that Profit’s short reports typically shed light on the history of a company for context. With Engro, the exercise seems a little futile. After all, it is Engro. But a refresher does not hurt.

In 1957, a joint Esso-Mobil venture called Pak Stanvac discovered vast deposits of natural gas in Mari. Esso proposed the establishment of a giant urea plant in Daharki, about ten miles from the Mari gas fields, which would use natural gas produced as its primary raw material to churn out urea fertilizer. Talks with the Government of Pakistan bore fruit in 1964, and an agreement was signed allowing Esso to set up a urea plant with an annual capacity of 173,000 tons. The total investment made was $46 million – it was the single largest foreign investment made in Pakistan to date then. The plant started production on December 4, 1968.

This, by the way, was Pakistan’s first branded fertilizer manufacturer. The branded urea was called “Engro” – an acronym for “Energy for Growth”. In 1978, Esso became Exxon, and the company became Exxon Chemical Pakistan Limited.

The way that the now infamous story in Pakistan’s corporate history goes, in 1991, Exxon decided to divest its fertilizer business on a global basis. The employees of Exxon Chemical Pakistan themselves decided to buy out Exxon’s 75% equity. This was perhaps the most successful employee buy-out in Pakistan’s corporate history to date.

Over the years that followed, Engro Chemicals Pakistan Limited started venturing into other sectors namely: foods, energy, chemical storage, handling, trading, industrial automation and petrochemicals. By 2009, Engro was already fast-growing and had diversified its business portfolio in as many as seven different industries. In 2010, a new Engro subsidiary, Engro Fertilizers Limited was set up.

Today, the company is one of the largest urea manufacturers in Pakistan. It has head office in Karachi, two plants – Dharki and Zarkhez – three zonal offices, and eight regional offices. It employs 1362 people (of which just 69 are women. The company’s chief executive is Nadir Salar Qureshi, who has been in charge since 2018, and had originally joined the company way back when as a business analyst.

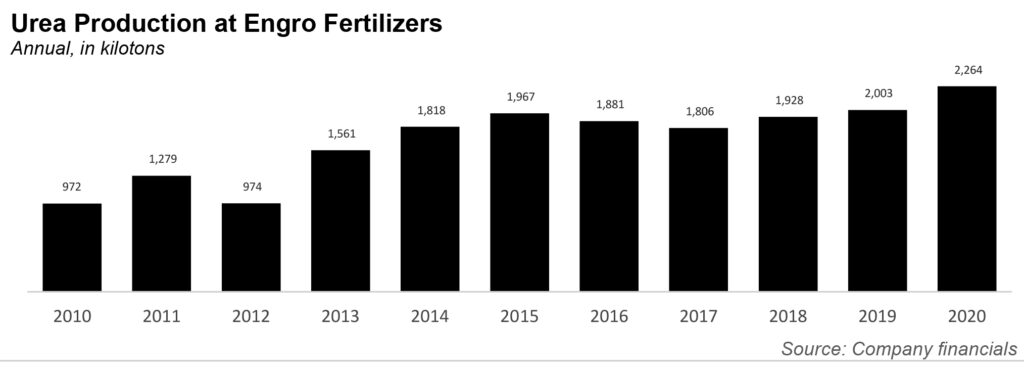

For his part, Qureshi has been nothing but optimistic about the company’s potential. “Over the last two years, with continuous focus on operational excellence by the plant team, we have been able to increase our production by ~330KT. This is a paradigm shift in the local fertilizer industry whereby urea manufactured from indigenous gas has largely ensured self-sufficiency to address domestic demand…our sales team delivered an outstanding performance as the company sold the highest ever urea volume of over two million tons.”

And nor is there any threat of competition. The fertilizer industry is part of the manufacturing sector and typically has a highly capital-intensive operational structure. The potential risk and threat from new entrants in the industry is minimal, given various factors including high initial capital cost, significant competition from major players and the competitive supply of industry’s primary raw material, which is natural gas. Engro has those factors pat down, which is how it was able to sail through the last year.