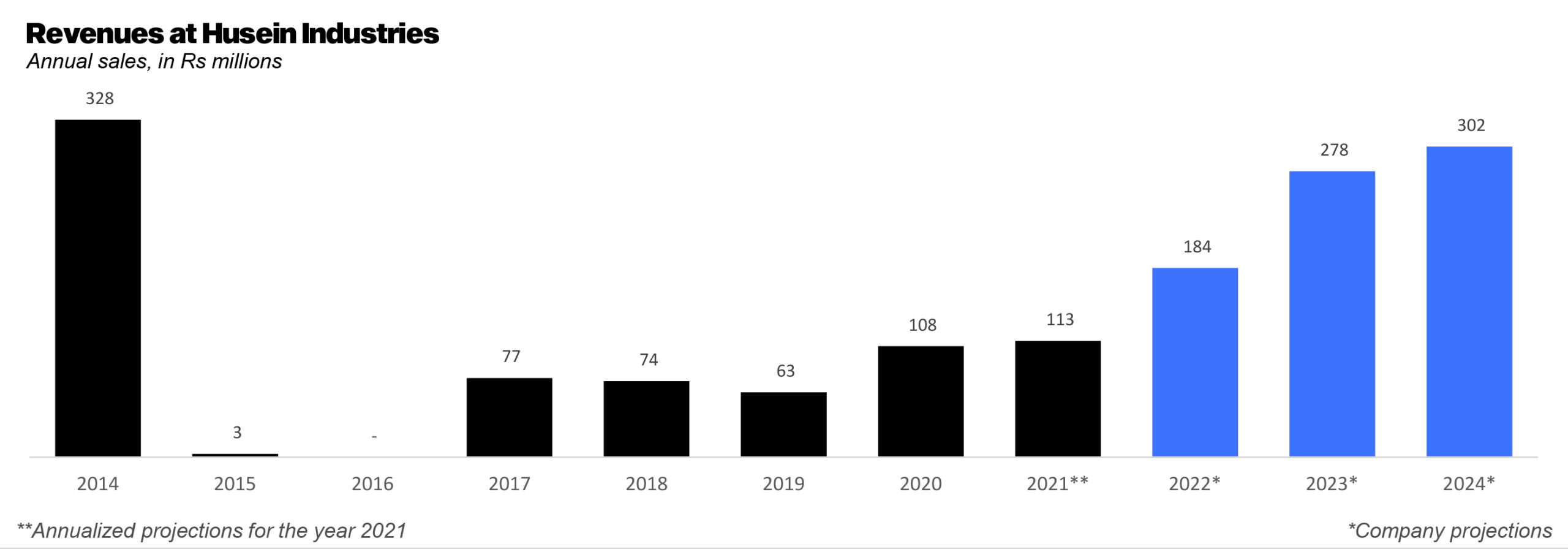

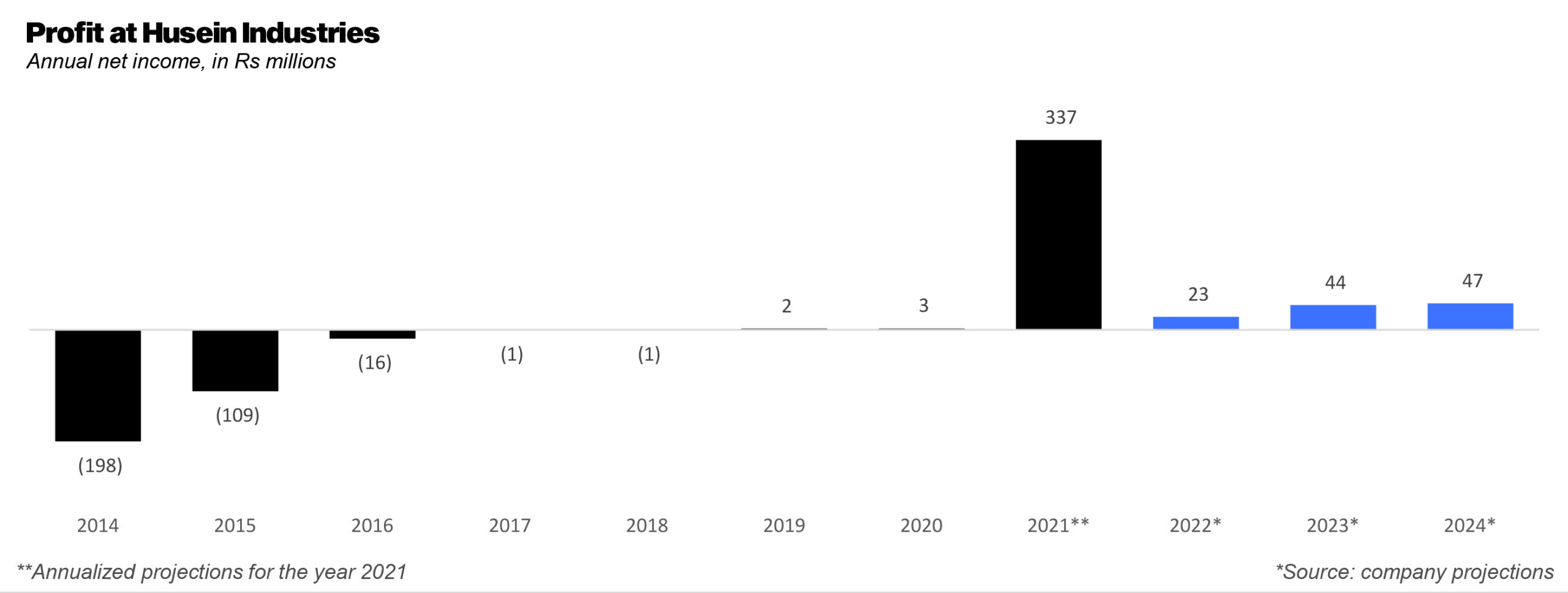

When was the last time Husein Industries saw a profit? Well, it depends on the technical definition of what profit is. So yes, in one sense it made a profit of Rs2 and Rs3 million in the years 2019 and 2020. And yes, that was better than the preceding five years of consistent losses.

But Husein Industries has not seen what is called an actual profit as a textile manufacturing company – which it was initially established as – for years now. In fact, it has sort of been flailing around for most of the last decade trying to figure out what to do with itself.

And now, Husein Industries has come up with a plan. Out with the old, in with the new: the company is reviving itself as a real estate player. It sounds strange but that is what it is. Husein Industries was established as a textile manufacturing company, failed at doing so, and is now turning into a real estate company in a bid to revive its failing fortunes. There is, however, one little stumbling block in this process.

The Pakistan Stock Exchange (PSX) still has the company on its default list, and if you go to the PSX”s website, a bright red ‘DEFAULTER’ flashes on Husein Industries entry. Not exactly the look one is going for when trying to convince investors that the company has turned a new leaf. So Husein Industries submitted its revival plan to the PSX on July 19, in order to get it overturned.

Before we get to the revival plan, some context: Husein Industries Limited, also known as HIL, was established in 1951 as a Textile Manufacturing Company, by Husein Ibrahim Jamal. It had a good run, particularly during the swift industrialization of a young Pakistan in the 1950s and 1960s, and was able to fully integrate from fiber to fabric, and start home textiles. It was initially considered a blue chip company at the then Karachi Stock Exchange, and was also one of the biggest exporters of household textiles to the United States.

The company did well enough for the then directors to actually donate to Karachi: such as the Husein Ebrahim Jamal Research Institute of Chemistry (in 1976, which was at the time the largest donation in the country), the NED University Latif Ebrahim Jamal (Husein’s son) Campus, and the Latif Ebrahim Jamal Nanotechnology Institute.

Then, 2008 happened. According to the company, the global recession threw the company in disarray, where it suffered extreme losses, as their US clients filed for Chapter 11 protection (ie. bankruptcy filed by US corporations under US laws). “Writing off significant export receivables put a great strain on the company and led to a cash flow crisis where HIL had to balance between paying its creditors, paying the bank, and meeting its overhead expenses,” the company explained. Profit does not know the exact losses or cash flow crisis, as the earliest publicly available financial data starts from 2014.

The following years were not kind: in 2010, the company came to a standstill, as it had no money to meet day-to-day obligations. It tried to secure extra financing from banks, and even reached a settlement agreement in 2011, which then fell through in months after pressure from the banks and creditors. Meanwhile, management and staff fled to other textile companies, and no further investments could be made in the company.

Then, of course, the PSX came calling. HIl was unable to prepare accounts on time, hold AGMs, and faced constant show cause proceedings and fines and penalties from the SECP. Finally, things came to a head in 2015, as the entire textile operations of HIL were shut down, and the majority of its workforce was laid off.

So, what could the company do instead? First it negotiated with the bank: and this time, was successful . in 2016, a settlement agreement was executed between the company and its secured creditors whereby the entire liability of Rs1,309 million was agreed to settle by December 2018. This settlement with secured creditors allowed the company to recognize a one time gain of Rs416 million. It also sold a bunch of assets and paid back the bank, with all obligations fully settled in October 2020.

Second, it decided to become a real estate developer and builder after seeking approval from shareholders. Apparently, recent government incentives for the real estate sector also increased the demand in the market, which helped HIL make that crucial pivot. Third, its first real estate project is Jamal Garden, which has been developed over eight acres of company owned land, and is a gated community with 113 residential plots, including a mosque, parks and medical facility. Two more commercial plots are to be developed later, which will include a market and office. Another housing society is being considered in Sheikhupura.

It is these plans which lead the company to project that it will make revenue of Rs184 million in 2022, and then cross the Rs300 million mark in 2024. Similarly, the company expects profit of Rs23 million in 2022, and then cross the Rs40 million mark in the next two three years.

But that is then. The more pressing matter is of course, the default list. “In view of aforesaid submissions and explanations; the directors of the Company and its management are hopeful that the PSX would agree to shift the name of the Company from defaulters’ segment to normal counter and allow resumption of Trading in the shares of the Husein Industries Limited,” the presentation read. Will it work?

This is a remarkable post by the way. I am going to go ahead and bookmark this post for my sis to check out later on tomorrow. Keep up the excellent work.

Many thanks for posting this, It?s just what I used to be researching for on bing. I?d a lot relatively hear opinions from an individual, slightly than a company internet page, that?s why I like blogs so significantly. Many thanks!

hi anyone, I was just checkin out this site and I really admire the basis of the article, and have nothing to do, so if anyone wants to have an engaging convo about it, please contact me on myspace, my name is kim smith