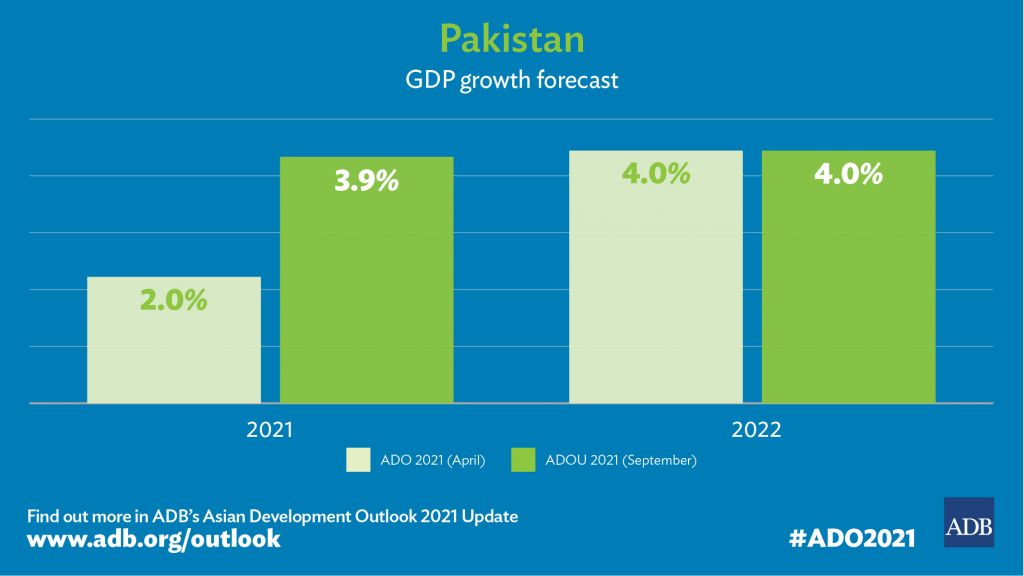

ISLAMABAD: Pakistan’s economic growth rebounded to 3.9 per cent in the previous fiscal year (FY21), ended June 30, and is expected to reach 4.0pc in the current fiscal (FY22) as business activity gradually resumes in the second year of the Covid-19 pandemic, the Asian Development Bank (ADB) said in a report on Wednesday.

According to the Asian Development Outlook (ADO) 2021 Update, the bank’s annual flagship economic publication, Pakistan’s economy is expected to continue recovering in the ongoing fiscal year, supported by stronger private investment, improving business activity, a steady vaccine rollout, and economic stimulus measures for FY22. However, significant uncertainty clouds the economic outlook over the course of the pandemic in Pakistan and worldwide.

“Pakistan’s economy is on the path to recovery, supported by promising growth in the industry and services sectors,” said ADB Country Director for Pakistan Yong Ye. “The continued rollout of the Covid-19 vaccination programme, structural reforms, and the expansion of social protection programmes are all key to ensuring inclusive and sustainable growth. Fiscal incentives and policies to boost export competitiveness, bolster the performance of the manufacturing sector, and augment private investment will continue to play an instrumental role in strengthening the economic outlook.”

Pakistan’s economic growth in FY21 was supported by improved Covid-19 containment strategies through the second and third waves of infections and continued accommodative fiscal and monetary policies that accelerated the recovery across all sectors. Growth in industry, predominantly construction and small-scale manufacturing, and services are forecast to improve in FY22. Agriculture is also expected to continue supporting GDP growth.

While inflation declined to 8.9 per cent in FY21, food price inflation remained high due to supply chain disruptions, increased prices for wheat and sugarcane, and an extended wet monsoon. Rising international oil prices boosted energy price inflation. Yet, inflation for other goods eased thanks to the appreciation of the Pakistani rupee and a postponement of planned hikes for electricity tariffs and domestic fuel prices, the report stated.

The State Bank of Pakistan (SBP) maintained its policy rate at 7pc to support economic recovery. Investment is expected to strengthen as global sentiment improves and the International Monetary Fund (IMF)-supported stabilisation programme continues to progress.

On the other hand, the report has projected Pakistan’s inflation to slow to 7.5pc in FY22, unchanged from the forecast in ADO 2021, as food prices moderate with supply chain improvement and production increases facilitated by the government’s Agriculture Transformation Plan (ATP).

Price rises for other goods are expected to be moderate due to tax relief in the FY22 budget.

It said that inflationary pressures will likely come from ongoing economic recovery and rising global oil prices but should be tempered by expenditure reform and the government’s commitment not to borrow directly from the central bank. Risk of inflation higher than forecast derives from any unusual increase in oil prices or from potential currency depreciation in the wake of any early winding down of the ongoing IMF programme.

The fiscal deficit is forecast to narrow to the equivalent of 6.9pc of GDP in FY22, which is still higher than the target set earlier under a medium-term fiscal consolidation programme supported by the IMF whereas growth in revenue is projected to accelerate with the rapid pickup in domestic economic activity and higher imports.

Further bolstering revenue growth, are the introduction of new tax measures under the Finance Act, 2021; a renewed focus on streamlining tax exemptions, and additional policy and administrative measures to broaden the tax base.

Expenditure is also projected to rise in FY22 as the government has budgeted substantial increases in subsidies and in social and development spending to protect the vulnerable and fortify growth and economic recovery.

The regional development bank’s data shows that Pakistan’s public debt outlook is sustainable in the medium term. With primary and fiscal deficits, high borrowing costs, and currency depreciation, public external debt reached $95.2 billion in FY21.

However, the government has been implementing a medium-term debt strategy for FY20–FY23.

The maturity structure of public debt has improved by reprofiling public debt into longer-term instruments. With strong economic growth prospects for FY22 and beyond, public debt remains on a downward path over the medium term.

As domestic demand picks up and international oil prices rise, the current account deficit is seen widening to the equivalent of 1.5pc of GDP in FY22, which is a smaller deficit than forecast in ADO 2021 in line with the FY21 deficit being smaller than projected.

Export growth is expected to accelerate, supported by a projected upturn in economic activity in Pakistan’s major trade partners. Exports will further benefit from continued initiatives to reduce the cost of doing business and especially from the government’s newly introduced export facilitation scheme, which allows the duty- and tax-free acquisition of inputs including intermediate goods, plant, and machinery.

Moreover, imports are expected to rise in response to domestic economic recovery, higher international oil prices, and rationalisation of custom and regulatory duties in the FY22 budget.

The report also adds that remittances are likely to remain elevated, supported by the Roshan Digital Accounts initiative, and will continue to narrow the current account deficit.

Meanwhile, Minister of State for Information and Broadcasting Farrukh Habib on Wednesday welcomed the Asian Development Bank’s (ADB) forecast about sustainable economic growth in Pakistan.

In a series of tweets, he said like other international financial institutions, the ADB’s forecast about Pakistan’s economy was welcoming.

اے ڈی پی نے کورونا وائرس کے حملوں کے دوران پاکستان کی کامیاب حکمت عملی کا اعتراف کیا ہے۔ہماری اپوزیشن اوائل میں ہی پورا ملک بند کرنے کا کہتی رہیں لیکن وزیراعظم عمران خان نے دیہاڑی داروں،معیشیت کا پہپہ چلتا رکھنے کے لئے بہترین حکمت عملی اختیار کی زندگیوں اور روزگار کو محفوظ بنایا https://t.co/YpQ1A0jk5B

— Farrukh Habib (@FarrukhHabibISF) September 22, 2021

The minister said the opposition has been calling for a complete countrywide lockdown from the day one of pandemic, but, he added, it was Prime Minister Imran Khan who had opted to the best policy against the coronavirus to save lives and livelihoods simultaneously.