The government needs money. All governments everywhere always need money, but for Pakistan right now shoring up revenues is a vital part of getting out of the eye of the storm we find ourselves in. And for that, the most indispensable part is revenue collection.

The IMF is also breathing down the government’s neck, peering very closely at whether or not the fund’s recommendations on revenue collection are being followed to a T, with the disbursement of the bailout package on the line.

So what changes has the government proposed in the finance bill? And more importantly, how do they line up with the expectations of the IMF? Additional revenue measures of around Rs 440 billion, out of which 70 percent pertain to direct taxation and the remaining 30 percent will be through sales tax and duties. These measures include taxing unproductive assets like real estate, tightening the minimum tax regime, introducing wealth taxes and additional super tax, direct and fixed taxation for sectors like imports and retail while savings and investments in financial markets are also being taxed at an elevated rate to generate incremental revenue.

There has also been a downward revision in salary tax rates and income slabs is a positive development for the working class, however it is contrary to what IMF demanded and the authorities might not be able to see this proposed amendment through. Relief for some sectors through sales tax exemption is provided but other sectors are on the receiving end of proposed amendments like reduction in input tax adjustments and increased sales tax rates.

Profit investigates how these key amendments affect the broader narrative of tax regulation. Particularly with regards to documentations of the economy and streamlining procedures for ease of doing business.

Sales sax

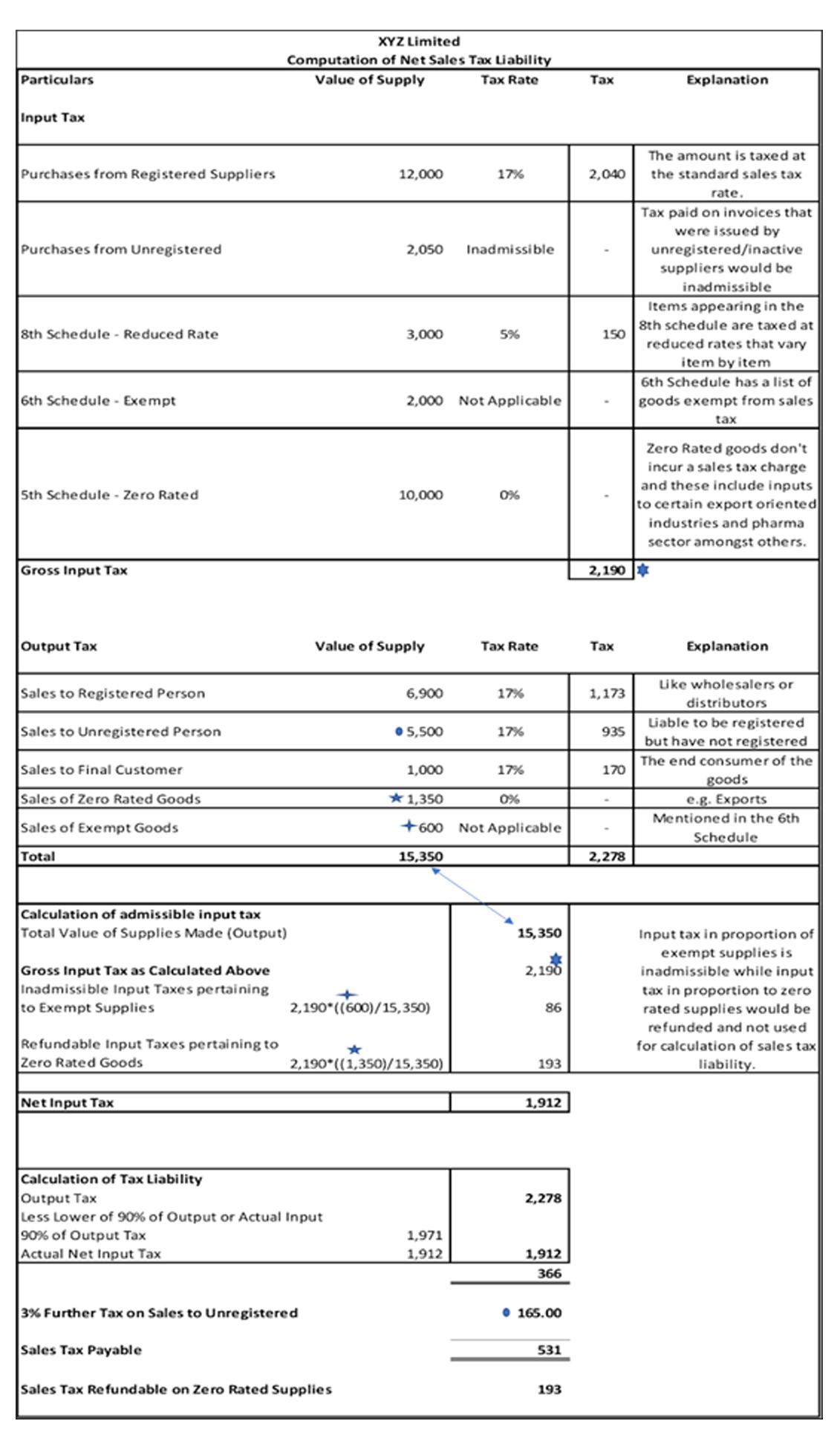

Before diving into the details of the proposed amendments to the sales tax regime, let’s see an example to understand how the sales tax liability is calculated and what does the commonly used jargon actually mean.

The calculation above is a simplified version of how sales tax liability is computed. The two main components are input and output taxes. Input, as the name suggests, is tax charged on purchases by suppliers/vendors while output tax is collected from the customers by the business.

The chargeability of these goods to sales tax and rate for that is determined by the classification of the goods whether they are ordinary goods or those classified in different schedules of sales tax act. Once the gross amounts are available for output and input taxes, the net input tax is compared with 90% of gross output tax and the lower of two figures is deducted from the gross output tax to calculate the sales tax liability. (The net input tax is gross input tax less proportion of input tax pertaining to exempt sales, inadmissible sales like sales of more than Rs. 100,000 without obtaining CNIC and Zero rated sales like exports for which input is not adjusted rather refunded in full.)

A further tax of 3% is also charged in some cases like the one mentioned in the example where supplies are made to customers that are not registered with sales tax authority even though they are legally required to.

Now that we have a better understanding of the sales tax mechanism, let us go through the important amendments proposed in the Finance Bill.

A major change in the sales tax regime is the exemption provided to the sector importing and manufacturing tractors. This is being perceived as a positive step for reduction of the prices of tractors for the final agri consumer. However, the fact is that by exempting sales tax, the input tax of tractor manufacturers would also be disallowed meaning the cost of that would be passed on to the final consumer. Further, there are existing refunds of the industry around Rs8 Billion that would be disallowed if the proposed amendment is to be implemented.

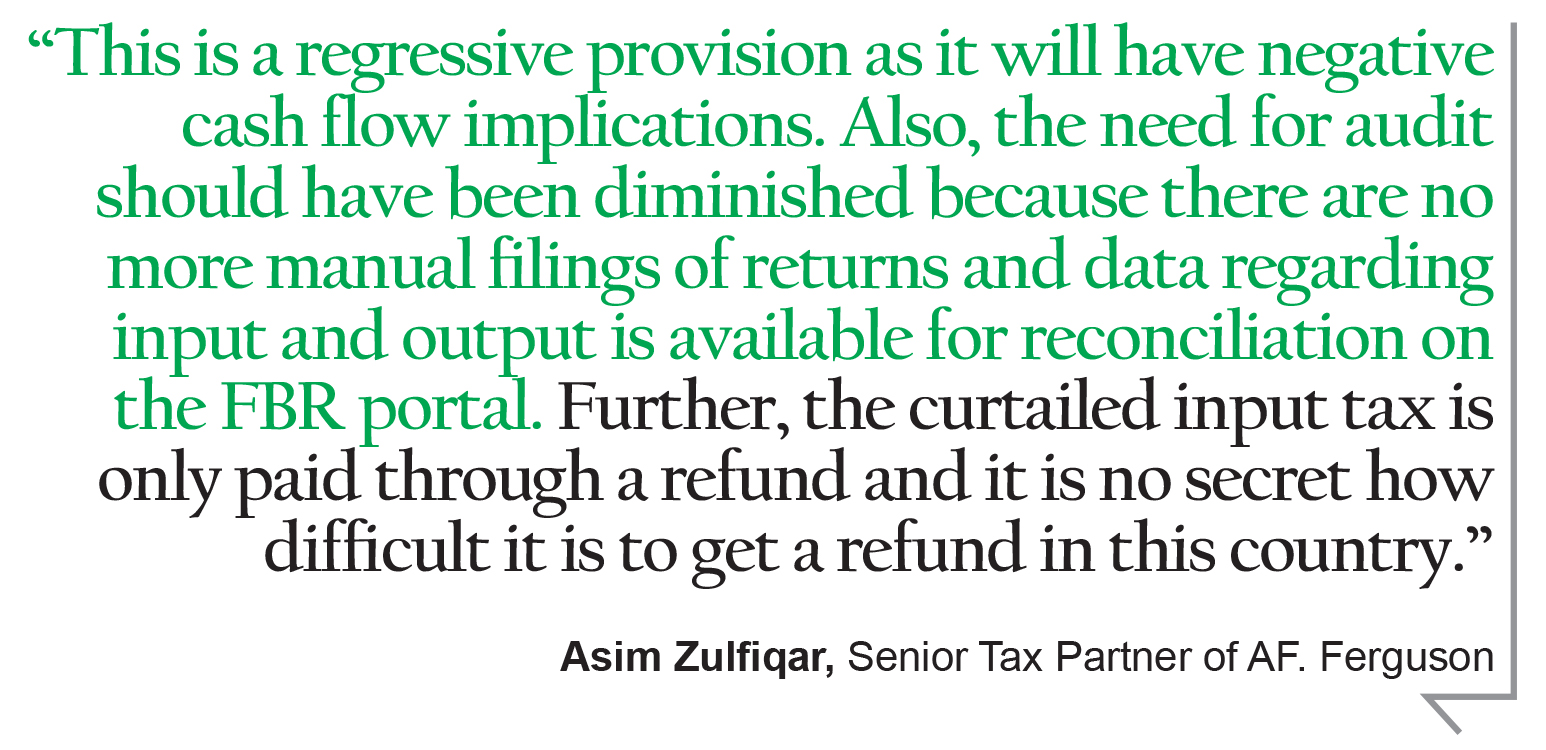

Moreover, as explained in the example before, input tax is allowed to be adjusted upto 90% of the output tax and any excess amount is refunded after conducting an audit as per the mechanism laid down by Sales Tax Rules. However, Public limited companies were an exception to this rule and were allowed a 100% adjustment. The finance bill now proposes to remove this exception and bring the public companies under the same ambit.

Asim Zulfiqar, Senior Tax Partner of AF. Ferguson & Co. Chartered Accountants, while addressing the matter in ICAP’s Post Budget Conference stated, “This is a regressive provision as it will have negative cash flow implications. Also, the need for audit should have been diminished because there are no more manual filings of returns and data regarding input and output is available for reconciliation on the FBR portal. Further, the curtailed input tax is only paid through a refund and it is no secret how difficult it is to get a refund in this country.”

A further tax of 3% is also proposed on sales to taxpayers that are registered but not active (due to non filling or other offenses). Though the step is in line with the existing treatment of sales to unregistered customers, it adds to the tasks of businesses who will now be compelled to check taxpayer status each time before invoicing as the FBR’s active taxpayer list is updated on a real time basis.

In addition to the changes above, the provision for disallowance of input tax credit relating to supplies made to customers in excess of Rs100,000 without obtaining CNIC was also removed. Asif Kasbati, A senior Chartered Accountant while commenting on the issue stated, “The amendment is not in the spirit of documenting the economy. However, from the perspective of the businesses it was a huge inconvenience as their customers were not willing to share their CNICs while the FBR officials were also misusing the provision to exploit them.”

Income tax

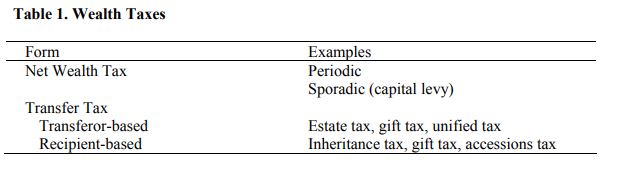

The direct taxes form a major part of the government’s efforts to increase the revenue in the forthcoming fiscal year. The proposal to implement multiple wealth taxes is one of the key measures to enhance revenue collection.

As per the IMF, “Two major types of taxes are levied on wealth: those applied sporadically or

periodically on a person’s wealth (net wealth taxes), and those applied on a transfer of

wealth (transfer taxes).”

The proposed levy of wealth tax in the finance bill 2022 includes capital value tax while changes in taxation for capital gain and deemed rental income can also be loosely classified as a wealth tax.

Capital Value Tax (CVT) was reinstated in the recent budget proposal after being repealed through the finance act 2020.

The proposed tax is to be applied on Motor vehicles held in Pakistan having value in excess of PKR 5 million at a rate of 2% and Assets of a resident individual (the person who stays in Pakistan for at least 183 days during a tax year), whether movable or immovable, held abroad having value in excess of Rs100 million at a rate of 1%.

While talking to Profit, Dr. Ikram ul Haq, expert in Corporate Law and Taxation, stated, “ The implementation of capital value tax is not permissible as it is in contradiction with the entry 50 of federal legislative list which restricts the federal government from charging CVT on immovable property.”

Further, Asim Zulfiqar, Senior Tax Partner of AF. Ferguson & Co. Chartered Accountants, while addressing the matter in a ICAP’s Post Budget Conference stated, “ In case of foreign assets that were taxed under declaration laws (Amnesty Schemes) there was a sovereign guarantee given regarding no further taxability of declared assets. However, the CVT seems to go against that assurance and this might become a hindrance in its implementation.”

There has also been a concept of deemed income tax on immovable property introduced. This tax, as per many experts, is a wealth tax due to a characteristic similarity with other wealth taxes which is being levied on fixed rate irrespective of the returns generated by the asset.

As per the proposed amendment, income tax would be charged at the rate of 20% applied on an immovable property’s assumed rental value equivalent to 5% of its Fair Market Value (can be ascertained through FBR rates and DC rates). Exception to this includes self owned properties that are used; for agricultural related activity (includes only land), as a business premises from which business is carried out. Further, the CVT is not applicable on a single self owned property and where the Fair Market Value of property(s) does not exceed Rs25 million excluding the aforementioned properties. This can be seen as a positive step to capture unproductive real estate assets. However, as per legal experts the applicability of this can be challenged in the court of law.

The scope of taxation on inheritance and gifts is also proposed to be increased in line with the government’s efforts to tax wealth. As per the existing laws covering the capital gains on assets, the value of an asset transferred under inheritance, succession or as a gift would be the fair Market Value of the asset. The new proposal aims to change it to the tax base of the asset in the hand of the original transferor. We can better understand this through an example. The capital gains are calculated as the difference between consideration received and the cost of the asset. If you were to receive a car as a gift from, let’s assume, Person A, the cost of asset for you would be zero but for tax purposes it would be the fair market value at the time of transfer.

So, at the time of receiving the gift if the market value of the car was 2,500,000, that would be the cost for you and if you sell it after a year for 3,000,000 your capital gain would be 500,000. However, under the proposed amendment the cost would not be 2,500,000 rather it would be the tax base of the asset (The original cost paid by the Person A less any depreciation claimed). So in that case, if Person A bought the car for 1,500,000 and claimed depreciation of around 500,000 on the car, the effective tax base would be 1,000,000. The same would be the cost for you to calculate your capital gain which would now increase to (3,000,000-1,000,000) 2,000,000.

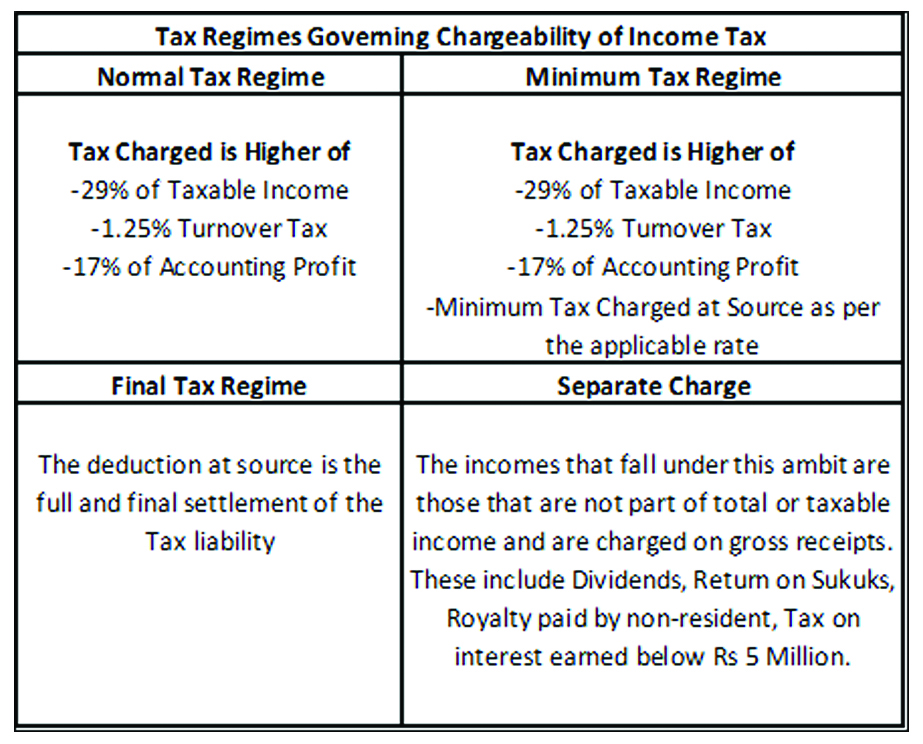

The finance bill also proposed to abolish the carrying forward of minimum tax to subsequent tax years. Minimum Tax (in this case refers to turnover tax) is charged at a rate of 1.25% on the gross sales of the company. To better understand this provision let’s take a simplified example of a company that has gross sales of Rs400,000 and a taxable profit of Rs10,000. The Minimum tax would be (400,000*1.25) Rs5,000 while the corporate tax would be (10,000*29%) Rs2,900. The differential of Rs2,100 under the existing tax regime can be adjusted against future tax liability within five years.

Abolishing this rate would mean that the businesses that are currently low on profitability would not be able to obtain future relief once they are able to improve their performance. Further, from an accounting perspective, this will have a negative impact on the deferred tax assets on the company’s balance sheets if applied retrospectively. (There is ambiguity regarding the application but as per experts it is likely to be applied prospectively).

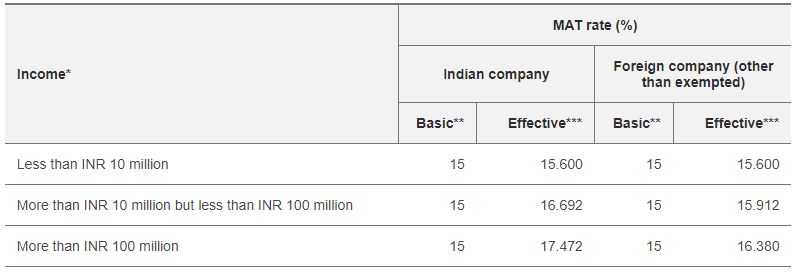

Dr. Ikram ul Haq, expert in Corporate Law and Taxation, while explaining the situation to Profit, commented, “The Turnover Tax is confiscatory in nature and not allowing a carried forward would further add to the vows of businesses. If you see other similar jurisdictions like India, the minimum taxes are charged on accounting profits rather than the revenue.”

Minimum tax rates in India as per PwC

Further, regarding the real estate sector, the holding period to avail exemption from capital gain tax on sale of immovable property is increased to 6 years form 4 and the rates for taxation have also been revised upwards. Asif Haroon, a Senior Chartered Accountant, while addressing the ICAP Post Budget Conference stated, “It is estimated that increasing the holding period by one year can generate incremental revenues of around Rs20 billion.”

Tax regimes for a few sectors have also been revised including retailers other than Tier-1 who have a commercial electricity connection will now pay tax through monthly electricity bills which would be a final tax. Also, commercial importers will also pay a final tax at the import stage which would be a shift from their existing minimum tax regime. The 100% tax credit for the IT sector exports has also been removed and replaced with a 0.25% final tax.

These measures will not only reduce documentation of the economy but will enable the businesses to pass on the incidence of tax to the customer, a trait that is usually associated with indirect taxation.

Asad Ali Shah, former president of ICAP told Profit that “the shift to final & fixed taxation discourages the documentation of the economy as the businesses falling under the ambit of it don’t file returns either due to the law or they have no incentive to do so. Also there is no reconciliation of their wealth. The commercial importers, majority of whom already avoid taxes through under-invoicing, will now be allowed to not disclose their profits.”

“In the case of the IT sector, the additional tax might be a blessing in disguise as it saves them the time by not having to go through the agonizing procedure of obtaining exemption certificates from FBR and then getting it renewed.” Shah further added.

There are other measures also proposed in the budget to increase collection through direct taxation including wealth taxes in the shape of poverty alleviation tax and super tax. While measures like abolishing tax credits on investments, increasing the scope and rate of taxation on gains from investment is likely to discourage investing activities.

Overall, the budget might give a perception of tilting heavily towards direct taxation but the matter of fact is that the incidence of many proposed amendments can easily be passed on to the final consumer while the taxation on wealth might not be implemented due to issues pertaining to its legality. However, one thing remains constant that the FBR is still relying on others to collect taxes on its behalf rather than utilizing its own resources. As discussed in ICAP’s Post Budget Conference, “If withholding taxes and indirect taxes are combined the effort based taxation of FBR is reduced to less than 10% and this raises a question of whether the board justifies the exuberant amounts spent for it to maintain a team of more than 20,000 personnel.”

I reviewed your blog it’s really good. thanks a lot for the information about this blog. I want more information

The blog is profitable and explanation is good

Nice information in this article

Ahtshaam you have reported one of the biggest land reform measure since 1970s about income tax on deemed income from immovable property apart from personal home. It’s the most widely applicable tax aimed at shaking up the non productive capital held by rich middle class. Judiciary is in cahoots and trying to thwart it due to conflict of interest.

Do it as a separate and powerful piece instead of burying it with other reforms as it is of public interest and likely to generate regular revenue and transform files and plot speculation and prices. It is also meant to drive moving investment towards flats and high rises. Super cool change in our economy but poorly being reported in mainstream media. So bravo but make it count please.

This legal advice is farcical that “The implementation of capital value tax is not permissible as it is in contradiction with the entry 50 of federal legislative list which restricts the federal government from charging CVT on

immovable property.” Dr. Ikram ul Haq, so called expert in Corporate Law and Taxation cannot differentiate between income tax and CVT. Hence reference to this exclusion is mischievous and a response from bourgeois to horde it’s assets.

I dеfinitely loved every little bit of it and I have you book marked too check .

온라인 카지노

j9korea.com